Update: September 27, 2022

Published: March 15, 2022

Far from subsiding, the tensions surrounding China and Taiwan have increased since my initial analysis. House Speaker Nancy Pelosi’s visit to the island resulted in minor military provocations from the Chinese, and both sides have continued verbal sparring. I originally wrote that a military conflict is a low-probability event, and my opinion has not changed based on recent events. Clients have asked about this scenario recently, so I thought I would highlight the initial analysis again.

Note: We will be doing an Investing Counterpoint episode on this scenario in the near future.

Russia’s invasion of Ukraine is affecting markets daily. We have created stress tests that have attempted to measure moderate and severe consequences for global markets as a result.

Even though that war is still raging as of this writing, this article will look forward to what could come next. For me, the next big risk is China attempting to annex Taiwan. Here is an interesting article that quickly summarizes the history of the “China-Taiwan divide.”

I was taking my time writing this as I consider this a relatively unlikely scenario. But recent posturing by the US and Chinese in and around Taiwan could exacerbate tensions and rapidly escalate the situation. See here, here, and here for three examples of recent events in a long history of saber-rattling that could be the beginnings of escalations.

China could also launch this attempted annexation while the world focuses on the Ukrainian crisis with the hope that there is no appetite to impose similar sanctions. The damage that would be inflicted on the economies imposing those sanctions on China would be severe even in isolation. Coupled with the damage inflicted on the US and allies, particularly European allies, by the existing sanctions, they may be right. But any military action by China surely must be answered, particularly by the US, which has vowed to support Taiwan against any Chinese aggression.

While I consider this scenario a low-probability event, it is an event that would have a very high impact on financial markets and should be considered. This blog will not go into all the geopolitical events that could cause the crisis – there are people much more familiar with these sensitivities than I am. But constructing scenarios to assess potential portfolio impacts is critical in a robust portfolio risk management process.

This scenario assumes that the situation escalates so that at least China and Taiwan’s military become engaged in conflict. The US, which has declared that it will defend Taiwan, may also get involved, though, as with Russia, I would expect that the US would have little appetite for a direct conflict with a nuclear-armed China. The admirable job the Ukrainian armed forces have done against the much more formidable Russians may also give hope that the relatively well-equipped Taiwanese military could replicate this success. After all, China has a strong interest in not flattening Taiwan in annexation (a concern Russia does not have in Ukraine), meaning that the conflict could be more focused.

We will also postulate that the West’s (mostly) united front in sanctioning the Russian economy and oligarchs would be repeated in our scenario. But China and Russia are very different economically, politically, and militarily. And the united response would also be uniquely tailored to meet these differences.

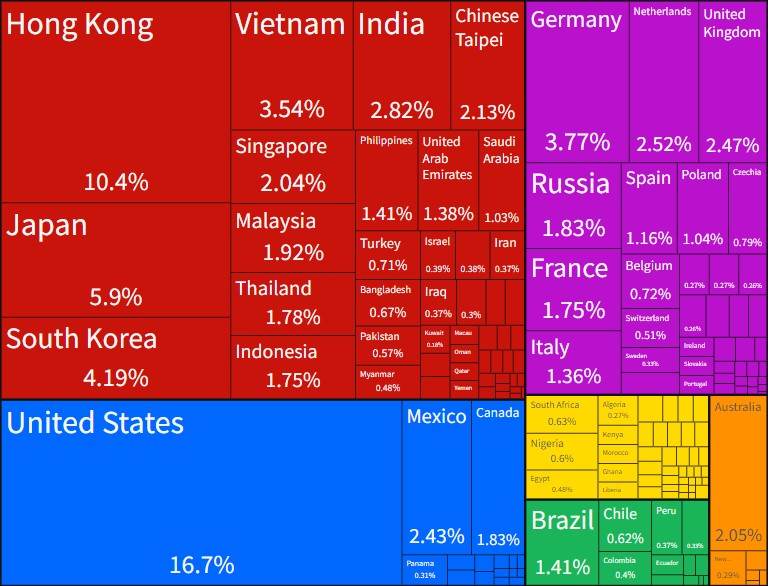

Economically, the primary differences between the Russian invasion of Ukraine and any conflict over Taiwan are scale and impact. The size of Russia’s economy (measured by GDP) is only about 10% of China’s. The total exports of China’s economy amount to about $2.6tn per year versus Russia at $403bn per year, and imports are about $1.7tn for China to $226bn for Russia. This makes imposing sanctions on Russia, relatively, a much easier proposition in terms of global impact. The graphic below comes from the OEC (which is a fantastic site) and shows the destination countries for China’s $2.6tn of exports.

