- What is QDIA?

- Why is QDIA important?

- What are the characteristics of a QDIA?

- Does a plan have to have a QDIA?

- What are the requirements of the plan sponsor?

- How to identify plans with no QDIA

- Red Flag: Do 401k plans need a QDIA?

- What is the fiduciary risk of not having a QDIA?

- What to do about no QDIA

What is QDIA?

A Qualified Default Investment Alternative (QDIA) is default investment option chosen by the company and given to plan participants who haven’t chosen their own portfolio. The selection of this default option is a fiduciary decision. So which investments are chosen to be included in the default option must be prudent and solely in the participants best interest, including having reasonable fees and expenses.

Why is QDIA important?

In the event that the participant fails to make an investment decision then the participant’s contributions will be invested in the QDIA. Many participants may be to busy or lazy or not consider it important to choose the investments in their plan. The more participants in the plan the more likely the plan will have participants who fail to choose. There are other instances to consider, like when an investment option is removed and there is no clear mapping for the replacement.

Having a QDIA allows a plan sponsor to be able to invest an undirected participant’s assets and still be allowed claim safe harbor under the ERISA.

What are the characteristics of a QDIA?

Typically, a QDIA will be a target date fund or a balanced fund. There are other options like a professionally managed account but to be eligible for safe harbor the default fund must take into account the participant’s/workforce’s age or retirement date. Low-return products can be used for up to the first 120 days.

Does a plan have to have a QDIA?

No, a QDIA isn’t mandatory. A plan could require it has meetings with all participants to ensure all participants have made elections. Alternatively, the fiduciary might decide the best option is a fund that doesn’t meet the QDIA requirements, like a money market fund for an extended period. A default fund can still be considered a prudent choice even if it isn’t a QDIA.

What are the requirements of the plan sponsor?

The QDIA must be managed by a fiduciary. This could be the plan sponsor or investment advisor or others who have been named a fiduciary. Before the start of each year, the participants should be given a notice explaining the risk, fees and their rights. The participants must be notified for the default fund to be considered a QDIA.

How to identify plans with no QDIA

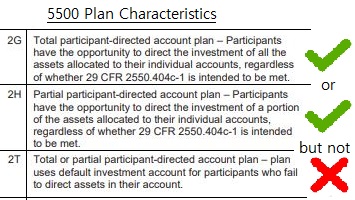

Larkspur-Rixtrema’s 401k prospecting software allows advisors to search for plans which have the red flag “No QDIA”. This red flag is determined by looking at the features which the plan reported having on its annual 5500 filing. This red flag has been applied to all plans which reported that they allow partial or total participant directed account but didn’t specify that the plan uses default investment account for participants who fail to direct assets in their account.

Red Flag: Do 401k plans need a QDIA?

What is the fiduciary risk of not having a QDIA?

Not having a QDIA could make a plan sponsor liable for the outcome of the default fund. Also, there is a risk that an uneducated participant may suffer from the result of poor fund selection and try to blame it on the plan’s lack of appropriate investment options.

What to do about no QDIA

In general, a 401k plan is a great benefit offered to employees. Without automatic enrollment the plan could have a low participation rate and therefore not be maximizing the benefit to the employer from offering the plan. By helping a plan to have a QDIA this will allow the plan to offer automatic enrollment while reducing their liability risk. These benefits can be sold to the plan sponsor as a way to improve the plan’s effectiveness and cost efficiency. Also, offering a strong default option can be a better option for some participants and reduce the stress for both employer and employee regarding making the decision.