COVID-19 has disrupted everyone’s lives and business and led to a lot of market volatility. Moreover, it has raised many questions about how to respond in a crisis; in particular how plan participants remain confident about their plan.

Even in times like these we must not forget fiduciary responsibility doesn’t go away, not even during a pandemic.

There is no doubt, however, that there are new rules. Here are some of the ways to adapt in this brave new world.

Review plan investment menu and policy

Investment option performance, Investment menu changes, Fee review and other topics should be discussed in the annual plan review.

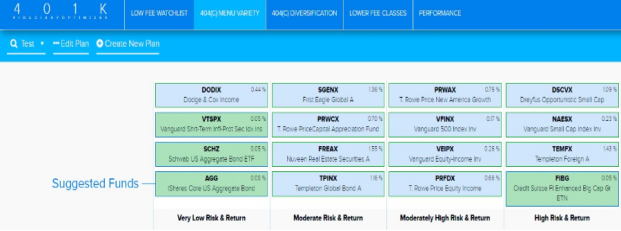

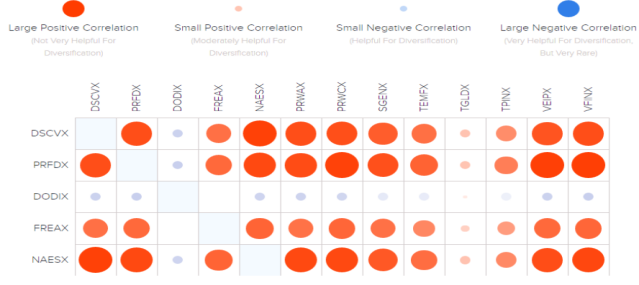

It is well known that a lack of fund diversification, fee inefficiency and dominate funds distort 401k plans, and thus it is getting hard to minimize risk. It is essential that the plan’s investment policy is appropriate. For example, it’s vital that the Investment Menu has low risk Investments alongside high risk assets to satisfy 404(c) requirements. Diversification helps to maintain portfolios when there is market volatility.

Using the Algorithms of the 401kFiduciaryOptimizer we can improve diversification in the plan’s Investment Menu. Advisors can remove these options and show other alternatives to a plan sponsor.

A closer look at the diversification problem in a plan:

Monitor a plan’s performance

ERISA requires plan fiduciaries to act with “care, skill, prudence and diligence under the circumstances then prevailing.”

Now, we must be prepared to continually adjust, because decisions made during this time may be changed by plan participants or by regulators.

In order to adjust processes in response to COVID, the monitoring plan investment alternatives is an action point for plan fiduciaries. It may sound complicated, even to professionals who often lack the analytical skills required. That is why taking a closer look at the 401kFiduciaryOptimizer can be a real help in monitoring plan investment alternatives.

Algorithms of the 401kFiduciaryOptimizer offer similar alternatives in order to help to identify investments that could save the plan participants a significant amount of money.

Communication with plan participants

With increased levels of market volatility the Set-it-and-forget-it approach, no longer works. Employers should be in regular communication with participants in order to review their investment choices.

As an investment advisor’s engagement can have long term benefits for employees and organisations, the format of investment reviews may need to be changed from traditional to non-traditional methods. These can include telephone, virtual meetings and more.

However, a lack of digital competency, can cause in the transition from in person to online communication.This can lead to a decrease in overall communication and negatively impact an advisor’s engagement.

Cybersecurity and data breach protections

Now more than ever is the right time to review existing mechanisms that protect participant information and assets.

Due to increased cyber attacks, plan sponsors and fiduciaries should develop a cybersecurity risk management strategy in response; in order to prevent and plan data breaches.

At a minimum, plan fiduciaries should be taking steps to protect their data:

- Plan fiduciaries should educate themselves about the types of potential security threats.

- Learning what strategies third-party service providers implement could be instrumental in preventing cyberattacks.

- We shouldn’t underestimate the negotiation of cybersecurity provisions in service agreements.

- Plan fiduciaries should gather information about the ways third-party service providers handle data to mitigate the risks of cyber attacks.