Exhibit 1: Destination for Chinese Exports

Source: OEC, China (CHN) Exports, Imports, and Trade Partners | OEC – The Observatory of Economic Complexity

The types of goods imported and exported by China and Russia are also much different and would impact global economies differently. Where the rest of the world readily produces Russia’s primary exports of oil, natural gas, and wheat, this is not the case for China, where almost 50% of its exports are related to computer equipment, semiconductors, and other items used primarily in technological applications. Some other supplier can’t replace these products. The US and other economies were already experiencing inflation, supply chain disruptions, and delayed shipments due to the global pandemic that were starting to subside. The Russia/Ukraine conflict has made inflation much worse. A dispute related to Taiwan would make these issues much, much worse.

Then we must consider the countries where the conflicts are centered, namely Ukraine and Taiwan. Here too, we have two countries that are dramatically different in scale and impact, with Taiwan’s economy being about 4x the size of Ukraine. Ukraine is a producer of corn and wheat as well as iron products of a size large enough, when coupled with Russian disruption, to exacerbate an already strained global food supply, and hence inflation.

Taiwan not only supplies many of the same integrated circuits and other technological products as China, but China is their largest export market, which means that many goods produced in Taiwan go to China before being exported to other countries as products. Since these economies are so interdependent, any sanctions or disruptions may be magnified.

Given the disruption in the food supply, I expect that the Russian/Ukraine conflict will be a larger humanitarian catastrophe in terms of suffering and starvation. This is particularly the case in developing economies that will be the first to go without. But the rest of the world also produces the commodities that are Russia and Ukraine’s primary exports, and in large amounts, so the rest of the world may be able to make up at least some of the difference. But any China-related conflict would have a more significant economic impact due to a lack of substitute product supply.

Given these facts and assumptions and knowing that the largest recipient of Chinese goods is the US (by far, taking almost 17% of all Chinese exports) and collectively Europe x Russia (taking 21%), the effect of this conflict would be quite different than what we are currently experiencing. In isolation, this stress would, in my view, be far worse than the current Russian/Ukrainian conflict. If China attempts to annex Taiwan while the Ukrainian conflict is ongoing, the crisis will be far worse than an annexation attempt in isolation.

This scenario assumes that the conflict occurs while the world still feels the current crisis’s effects. It also assumes that the world will present the same united front in sanctioning all aspects of the Chinese economy and that the US will not be involved militarily. Neither is assured. Nor is it assured that multinational corporations that have pulled out of Russia would also pull out of China. Given that the West has played a strong hand against Russia, China will either be deterred from action, prepared for the consequences, or bet that the West doesn’t have the stomach for a repeat performance of sanctions.

But assuming crippling economic sanctions and a significant rejection of Chinese exports by most of the world, and a boycott by multinationals, the primary stress would be on the Chinese economy and market, which I expect could fall by 70%. This is particularly true if the conflict lasts for several months. At the same time, the US semiconductor sector could fall by 60%, which will, of course, impact other sectors, especially tech and automotive. Removing China as a market for some key US and European food exports would likely cause soybeans to fall by 25%. Potential selling pressure on US Treasuries, as China is the second largest foreign holder of UST, would cause a 25bps upward shift in the yield curve even as investors flock to UST as a safe haven.

While similar geopolitical disruptions have had much smaller effects than the one we model here, I believe there is the potential for a China/Taiwan conflict to be much more disruptive, with the impact much more widely felt. This is particularly true in conjunction with the ongoing Russia/Ukrainian conflict.

To give a sense of the effect on markets, this scenario would result in the S&P 500 declining by about 50% and the US Bond Aggregate declining by about 3%.

Here, at RiXtrema, we help financial professionals improve their clients’ portfolios by carving out a thoughtful, appropriately sized position for each fund that fits the client’s risk tolerance and risk capacity. Feel free to learn more about our Portfolio Crash Testing tool on our main website.