According to coinmarketcap.com, as of April 2021, there were more than 9,000 cryptocurrencies that facilitate peer-to-peer transfers of data and value. Where does this leave the individual who believes in the future of these crypto-assets but can’t figure out how to invest in them? The vast majority of advisors don’t recognize them as an investable asset class; therefore, many are not able to talk about them intelligently. More than 6,700 different cryptocurrencies are traded publicly, according to CoinMarketCap.com. And cryptocurrencies continue to proliferate, raising money through initial coin offerings, or ICOs. The total value of all cryptocurrencies on April 20, 2021, was more than $2.2 trillion, according to CoinMarketCap, and the total value of all bitcoins, the most popular digital currency, was pegged at about $1.2 trillion. So it is slowly coming to a time when your clients will be probably going to be asking about this, if they haven’t already. Some financial advisors have found that being knowledgeable about investing in cryptocurrency is a way to bridge the gap with younger generations of their clients’ families. So to become a trusted advisor you will sooner or later start talking about the major aspects of adding cryptocurrency to a client’s portfolio.

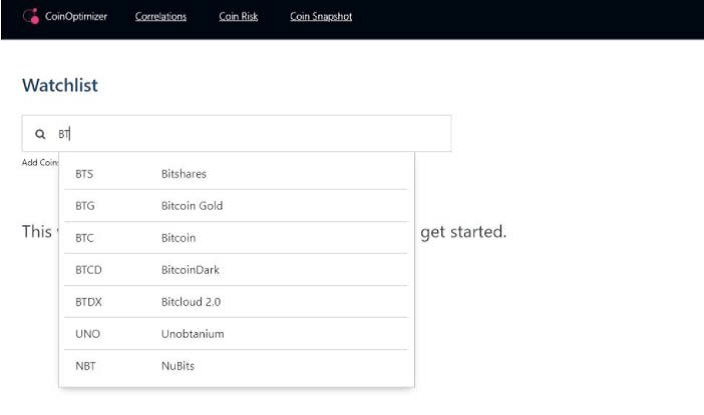

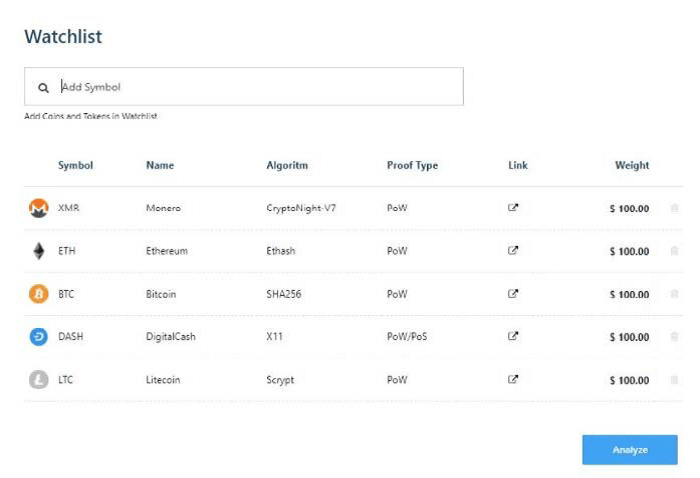

At your first login you will see an empty Watchlist. There are

hundreds of coins that could be added for further analysis and

comparison. Simply start typing a name or abbreviation of the

coin or token you would like to add.

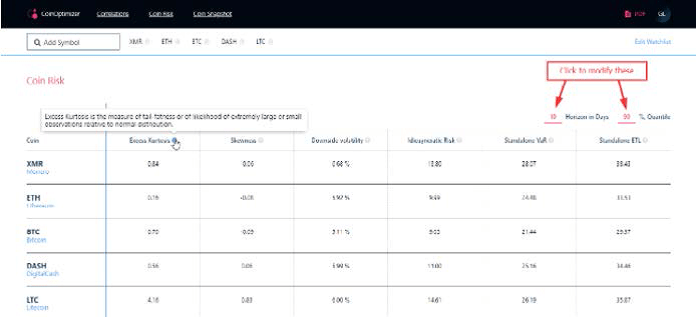

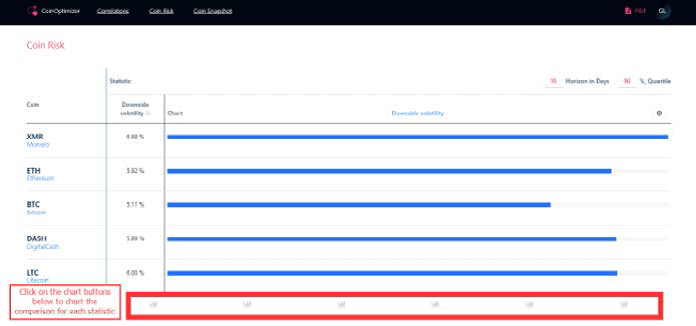

Now, proceed to the Coin Risk report.

