- CRS Form:

- First, what is the CRS Form?

- Ok, but what’s in the thing?

- Don’t forget lovely formatting

- Delivering the CRS Form

- When do BDs provide a CRS Form?

- What about delivery for firms?

- Don’t forget about filing

- Then, there’s Recordkeeping

- RIXTREMA’S REG-BI OPTIMIZER is the fastest way to show a “Good Faith Effort”

Two things have become more worrying during my Reg-BI research.

First, the CRS Form is not cheap to build. Each advisor may well spend an average of 23.77 hours and over $6,000 to build the form.

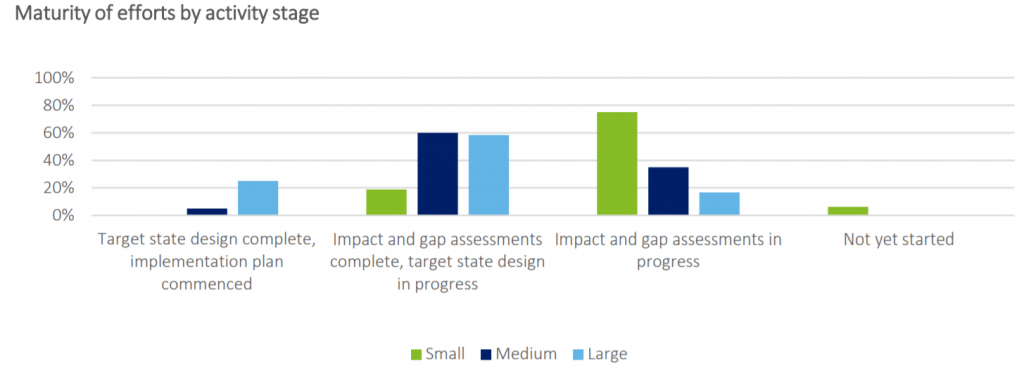

But, the second, more worrying realization is that small firms are not as prepared as larger firms. As a Deloitte survey study found, small financial services businesses lag behind larger firms in their efforts to become compliant with Regulation best-interest.

The SEC though outlined the most important steps that Small entities can make to show a “good faith effort” at reaching compliance with the CRS Form component of Regulation Best Interest. This article will outline those findings but there is a wealth of information on our blog and in the compliance guide.

Read more about what a “best interest” recommendation is HERE.

CRS Form:

I wrote before about why the CRS Form may be the most challenging compliance requirement for small RIA firms because they do not have an internal compliance department to defer costs. Nonetheless, it is a requirement and every firm that offers services to a retail investor must file a CRS form with the Commission and deliver it to each investor.

First, what is the CRS Form?

The CRS Form is in addition to current disclosure and reporting requirements but does not replace any of Reg-BI’s other requirements. The summary is intended to be short and only two pages long for either Broker-Dealer or Registered Investment Adviser, and four pages long for dual registrants.

Ok, but what’s in the thing?

The SEC’s Small Business Guide makes note of the following topics:

- An introduction to the firm and the point of the form;

- Relationships and Services offered by the firm;

- Fees, Costs, Conflicts, and Standard of Conduct with part 2;

- Disciplinary History; and

- How the reader can find more information about the firm.

Firms can use their own wording but are not allowed to include other disclosures in the CRS form. Only those that are permitted or required by the CRS form instructions.

Don’t forget lovely formatting

The formatting also has to be carefully crafted and in 2 pages (4 for dual registrants). Dual registrants or affiliates must prepare a single CRS form or two (one for brokerage and one for investment advisory services) Not exceed four pages. Regardless of length, the form must be composed in plain English (no legal jargon!) and must consider the investor’s level of financial experience. Consult “A Plain English Handbook” to learn more.

Delivering the CRS Form

The CRS forms must be delivered electronically to a retail investor and prominently displayed on the firm’s website, if they have one. If delivered in paper form, then it must be among the first documents provided and delivered when or before an investor enters into an advisory contract – even if the agreement is oral.

When do BDs provide a CRS Form?

Broker-dealers (BDs) must deliver a relationship summary to each retail investor before or at the time of making any:

- a recommendation of an account type, a securities transaction, or an investment strategy involving securities;

- placing an order for the retail investor; or

- the opening of a brokerage account for the retail investor.

Click here to get our comprehensive Reg-BI mini-ebook.

What about delivery for firms?

The CRS Form contains information pertaining to the unique BD or RIA and the firm they represent. Firms must deliver the most recent relationship summary to a retail investor who is an existing client or customer before or when they:

- opens a new account that is different from the retail investor’s existing account(s);

- recommends that the retail investor roll over assets from a retirement account into a new or existing account or investment; or

- recommends or provides a new brokerage or investment advisory service or investment that does not necessarily involve the opening of a new account and would not be held in an existing account.

Firms must deliver the summary within 30 days upon the request of a client or customer and must deliver an updated form whenever they make changes (within 60days of making the change).

