We know that visuals are essential and therefore we would like to share this guide with you, so you can start using RegBI as quickly as possible. You can choose Non-Qualified to Non-Qualified transaction type, 401K to IRA, IRA to IRA or Initial vs Proposed scenario. We are not working with the entire plan, but looking into individual investments. Let’s cover the 401K to IRA rollover scenario, because when the money leaves a 401K plan, there are extra regulations come into it. Let’s take a look at what RegBIOptimizer’s comprehensive Summary report.

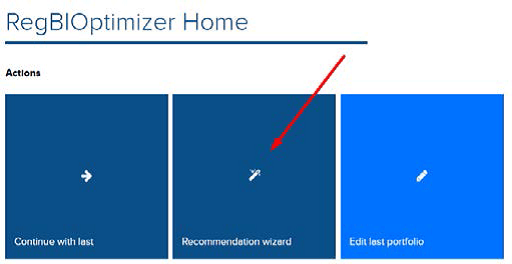

Choose Recommendation wizard option and it takes you to

the process.

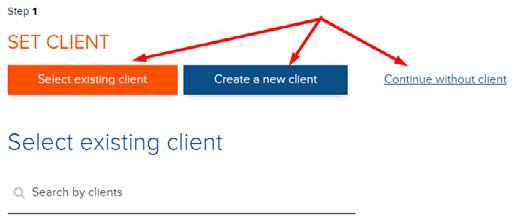

Choose the client you do a rollover recommendation for.

If you create a new client n this step the email is mandatory,

it will be used as a unique identifier.

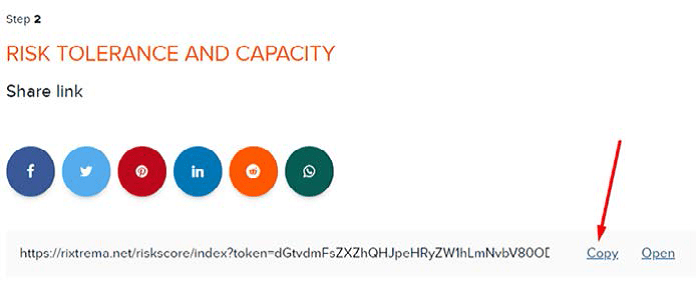

We are assessing the best interest on the Step 2.

We going to look at suitability, how suitable is the portfolio is to the

investment risk tolerance.

Copy the link and send it to your client by email. This step is optional.

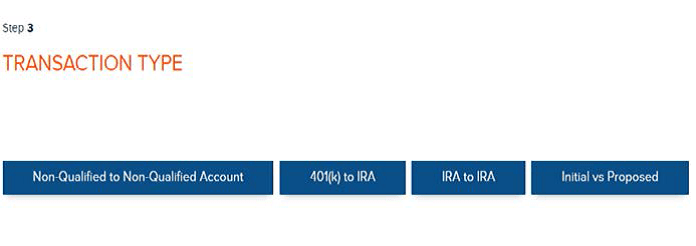

Choose Transaction type. In our case it is 401K to IRA scenario.

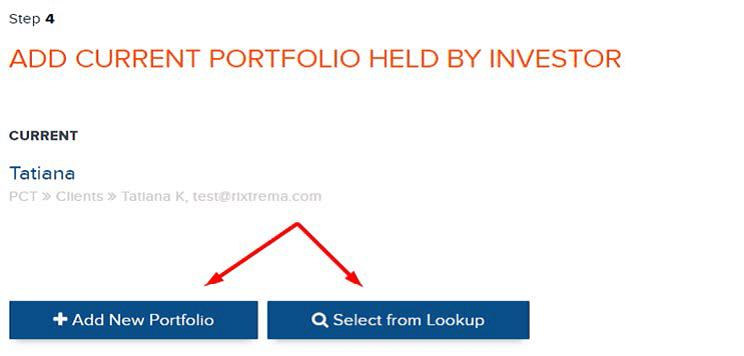

Add a current portfolio.

Once you click Add new Portfolio, you can add something in by

typing a ticker symbol or you can upload them from an Excel file

(tickers in column A and values in column B).

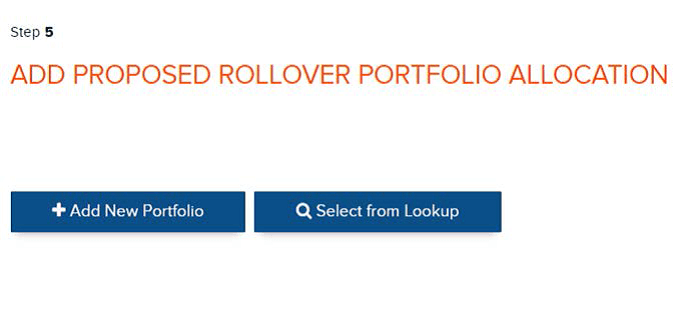

Add a Proposed Rollover portfolio.

Create a new one or upload from the Lookup

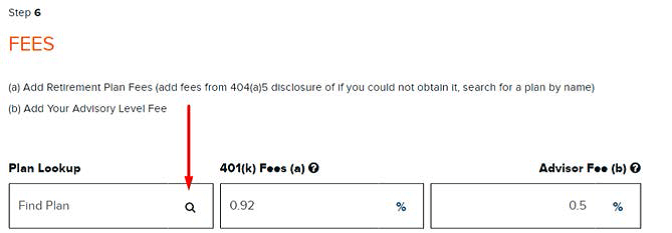

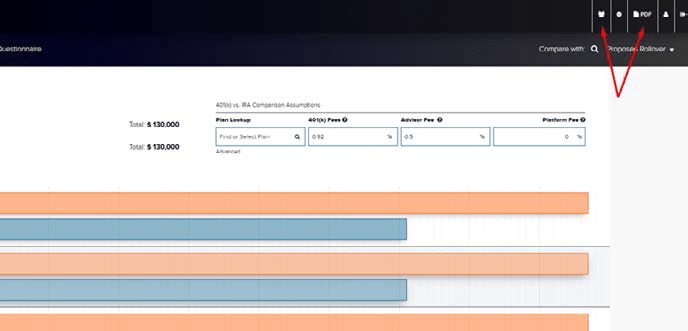

The next step is a Fees area.

You may need to look up for these fees in 404(a)5 disclosure.

RegBIoptimizer will automatically pull in retirement plan data

for the plan from which you are rolling over. Our database

contains over seven hundred thousand retirement plans already

prepopulated. Just type a name and pick a plan. Don’t forget your

advisory fee, in this case, 0,5%.

Change percentage to $ amount if needed by clicking on %

symbol.

The next step is Individual factors, which is a questionnaire.

Answer these questions to track if you’re acting in someone’s best

interests. Write anything extra you want to in the Comments sections.

Customize offered services and compare your recommendation

with what they currently have in the portfolio. Check the box if the

client gets one. Or add new service by typing it in.

Then hit the summary button in the bottom right corner.

The summary report will pull in all required data for both initial

and proposed allocation and will calculate all fees. Create a PDF

report by clicking on the PDF button. Once you create a PDF the

current rollover will be saved in your Admin panel in the top right

corner.

On this page you can also edit the information you put in before

on the previous steps.