- BlackRock is a Behemoth

- Blackrock’s warm-and-fuzzy Coal Industry Divestment

- Divesting – Is it the final nail in the coal coffin?

- Seeing beyond the warm-and-fuzzy Green – Washing

- The problem with sustainable initiatives – accountability

- Greenwashing is good for business and brand

BlackRock is a Behemoth

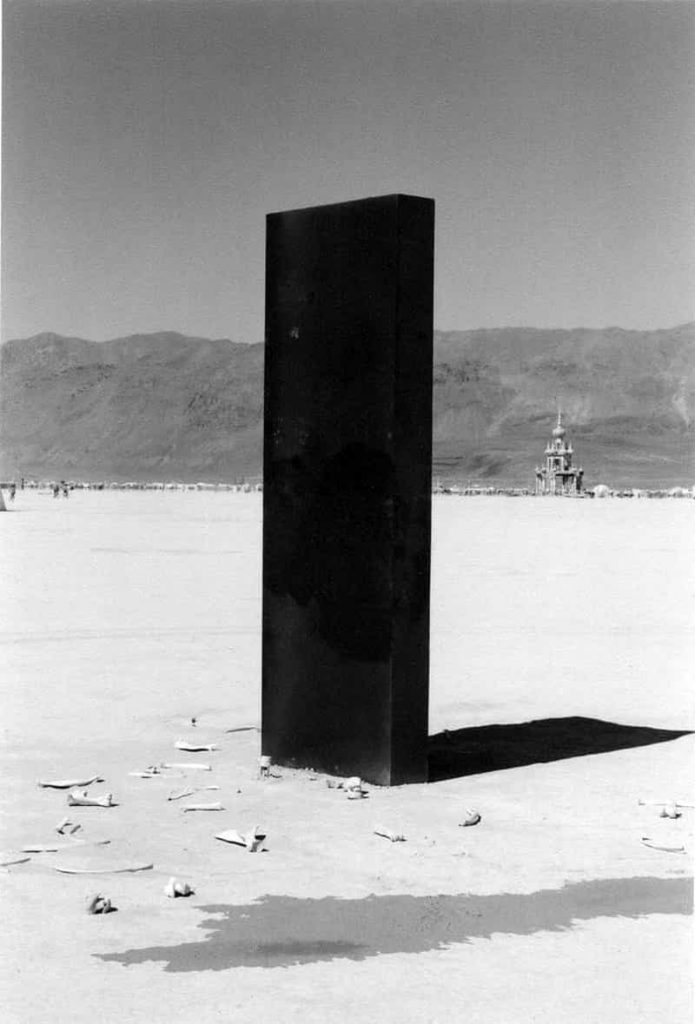

BlackRock is the type of firm that needs no introduction to financial advisors. As the world’s largest asset management firm, Blackrock manages over $7tn financial assets – and always reminds me of the first act in Kubrick’s 2001 Space Oddessey (Image 1). Last month the firm adopted a new sustainability initiative, and – just as the black monolith liberated the apes from their arid environment through weaponry – BlackRock is large enough to put a sharp edge on the sustainable investing industry.

Blackrock’s warm-and-fuzzy Coal Industry Divestment

BlackRock CEO Laurence Fink wrote a letter to CEOs announcing that environmental sustainability will be the cornerstone of BlackRock’s future investment decisions.

We’ve written before about the wave of ESG Investing interest, how Millennials and Gen Z are preferring in-person advisors to Robo or DIY methods. Yet, financial advisors are not meeting that demand. BlackRock’s’ initiative will certainly energize more interest in ESG and sustainable investing.

One question on my mind: Is BlackRock’s decision motivated by reformatting the brand, or is it just good business sense?

Divesting – Is it the final nail in the coal coffin?

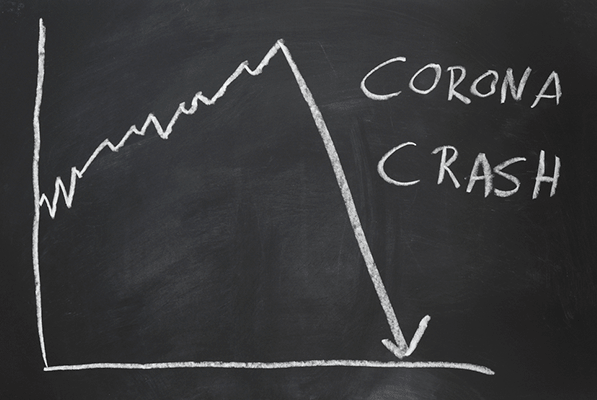

The new sustainability direction will divest their $1.8tn portfolio of actively managed funds from any firm generating more than 25% of revenue from thermal coal. What’s more impressive is that they estimate to have this done by mid – 2020.

