Sponsors may not be maximizing their 401k contributions, and Larkspur Executive’s tools can easily show this deficit. Your sponsor contacts are most likely considered highly compensated employees (HCE) by the IRS – an employee who owns more than 5% of the interest in a business, earns more than $120,000 (2019), or is simply in the top 20% of employees when ranked by compensation. HCE’s are subject to more strict contribution limits to prevent wealthier employees from disproportionately benefiting from the tax deferment aspects of 401k plans.

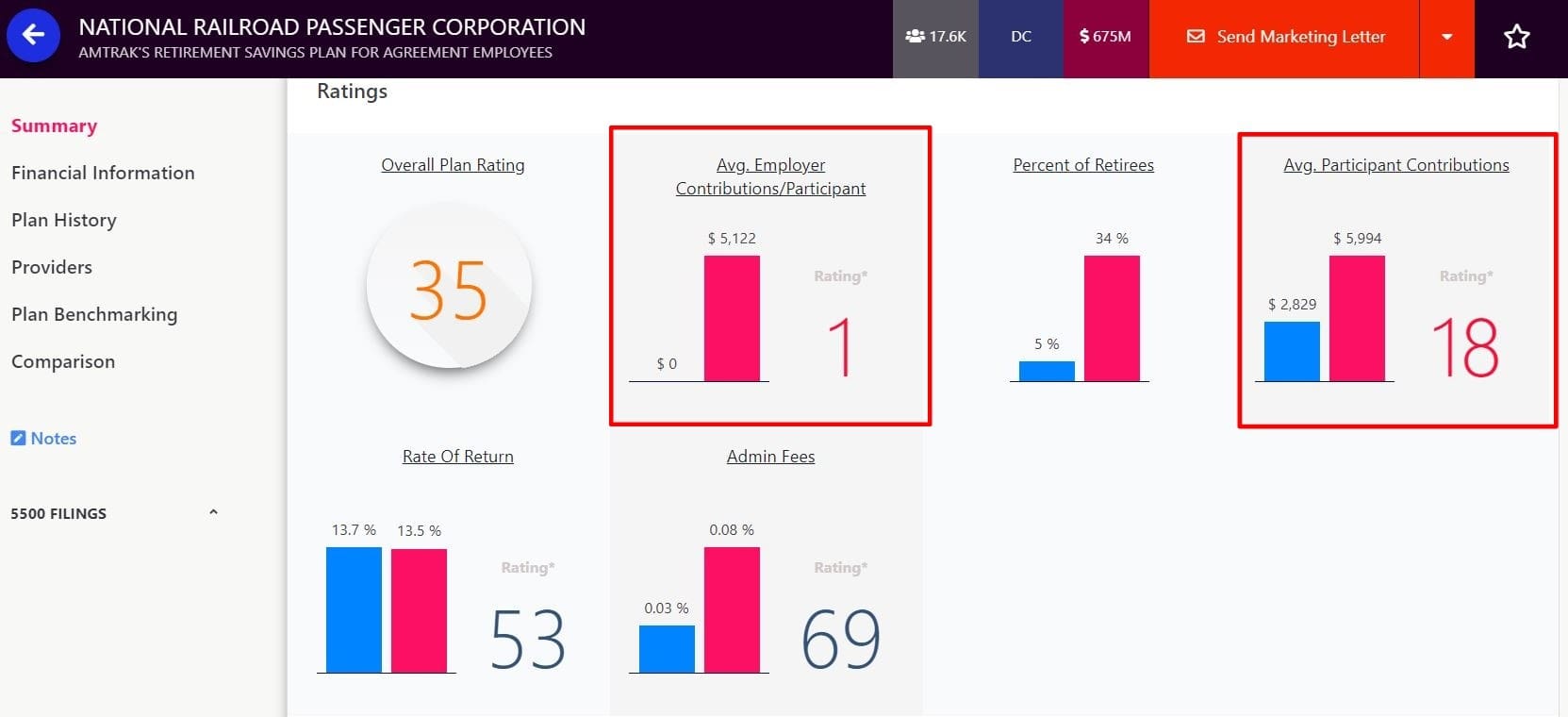

The IRS requires companies to minimize the discrepancy between the retirement benefits of HCEs and lower compensated employees. Average employer contributions per participant is an indicator of this balance, and it may reveal more to the plan sponsor than the advisor because the sponsor will know more about its internal HCE’s contributions. Since the majority of participants are likely lower compensated employees, the ratio of participant to employer contributions could give the sponsor some pause if the average participation contribution is lower than expected. The sponsor could lose its tax-qualified plan status and be forced to re-distribute all of its plan contributions if its HCE contributions are significantly larger than those of its lower compensated employees.

Larkspur Executive’s summary page and the new custom template marketing letter (CTML) tool can quickly and clearly communicate relevant information to your prospective sponsor. An HCE’s contribution is limited by the participation level of lower compensated employees, so the average contribution made by HCEs cannot be more than 2% higher than that of other employees. If you can prove to your prospects that their current financial adviser is neglecting their plan participation rate, then HCEs will know that they are losing money.

The Client Success Team (CST) is eager to help you maximize your value from Larkspur Executive by helping you integrate the CTML tool into your workflow. They have templates available for you to choose from or can help you craft and upload one of your own. This new custom template marketing letter feature can save you loads of time by streamlining your first contact with prospects. So, contact your CST specialist soon to start reaching sponsors who are leaving money on the table.

KEY TAKEAWAYS

- Highly Compensated Employees’ 401k contributions are bounded by the participation of lower compensated employees.

- A low average employer contribution per participant may put sponsor’s at risk of violating the IRS’ discrepancy ratio between HCEs and non-HCEs.

- How much an HCE can contribute to their own retirement plans depends on the level of non-HCEs participation in the plan.

- Larkspur Executive’s new Template Tool can help you craft messages quickly and streamline your marketing to prospects.

Pingback : Plan Ratings in Larkspur Executive -