Coin Risk report will show you important statistics on behavior of

each coin, including Excess Curtosis, Skewness, Downside Volatility,

Idiosyncratic Risk, Standalone VaR and Standalone ETL, to help

you explain the differences between cryptocurrencies. Hover your

mouse pointer on the question symbols next to each parameter to

see a brief description (you can scroll to the bottom of the report

to see the same details too). The Horizon and %, Quantile fields can

be modified.

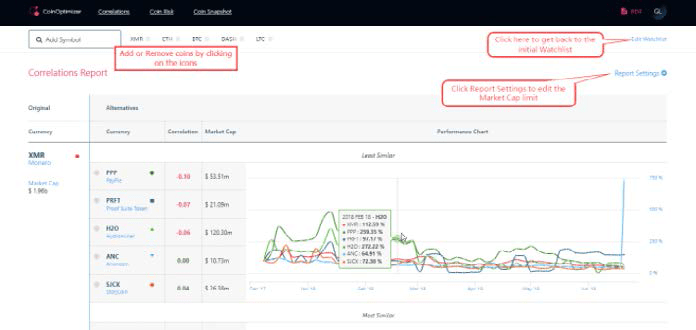

Hitting Analyze button takes you to the Correlations report.

The Correlations report will show you the most positively and

negatively correlated coins for each chosen cryptocurrency. In

other words, we will see similar and dissimilar coins for any given

cryptocurrency. You can review and compare by a correlation

level, market capitalization of each coin and performance charts.

Now, proceed to the Coin Risk report.

Coin Risk report will show you important statistics on behavior of

each coin, including Excess Curtosis, Skewness, Downside Volatility,

Idiosyncratic Risk, Standalone VaR and Standalone ETL, to help

you explain the differences between cryptocurrencies. Hover your

mouse pointer on the question symbols next to each parameter to

see a brief description (you can scroll to the bottom of the report

to see the same details too). The Horizon and %, Quantile fields can

be modified.

Also, below the list there are chart buttons for each statistic that

helps to review the comparison between the coins in a convenient

chart form.

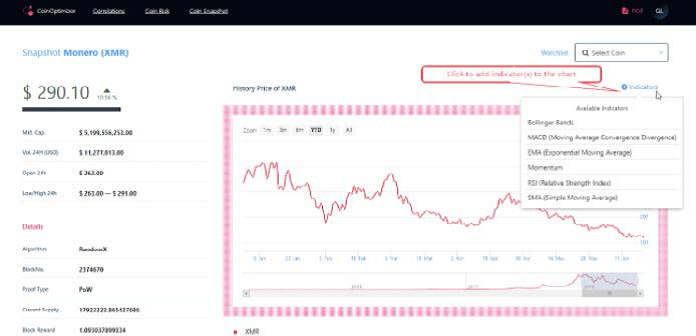

At any time you can click on the coin abbreviation or the Coin

Snapshot button at the top and you will see the technical analysis

of the coin including momentum and other more sophisticated

indicators.

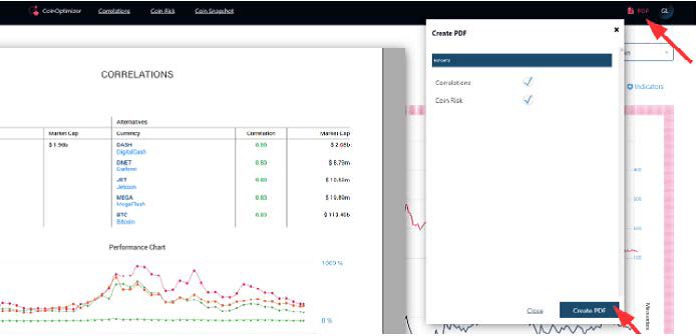

Hit PDF button in the top-right corner to create a convenient

PDF document that will include each coin details along with

Correlations and CoinRisk reports, that could be further emailed

as an attachment or hard-copied for book keeping purposes.

For any further questions or suggestions please contact us at clientsuccess@rixtrema.com or dial (212) 513-7070 or (800) 282-4567.