- Making sustainability integral to portfolio construction and risk management

- Exiting investments that present a high sustainability-related risk

- launching new investment products that screen fossil fuels; and

- strengthening a commitment to sustainability and transparency in investment stewardship activities.

We are on the same page if those sound a bit hoity-toity. Yet, I encourage you to read the full letter because the commitments to change are more steadfast than those brief bullet points.

Coal is the single most significant contributor to climate change. According to the 2018 IPCC report, coal-fired power generation must decrease by 78% by 2030 to keep the 1.5C limit within reach. Fink writes that government intervention and regulatory reform is inevitable and will have shattering impacts on the fossil fuel industry.

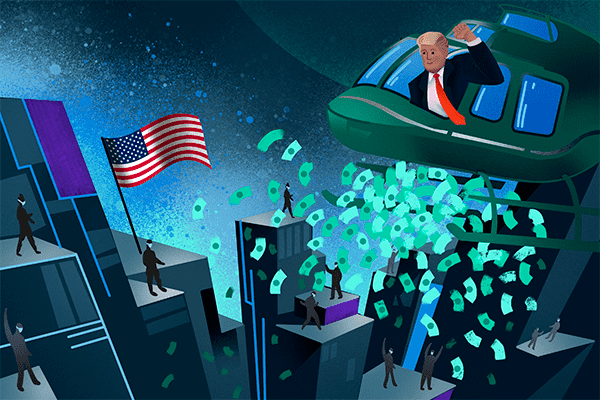

Let’s take a step back and look at this more objectively without the environmental imperative. This sustainability shift shouldn’t shock anyone. Coal has been a dying industry for the past decade, and nothing has changed since Trump vowed to save the industry on the campaign trail.

Moving away from coal is a natural choice for BlackRock. The share of coal-produced energy is declining every year in the US. There has been no Anthracite awakening by the Trump administration simply because the government can’t make rival energy sources more expensive. More natural gas – the cleaner alternative – is burned off than is consumed by midsized countries. (Not a reassuring image)

Seeing beyond the warm-and-fuzzy Green – Washing

It’s important to remember that BlackRock has been the world’s largest investor in coal plant developers – holding shares and bonds valued at $11 billion in 56 coal plant developers (2018).

Environmental groups, like the Sierra Club and Amazon Watch, launched a campaign called BlackRock’s Big Problem in 2018. The action came after a report showed that BlackRock owns “more oil, gas, and thermal coal reserves than any other investor – 30% of total energy-related emissions from 2017. The company is the world’s largest investor in coal, oil, and gas companies, and those “driving deforestation.”

The problem with sustainable initiatives – accountability

Standard Chartered, another top-10 coal investor, adopted a new coal policy in 2018, which says: “We will not directly finance any new coal power plant projects.” Yet, despite not directly financing any new deals for coal plants in 2017 or 2018, it loaned more to top coal plant developers in China, Indonesia, Japan, and the Philippines – corporate lending jumped from $373 million in 2017 to $1.18 billion in the first three quarters of 2018.

While the market may force BlackRock to change its ways, nobody is holding them accountable or keeping them from following Standard Chartered. Best to remember – BlackRock isn’t just any old investment bank. Its reach allows it to operate in sectors not governed by domestic regulators – especially shadow banking. The Financial Stability Board reckons that at the end of 2017, shadow banks generated $184tr in financial assets. So, there isn’t much of a reason to think that BlackRock will even follow-through with their divestment – perhaps disguise their lending.

Greenwashing is good for business and brand

So, it’s fair to rule out Larry Fink’s warm-and-fuzzy change of heart about environmental issues as a prime motivating force. Blackrock’s Coal divestment may be unloading already unattractive investments – picking the low-hanging fruit.

Yet, regardless of its history or motivation, BlackRock’s investment policy change is a cleave on the financial industry iceberg – one that may expose the rest of the asset management sector to the light of sustainable investing. As I wrote before, just as with the elimination of transaction fees, numerous other brokerage institutions and banks followed Charles Schwab when it announced commission-free transactions. I wouldn’t be surprised if many other firms follow BlackRock’s play. Once governments take real action to curb climate change, the risk of holding coal and other fossil fuel industries will be more apparent.