- Factors Contributing to Retirement Planning Problems

- Problems Arising from These Factors

- Addressing These Problems

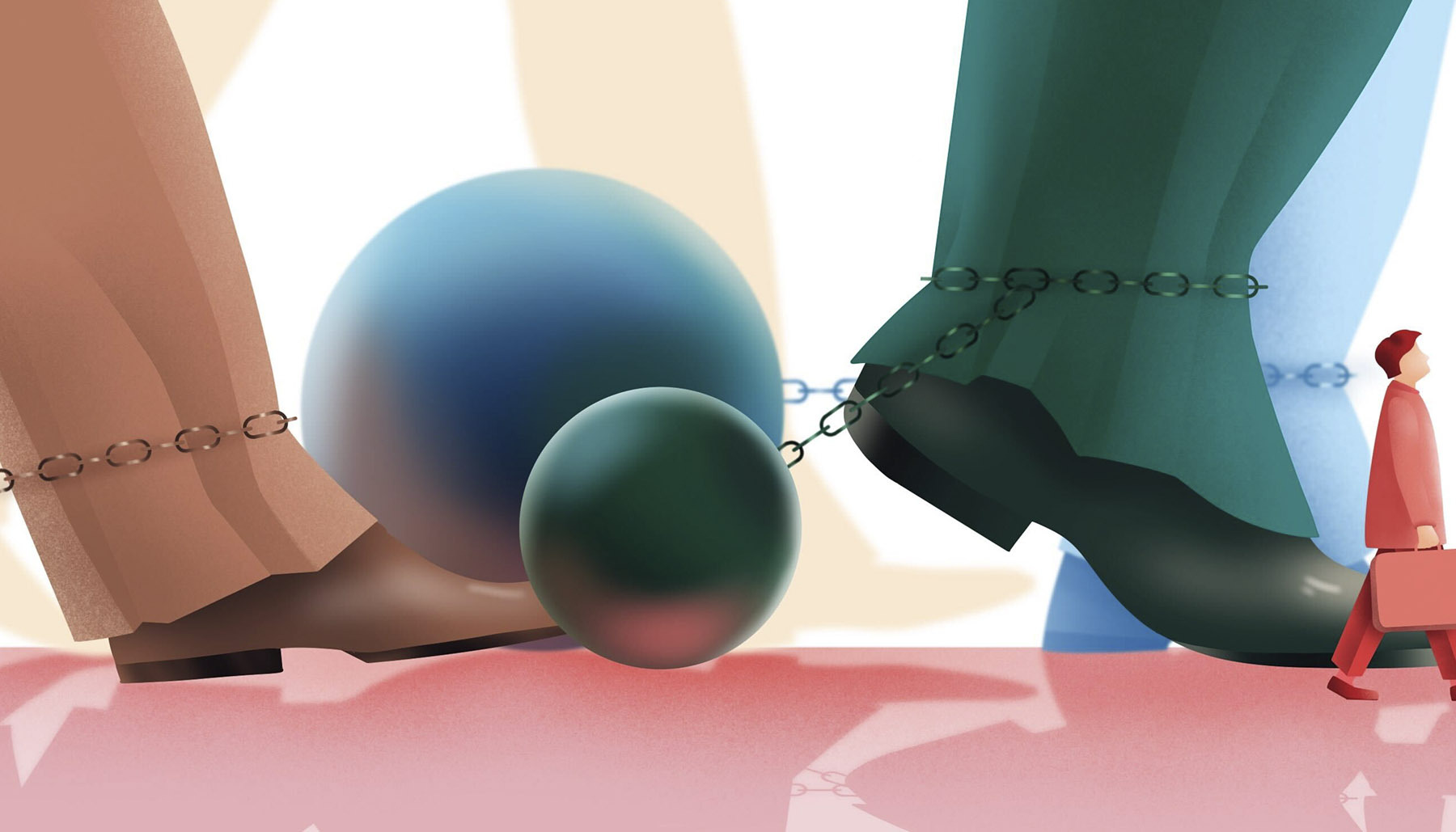

Factors Contributing to Retirement Planning Problems

In the US, and around the world, there is a retirement planning crisis. Individuals are simply not properly preparing retirement. Unfortunately, many are hindered by economic factors like low wages, stagnant wage growth, and high living expenses. This can make it difficult, and sometimes impossible for individuals to save adequately for retirement.

There are also social factors to consider, a lack of access to employer-sponsored retirement plans, especially for small business employees and gig economy workers, can limit an individuals’ ability to save for retirement.

