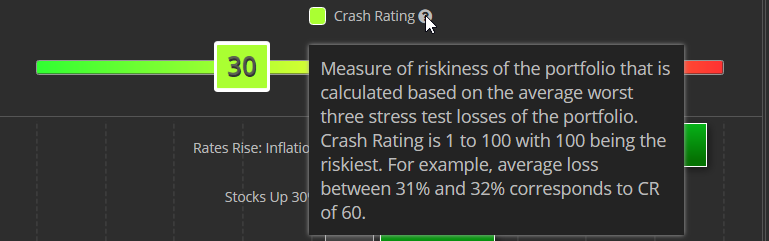

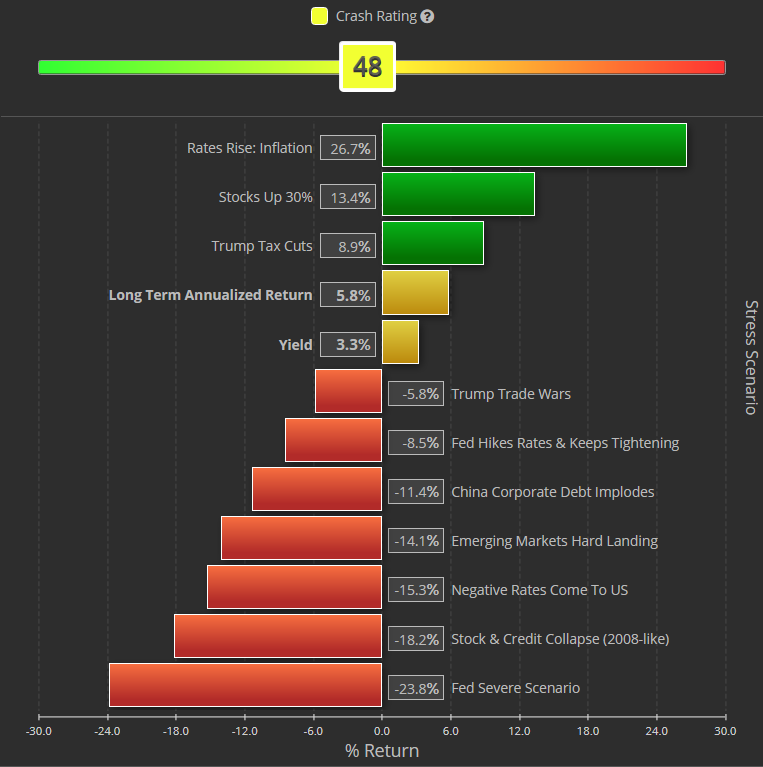

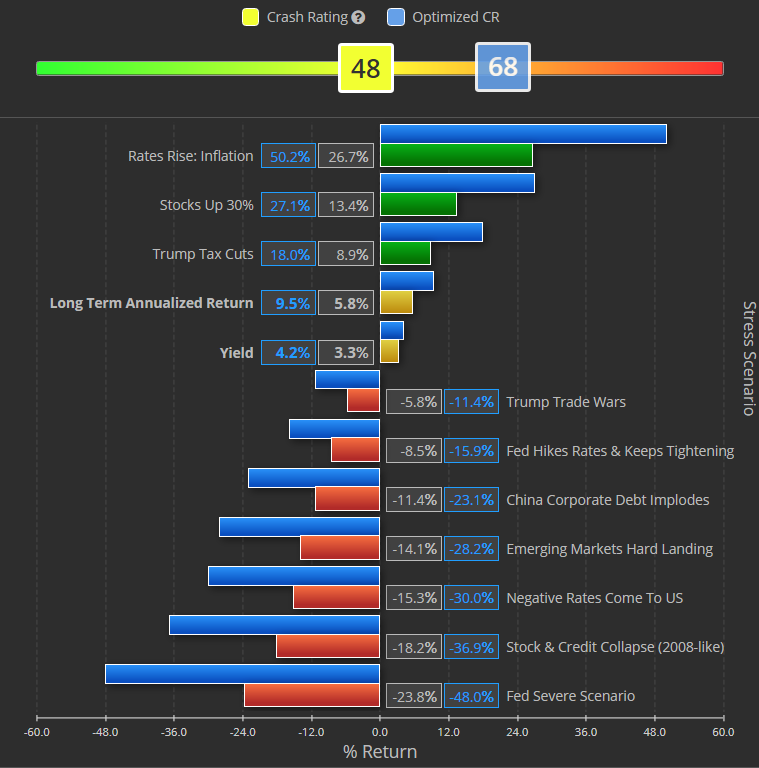

Crash Rating is a number used to measure the risk of a portfolio. It is a representation of the loss a portfolio may incur during our worst stress-testing scenarios. Here are 5 things that you need to know about the Crash Rating in Portfolio Crash Testing:

1. A portfolio’s crash rating can rank from 1 to 100, with 1 being the lowest in terms of risk and 100 being the highest.

2. A crash rating is calculated by taking the sum of the three largest losses that a portfolio incurs among all stress-testing scenarios.

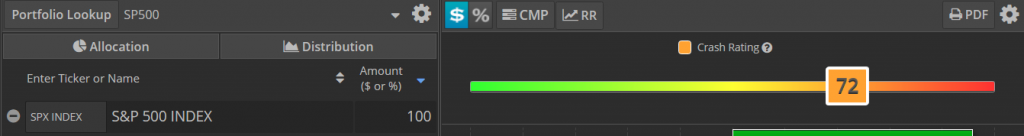

3. The S&P 500 ranks at a 72 on our current Crash Rating scale:

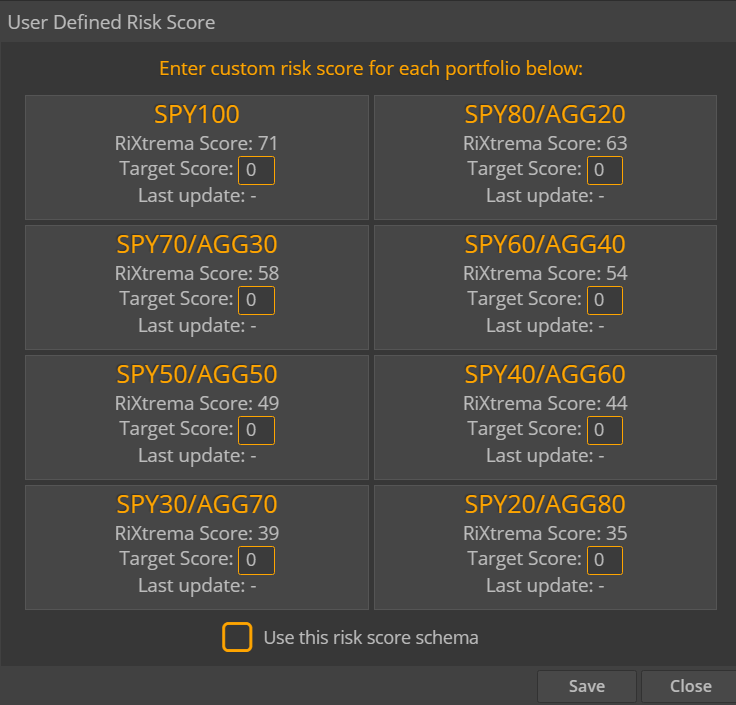

4. Our Crash Rating can be harmonized with any other risk score out there. To harmonize it with the risk score you are using, you simply need to plug in your target score for each of the following portfolio allocations:

5. As the markets are always changing, our Crash Rating is constantly updated with our Portfolio Risk Model to make sure that your portfolios always have the most up-to-date risk measurement with today’s markets.

Portfolio Crash Testing (PCT) is different from all other stress testing systems (including those available to institutions) for numerous reasons. Here are 14 Reasons Why Financial Advisors Should Use Portfolio Crash Testing

Pingback : Your 1 minute case study on 401K Retirement Plans: Crash Testing a 401(k) Plan

Pingback : 10 Hidden Features of Larkspur-Rixtrema You Need to Know About

Pingback : 7 Exclusive Case Studies on 401K Retirement Plans for Financial Advisors

Pingback : Tenuous At Best IMF Reveals A Sluggish U.S. And Eurozone Buoyed By Emerging Markets -