Don’t forget about filing

RIAs must file their summary as Form ADV Part 3 (Form CRS) electronically through the Investment Advisor Registration Depository. BDs must file Form CRS electronically through the Central Registration Depository (WEB CRD). That just has “fun” written all over it.

Then, there’s Recordkeeping

It isn’t enough to just deliver the form to your clients. The SEC will want proof that you did just that. So RIAs and BDs must make and keep:

- true, accurate, and current copies of each delivered form and each revision to the form;

- a record of the dates that each relationship summary, and each amendment or revision thereto, was given to any client or to any prospective client who subsequently becomes a client.

Investment advisers must maintain and preserve these records in an easily accessible place for a period of not less than five years from the end of the fiscal year during which the last entry was made on such record, the first two years in an appropriate office of the investment adviser.

RIXTREMA’S REG-BI OPTIMIZER is the fastest way to show a “Good Faith Effort”

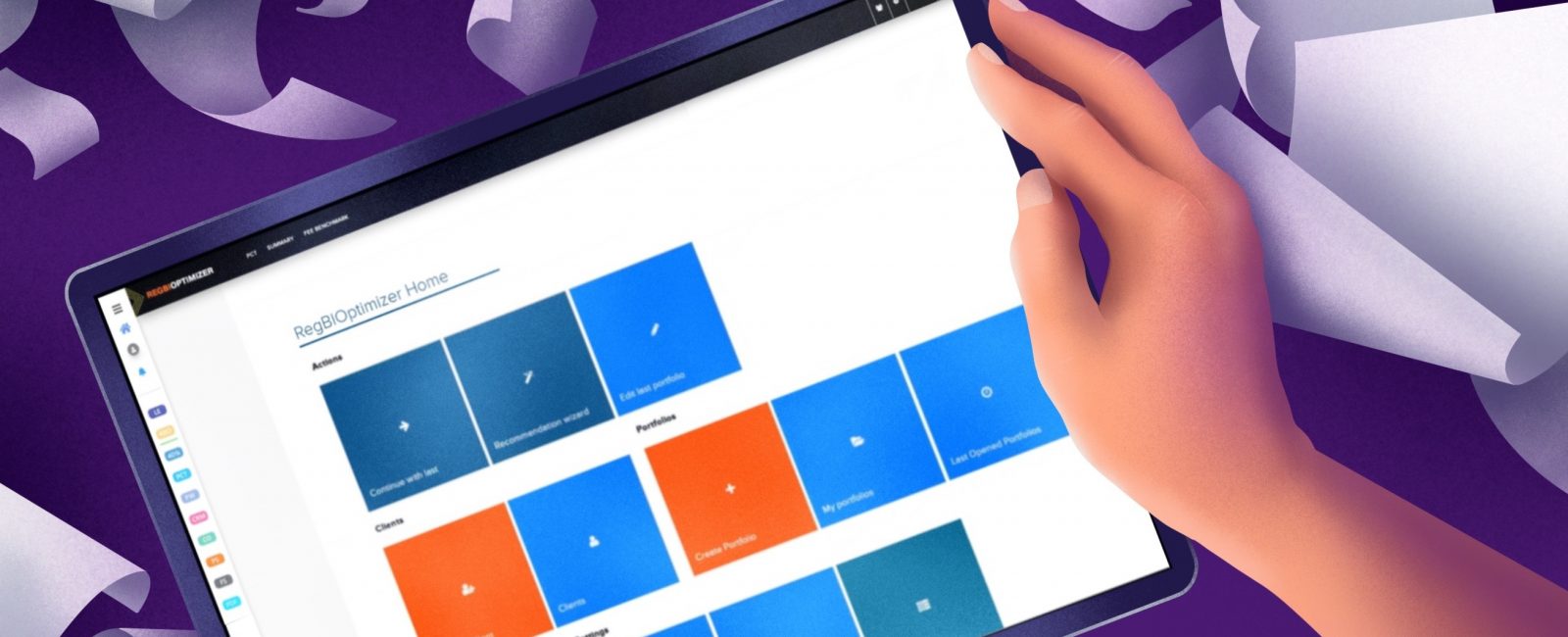

Since the January launch, many advisors are finding that RiXtrema’s Reg-BI optimizer meets the SEC’s Reg-BI expectations and helps optimize processes to ensure proper documentation.

The product is reviewed by top ERISA attorneys who are experts in pension regulatory law. Groome Law reviewed RiXtrema’s product before it launched and found that it met all the SEC’s expectations.

Click here to get our CRS Form Checklist.

The compliance software comes with an administrator panel for Compliance Officers. The admin panel alerts officers if a BD or RIA misses a step or forgets to fill in any part of the Reg-BI Best-Interest requirements.

What are you waiting for? Just click the banner below to schedule a short 15-minute demonstration on how it can help your firm reach compliance.