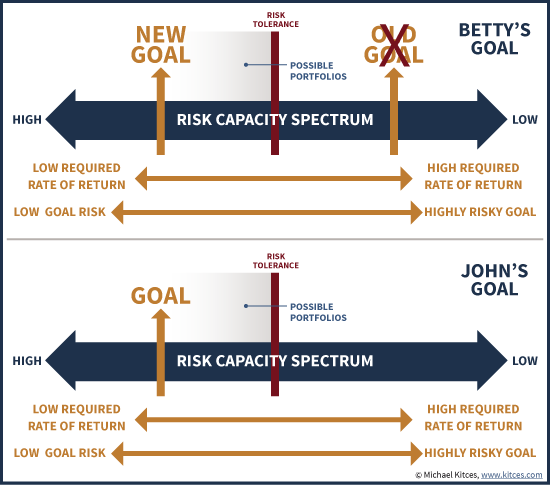

When discussing investment plans with clients, it always makes perfect sense for an advisor to talk about ‘why’ before ‘how much’. The ‘why’ for the investor is always the goal. This is why they invest the money and certainly why they tolerate any risk in the first place. In this respect, there are excellent insights from Michael Kitces’ blog post about the interplay between risk tolerance, goals and risk capacity. Here is the link to that post.

Measuring risk tolerance without asking why the client is tolerating risk has always perplexed me. Does anyone you know why it came to be that way in the world of financial advice? I have a hypothesis that the concept of risk tolerance was simply lifted out of professional asset management. When portfolio managers manage their funds, they always target a risk level i.e. risk tolerance. They never ask about why, because a mutual fund or a hedge fund do not really have a goal other than making as much money as possible within a risk tolerance bound. And it seems this was just transported into an industry where it doesn’t make much sense!

In February of 2015 I wrote an article discussing this conundrum. Here is an excerpt from that article (in full here):

I like to use car shopping as an analogy to the investing process. When we buy a car we are after certain things like performance, handling etc. In order to obtain things that we desire, we must incur risks. For cars, those are usually measured as crash test ratings from the Insurance Institute of Highway Safety. Let’s imagine what it would it be like to buy a car with a view only to targeting our tolerance for risk and forgetting why we are tolerating risk.

Car Shopper: “I am considering these two cars, can you explain to me the difference between them?

Car Salesperson: “Sure thing. The one on the left will give you a whiplash when hit from behind and the airbag will break your nose. The one on the right will actually break a number of bones, including a collar bone and will possibly give you back pain for a good long while. Now, which risks are you ready to tolerate?

Car Shopper: “I’ll take the broken nose please…”

And this is precisely what happens when risk tolerance questionnaire becomes the center of the financial advisory process.

By the way, Advisor BioniX, our robo product for advisors has a questionnaire that combines goals with risk tolerance and does not allow investor to complete the process if the goal does not square with risk tolerance.