I agree with the author of “Are Qualified Default Investment Alternatives (QDIAs) Good, Bad or Lazy “Choices”?” that QDIA should be an important component of any retirement plan. Besides the fact, it protects the fiduciary of the plan as well as provides an invaluable option for participants. There are millions of people who need financial education on how to invest money for their retirement.

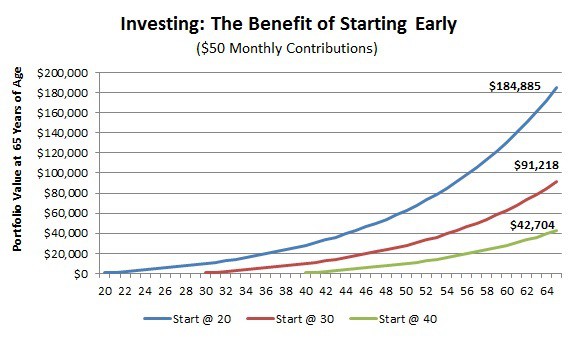

Unfortunately, not all of them get it due to various reasons. This makes these participants less prepared for their future retirement as they miss out on early retirement savings. By looking at the chart below, you can see that investing early will make a huge difference in how a person will retire in the future. A small monthly contribution of $50 starting at age of 20 will result in 4.5x retirement portfolio value in comparison to starting at age 40.

So, if the retirement plan has QDIA in place, then all participants in the plan who hesitate to make an active choice about investment selections would not miss out on the opportunity to invest. The QDIA option helps to simplify the decision-making process for participants who lack investment knowledge by allocating their retirement contribution among the Target Date Funds suitable for their age.

Pingback : Telling Your Clients that Investing Early For Retirement Is Vital

Pingback : Red Flag: Do 401k Plans Need a QDIA?