President Donald Trump signed the $2.3 trillion coronavirus stimulus legislation on Friday, 3/27/20, a.k.a. The “Coronavirus Aid, Relief and Economic Security” Act (CARES). The Act represents government spending equal to 52% of the $4.447 trillion in 2019 actual government outlays. This stimulus package will be a massive help for many Americans who lost their jobs because of the pandemic.

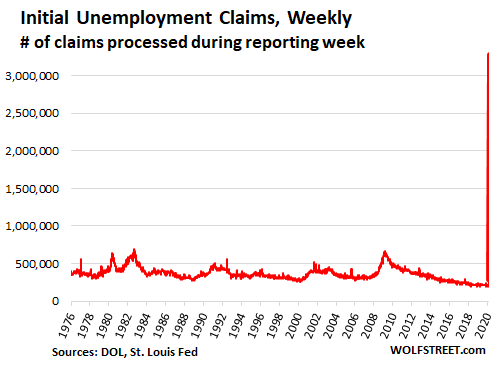

Figure 1 shows that unemployment claims are at an unprecedented level. During the last week of March 2020 for the United States, with 3.3 million people filing help. So, this package will be a life vest for so many who need to persevere through this crisis.

The stimulus will be distributed through various channels such as direct payments, unemployment insurance, payroll taxes, use of retirement funds, 401(k) loans, etc. (you can read more about it in “The CARES Act Has Passed: Here Are The Highlights”). The direct payment will supposedly be distributed around mid-April as part of the stimulus and is like free money to keep afloat all who work and file taxes. However, for many people who suffered from job loss or staying on unpaid furlough, there is another option that allows them to tap into their retirement savings. This can be a life-changing option for those who really need it. But, for many, it will also be a temptation to withdraw funds from their retirement accounts prematurely.

Advisors need to stay connected with their clients to communicate and guide them through this emotional time. In a time of uncertainty, we all tend to panic, and, when it comes to our investments, people follow the knee-jerk reaction. This reaction can be age-specific, so communication should be age-specific as well. For young participants, advisors should focus on the opportunity to make an investment at lower prices. For those who are reaching retirement, the focus should be on staying confident with the plan. For those who already retired, the focus should be on staying disciplined with the distributions. In general, the importance of saving and staying in the plan still holds. All other options should be explored by individuals before tapping into their retirement savings.

The CARES Act optional provision of distribution from eligible retirement plans and IRAs sets the new limit on the amount that can be withdrawn in one taxable year which should not exceed more than $100,000. Under this law, the distribution would not be subject to a 10% penalty for early withdrawal for people who have not reached the age of 59-½. Additionally, the mandatory 20% withholding tax on these distributions would not apply. Moreover, these distributions can be spread out for the tax purpose over three years, and they will be treated as satisfying the requirements for the hardship distributions from a 401(k) plans. Some participants may opt to take loans instead of distributions. The CARES Act increases the maximum dollar amount available for loans from tax-qualified plans from $50,000 to $100,000. Also, it increases the maximum percentage limit for loans from 50% of the present value of a participant’s benefit to 100% of the present value of a participant’s benefit under the plan. Still, loans must be expressly permitted under the plan.

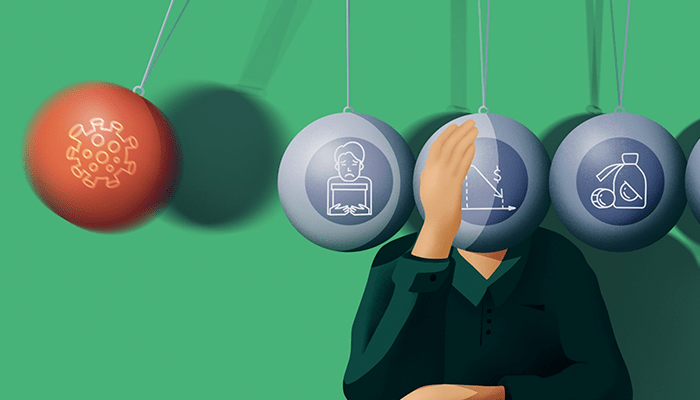

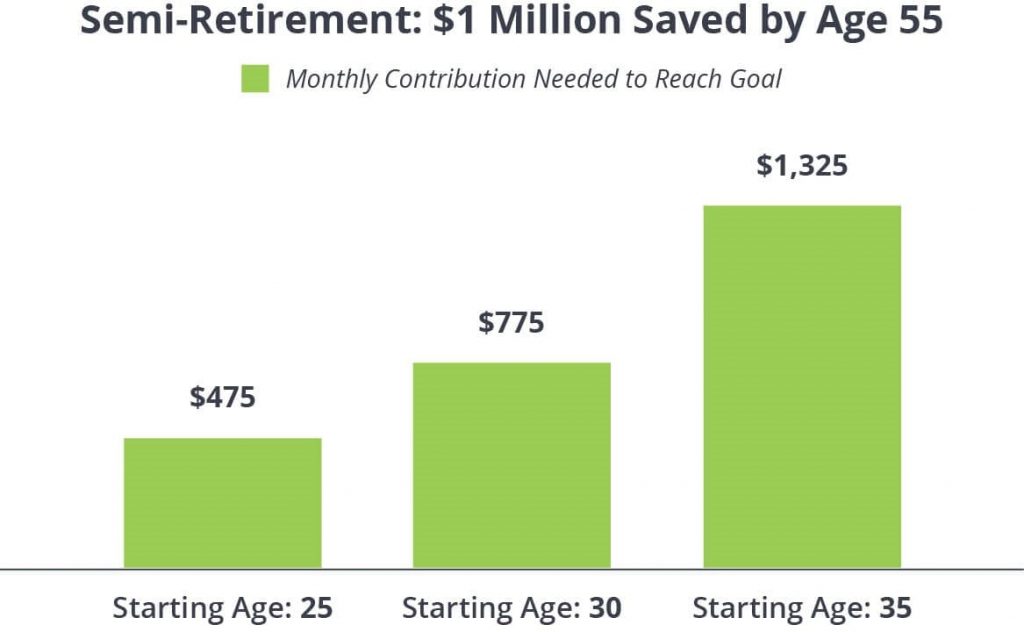

We all agree those are extraordinary measures at extraordinary times. However, I would argue that everyone should be extra careful before making a decision to access these funds because the implications of doing so can be far-reaching. For one matter, everyone heard and knows there is no worst timing than to sell at the bottom and buy at the top. Right now, our financial markets are undergoing a steep correction in the valuation. A steep slide in the stock market value equal to approximately 33% left many investors unprepared and badly bruised. It is scary, and it is normal to worry about your nest egg. Still, if you pull out of the market right now, you are losing a chance to get even because after sharp sell-offs markets tend to spring back up in a matter of weeks if not days. Figure 2 shows the impact of not saving every year for retirement now. (you can read more about the importance to save early HERE).

As you see, tapping into retirement savings should be a final option because withdrawing from a retirement account can result in hardship later. There is no easy strategy to get through this crisis, but most advisors should be able to come up with a client tailored plan on how to get through it in one piece. If the sacrifices are necessary, withdrawals should start with the least essential assets like savings planned to be used for an upcoming vacation or to get a new car and then work your way up. We all hope that the COVID pandemic will be over soon, and we will get through it, but we must also see the big picture of our life past this crisis.