- Workers Still Quitting Despite Looming Recession

- What the Numbers Say

- How Are Companies Responding?

- The Fed’s Role

- Financial Wellness Works Both Ways

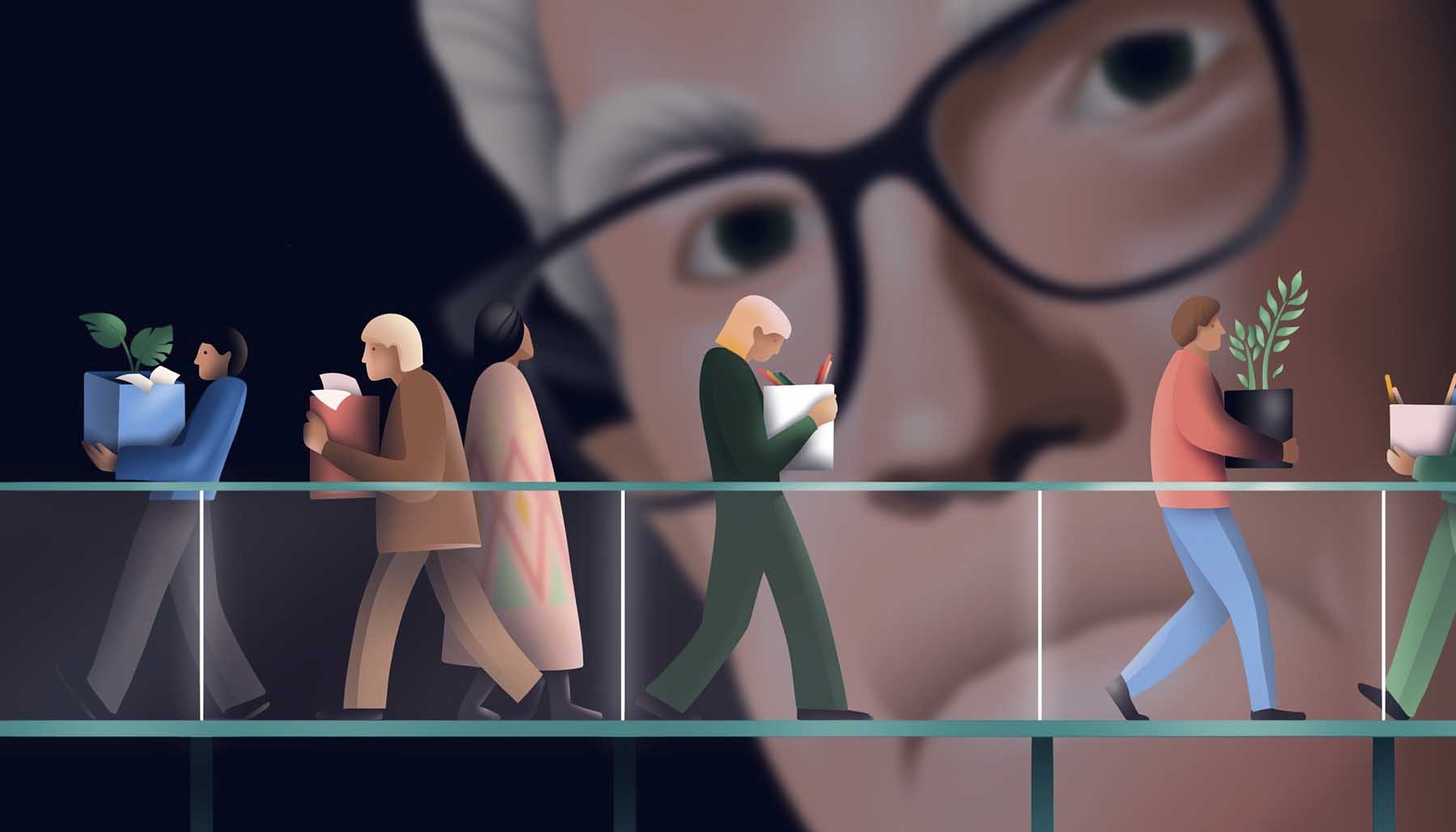

Workers Still Quitting Despite Looming Recession

During the pandemic, workers across America began to reflect and reassess their attitudes towards their jobs. The term ‘quiet quitting’ came into common parlance, a term associated with no longer going above and beyond, but simply doing the tasks assigned to them, nothing more. Other workers have taken it a step further by actually quitting; with the expectation that they’ll find higher pay, and better benefits elsewhere. Free M&Ms and bean bags are nice-but what people really covet is a secure retirement plan, and they are willing to risk unemployment to get it.

Even with a recession breathing down their necks, Americans are still leaving in their droves. The question is how companies respond. Will they hope workers are cowed by the recession, or will they work harder to retain talent, with the carrot approach, in the form of increased wages and benefits?

What the Numbers Say

Researchers at Gartner predict that ‘voluntary turnover’ will shoot to 20% this year; meaning that as many as 37.4 million Americans will quit confident that they will find greener pastures elsewhere.

These numbers are bolstered by a the 2022 Global Benefits Attitudes Survey, where nearly 10,000 American workers were asked directly about what is most important to them:

- 44% Retirement

- 39% Flexible Work

- 62% Guaranteed Retirement Benefits

- 58% More Generous Retirement Benefits

- 53% Retiree Medical Benefits

The message is loud and clear, a growing number of Americans want a serious offer on the table for their retirement.

How Are Companies Responding?

The trend at the moment seems to be for companies to offer a benefits-financial wellness program hybrid. That means that on top of retirement plan contributions, companies are rolling out financial wellness programs that include help with savings, paying off student loans, shock readiness, and the opportunity to talk directly with a financial advisor.

However the magic formula will likely be higher compensation and how much employer matching, on the dollar, is on offer.

The Fed’s Role

Of course the potential monkey wrench in the spokes of this humble American dream, for better retirement benefits, is the Fed, who have raised rates by 75 basis points. Forewarning this move In a recent speech, the Federal reserve chair, Jerome Powell, said that the American central bank was willing to ‘inflict pain’ on American households to combat inflation. In short Powell, by increasing interest rates, is willing to spark a recession that will lead to mass layoffs and hamstring the bargaining power of even the most talented American employees.

When Powell talks about a likely ‘softening of labor market conditions’ he is talking about only one thing-unemployment.

The basic idea is to cauterize the wound, a ‘little’ pain now to prevent much worse pain later. However, given the complex reasons for the economic turmoil, the pandemic, the supply chain crisis and war; what if Fed is wrong, what if they fail to regain price stability and lower inflation?

Average Americans will have been sacrificed for nothing and increasingly won’t be planning for retirement, instead focused on day to day expenditures. For better or worse Powell has vowed to ‘keep at it’

Financial Wellness Works Both Ways

According to Jerome Powell and the Fed the outlook is bleak, and to a large extent companies are at the mercy of rate hikes, in terms of what they can offer. But companies need to remember that, in order to attract, nurture and retain talent, they can’t just talk about financial wellness, they also have to deliver it; as best they can even in tumultuous times like these. Guaranteed retirement benefits secure the future not just of employees but businesses too.

If you want to grow your business in challenging times, talk to one of our client success team, to see how you can plan for success with Larkspur Executive; our premier prospecting software.