Furthermore, individual circumstances, like a lack of financial literacy and knowledge about retirement planning strategies, can hinder individuals’ ability to make informed decisions and effectively save for retirement. High levels of debt, such as credit card debt or student loans, can also impede retirement savings.

And finally, government policies, uncertainty surrounding the future sustainability of Social Security creates concerns for retirees who heavily rely on these benefits. Additionally, tax policies and regulations can impact individuals’ ability to save and invest for retirement.

It is important to note that these factors are interconnected and can compound with each other, making it even more challenging for individuals to address retirement planning problems.

Problems Arising from These Factors

The above mentioned factors can aggravate the existing retirement planning problems. Some of these problems include:

Inadequate savings: Many Americans have not saved enough for retirement, leading to a significant shortfall in their retirement funds. This is often due to low wages, high living expenses, and a lack of financial literacy.

Lack of access to employer-sponsored plans: Not all employers offer retirement plans such as 401(k)s, leaving many workers without access to tax-advantaged savings options. This particularly affects small business employees and those working in the gig economy.

Social Security uncertainties: The future sustainability of Social Security is uncertain, with concerns about its long-term solvency. This creates uncertainty for retirees who heavily rely on Social Security benefits as their primary source of income.

Rising healthcare costs: Healthcare expenses continue to rise, posing a significant burden on retirees. Many individuals underestimate the cost of healthcare in retirement, leading to unexpected financial strain.

Longevity risk: With increasing life expectancies, individuals face the risk of outliving their retirement savings. This can result in financial insecurity during the later years of life.

Investment volatility: Market fluctuations can significantly impact retirement savings, especially for those heavily invested in stocks or other volatile assets. Economic downturns can erode retirement funds, causing setbacks for individuals nearing or in retirement.

Lack of financial literacy: Many Americans lack basic financial knowledge, including understanding investment options, tax implications, and retirement planning strategies. This hampers their ability to make informed decisions and adequately plan for retirement.

Debt burden: High levels of debt, such as credit card debt, student loans, or mortgages, can impede retirement savings and create financial stress for individuals as they approach retirement age.

Inflation risk: Inflation erodes the purchasing power of retirement savings over time. If investment returns do not outpace inflation, retirees may find it challenging to maintain their desired standard of living.

Cultural and societal factors: Some cultural and societal factors, such as a lack of emphasis on retirement planning or a focus on immediate gratification, can contribute to inadequate retirement savings and planning.

Addressing These Problems

Addressing these retirement planning problems requires a combination of personal financial responsibility, employer initiatives, government policies, and increased financial education to ensure individuals can achieve a secure and comfortable retirement. To address these problems, several steps can be taken.

Increase financial literacy: Educating individuals about retirement planning strategies, investment options, and the importance of saving early can empower them to make informed decisions. This can be done through financial education programs, workshops, and online resources.

Improve access to retirement plans: Expanding access to employer-sponsored retirement plans, especially for small business employees and those in the gig economy, can help individuals save for retirement. This can be achieved through policy changes or incentives for employers to offer retirement benefits.

Encourage savings: Implementing policies that incentivize and encourage individuals to save for retirement, such as tax breaks or matching contributions, can help boost retirement savings rates.

Address economic factors: Policies aimed at improving wage growth and reducing living expenses can alleviate some of the economic barriers to retirement planning. This can include measures to increase minimum wages, provide affordable housing options, and reduce healthcare costs.

Strengthen Social Security: Ensuring the long-term sustainability of Social Security benefits is crucial for retirees who heavily rely on these funds. Policymakers can explore options to strengthen the program, such as adjusting the retirement age or increasing funding sources.

Promote debt management: Encouraging individuals to manage and reduce their debt levels, such as credit card debt or student loans, can free up more funds for retirement savings. Providing resources and support for debt management and repayment can be beneficial.

Foster a culture of retirement planning: Promoting the importance of retirement planning through public awareness campaigns and cultural shifts can help change societal attitudes towards saving for retirement.

As we can see, addressing retirement planning problems requires a multi-faceted approach involving government policies, employer initiatives, educational programs, and individual actions. Collaboration between various stakeholders is essential to create an environment that supports adequate retirement savings for all individuals.

At RiXtrema, we provide financial advisors with prospecting software for 401k plans all over the country. Our tools use qualified plan data taken from 5500 filings and open sources, allowing us to reach out to plan executives with marketing letters. We comply with fiduciary regulations, and can measure the risk of every client’s portfolio. Recently we have launched new AI tools. You can find all of RiXtrema’s products on our main website rixtrema.com and sign up for a free demo of any tool!