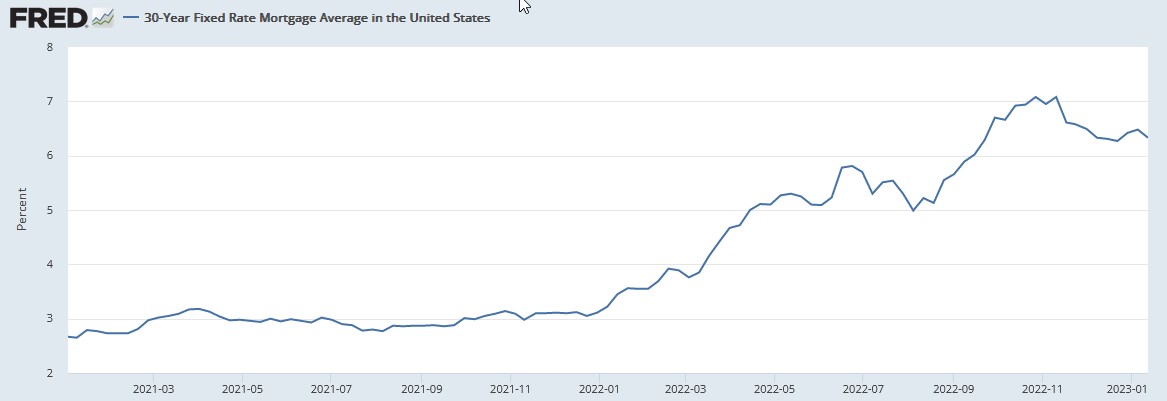

Not so long ago, we were in the age of “free money” when in 2020 the US Fed plunged interest rates down to 0% to boost economic activity during the pandemic. These policies opened a floodgate for all kinds of investments resulting in a frenzy of buying activity leading to record-breaking price appreciation, especially in Real Estate. But as we entered 2022, the US Fed “free money” policy has pivoted 180 degrees to aggressively raising interest rates. Lack of cheap credit created a lot of stress on the capital markets. Those two events led to a downward pressure on asset prices including real estate. 30-year fixed rate mortgage doubled in just 1 year from around 3% to 6.33% today.

So, are home prices poised to fall? This is a question that begs for an answer from a lot of people these days. As always, there are different points of view, and we should look at both sides. One view on the subject matter is that a slowdown in the housing market could be cushioned by a relative lack of available homes in the U.S. and by strong household finances. Goldman Sachs economists think “it’s unlikely there will be a large wave of forced selling in the U.S. because a recession would probably be mild, the housing market is tight, mortgage quality is solid, and a large proportion of the mortgages have a fixed rate.”

However, if you look at certain cities in America right now, whether it is Austin, Texas or Phoenix, Arizona, or Boise, Idaho, inventory on the housing market, the amount of homes for sale have spiked from 300 to 400 percent in just four to five months. We were already seeing home prices go down month over month in many of these. So, as you guessed, another point of view is that we are facing an imminent housing crash which can get worse over the next several months as the probability of economic recession is growing. Recession will lead to more foreclosures and as home builders continue to deliver new homes every month the problem with tight markets will be resolved.

Home prices got appreciated across the country. However, the price appreciation was not the same everywhere. Some of the abovementioned markets saw their housing markets appreciate 40-60% in the recent housing bull run. It is logical to expect that there’s certain areas in America where this housing crash is going to be brutal in the range of 40% or so. It’s going to be very similar to what occurred from 2007 to 2012. Other areas with less ballooned prices can see smaller price depreciation in the range of 5-10%. But on average, it can be expected that home prices will go down by 30%.

Some people can say: “What is 20%, it is not a big deal”. But it is a big deal if you think that 15% of current homeowners have purchased their home over the last couple years. So, what does it mean? It means that a lot of people are now going to be underwater on their mortgage as home prices decline and that’s going to lead to foreclosures. With a greater probability of recession, foreclosures and defaults will rise and have a negative wealth effect across the economy. It will lead to lower consumer spending and is going to make the recession even worse. Home prices will go down even more. Since housing is a massive asset with a market value of 40 trillion dollars, which is even bigger than the stock market, when it goes down, historically, it propels the overall economy into a nosedive.

As the home price decline cycle has already started, the real estate market is facing a lack of demand from buyers. As matter of fact, we are close to a 10-year low in home buyer demand and in certain cities home buyer demand is down by 50%. Apparently, people start to understand that if they buy a house today it is very likely that the value of the house in 3 to 12 months is going to be lower. Currently, we are at the end of housing expansion that lasted for 10-11 years. Due to fear of missing out, a lot of buyers purchased their houses already instead of buying them later. Other words, during the period of pandemic and low interest rates buyer demand has been exhausted. The raising mortgage rates will continue to push out willing buyers from purchasing the house.

Another trend affecting housing prices is gradual reversal of migration. During the pandemic a lot of people left cities for suburbs. It pushed the housing prices in a lot of areas like Utah, Tennessee, Arizona, Ohio, etc. Now a lot of companies call their employees back to the offices. A lot of remote workers from states like California and New York who moved to suburbs of other states can find themselves to be laid off because of economic slow down and probably recession in the near future will be going back to their root states where their professional networks are to find next job. This revers migration will create additional downward pressure on house prices in the areas where the prices ballooned over the past few years.

There are other problems in the real estate markets such as the discrepancy in the percentage of occupied houses by senior adults (65 and over) versus young adults (under 30) where senior adults occupy approximately 25% versus 10.9% by young adults. Eventually, these houses will end up on the markets which add to supply. Another boost to supply can come from investors who purchased a house to generate additional cash flow such as short-term rentals, fix and flip deals, etc. Once the investment becomes underwater more and more investors will rush to the exit adding to existing housing inventory.

Today, we have prices and rates going down which creates little incentive to buy. However, you have a lot of incentive to sell because you get a better price today than if you wait till later to sell your house. For example, you can see the percentage decline of the biggest home prices in 2022 based on Redfin data (see below).

A lot of real estate analysts predict that it is only the 1st inning of the housing market correction. Some of the hottest markets can see more corrections going forward. The best advise they can provide those who wants to buy a house is to wait for a few months, look around and be ready to get a better deal in the future.