With tax season in the rear-view mirror, for this year, advisors and investors can now refocus on portfolios. The most common way to look at portfolios is through the prism of asset allocation models. We are all familiar with different allocation strategies like 60/40, 50/50, 30/70, etc. Those numbers simply represent portfolio allocation to different asset classes. For example, 60/40 would represent Equity (60%) and Fixed Income (30%). Also, those strategies can be called Aggressive allocation (60/40), Moderate allocation (50/50), Conservative allocation (30/70) and everything in between. It is very important to adjust your portfolio allocation relative to your risk tolerance and these strategies are helpful to address it. However, looking at portfolio investment in a more holistic way is even more important. The holistic approach means taking into consideration the tax efficiency of investment accounts.

Tax efficiency comes from understanding how different investment accounts work and what investments are the most suitable for each account. There are a few different investment accounts: taxable accounts (regular trading accounts), tax-deferred accounts (401k, Traditional IRA) and tax-free accounts (Roth IRA, Roth 401k). The idea of efficient asset location is to generate more returns in a tax-efficient manner. For example, two identical portfolios, one built in the taxable account, and one built in a tax-efficient way, can generate completely different returns. The additional tax-adjusted returns can generate over 6% in additional spendable income over a course of 30 years. Without a doubt, the investor will be happy to have more spendable income that comes from the tax-efficiency allocation approach.

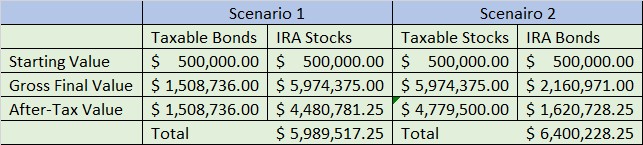

Now, let’s look at the steps that every adviser and/or investor should be taking to create a tax-efficient portfolio approach to minimize “tax-drag” on the final returns of the total portfolio. It is important to build an asset location priority list. The asset location priority list is based largely on tax efficiency, which can be used to help identify where to house each type of investment, with the least tax-efficient holdings being placed into the most tax-advantaged account. A very good example to illustrate the asset location priory list logic is to use two simple assets like stocks and bonds. Every investor knows that stocks, if held long term (more than 1 year), taxed at the normal rate, which can range from 0% to 20% in 2022 depending on the income. It means that stocks held in the taxable account will be taxed at that rate. However, the same stocks held in tax-deferred accounts like the Traditional IRA will grow tax free, but when investors withdraw the gains, it will be taxed at ordinary rate, which can be as high as 37% in 2022. This makes clear why keeping stocks in the taxable account makes more sense. Another great example of tax-efficiency management is bonds. Bonds are cash producing assets that generate regular interest payments that can be taxed as ordinary income if held in the taxable account. However, if it is placed in the tax-deferred account generated income can be reinvested and continue to grow tax-free. To illustrate this example, I created a table where two assets are placed in different accounts. In scenario 1, bonds are taxable, and stocks are tax deferred. In scenario 2, it is reversed. As a result, with long term capital gains rate of 20% and ordinary tax rate of 25%, scenario 2, where bonds grow at tax free and interest income gets reinvested tax-free, outperforms scenario 1 by 6%, resulting in additional $410,711.00. Moreover, the biggest contribution to after-tax value comes from stocks being taxed at a capital gains rate of 20% in scenario 2 vs. ordinary rate of 25% in scenario 1.

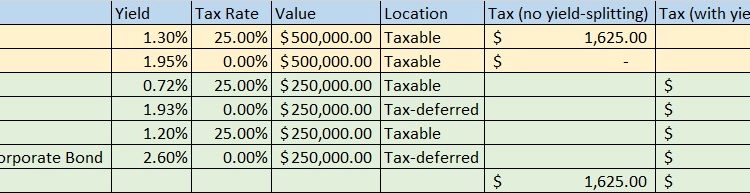

After an investor understands tax benefits of each account and tax treatment of each asset class, it is time now to think about asset allocation among asset classes and investment accounts. It is important to consider this in the context of your entire portfolio. The allocations should reflect your return needs for return, balanced against your tolerance for risk. I already mentioned above typical asset allocation strategies such as Equity 60% and Bonds 40%, aka 60/40 portfolio. However, such a portfolio can also be constructed using yield-splitting strategy. The yield-spitting strategy enhances tax efficiency by replacing the use of broad-based index funds with a corresponding pair of funds – one low-yield tax-efficient fund and another higher-yield, tax-inefficient fund. To illustrate this method, I would like to return to the stocks and bonds examples above to simplify the analogy.

From the table above, we can see that scenario 2 outperforms scenario 1 by approximately 6% over the same investment period. The scenario 2 assumes investing $500,000 in the broad market fund such as S&P 500. This index is composed of different stocks, value and growth stocks. So, this broad market fund can be represented by two broad market funds focused on growth and value, Core S&P U.S. Value and Core S&P U.S. Growth. Usually value stocks are high-yielding stocks and growth stocks are low-yielding. It makes sense to split asset allocation to the stock market among those two asset classes rather than put all money into one broad index. The yield splitting strategy allows us to put high-yielding market index (value) into a tax-deferred account and low-yielding market index (growth) into a taxable account. Similar logic can be applied to bonds. Core U.S. Aggregate Bond can be split into two categories, U.S. Treasury Bond and Broad USD Investment Grade Corporate Bond. U.S. Treasury bonds are tax-efficient because there is no state tax on generating income and it can be placed into a taxable account. However, the corporate bonds are high-yielding and can be placed into a tax-deferred account. The yield-splitting strategy can generate annual tax savings of 35%-40%.

As you can see every aspect of tax-efficiency can lead to better annual tax savings and overall spendable income down the road when it is needed the most, at your retirement. Building a tax-efficient retirement portfolio is one of the most effective ways to reap great retirement benefits for any investor.