The London silver vaults are looking increasingly depleted, and it is not immediately clear why. When we covered this story last year so much precious metal was leaving, it looked like some kind of heist. The world of precious metals, like almost everything, has its own tribes, the battlegrounds are drawn between goldbugs on one side, and silverites on the other.

Of course we are serious, non-ideological, people at RiXtrema so our loyalties do not lie in any one camp. Instead we look to the data to guide us.

Where did it all go?

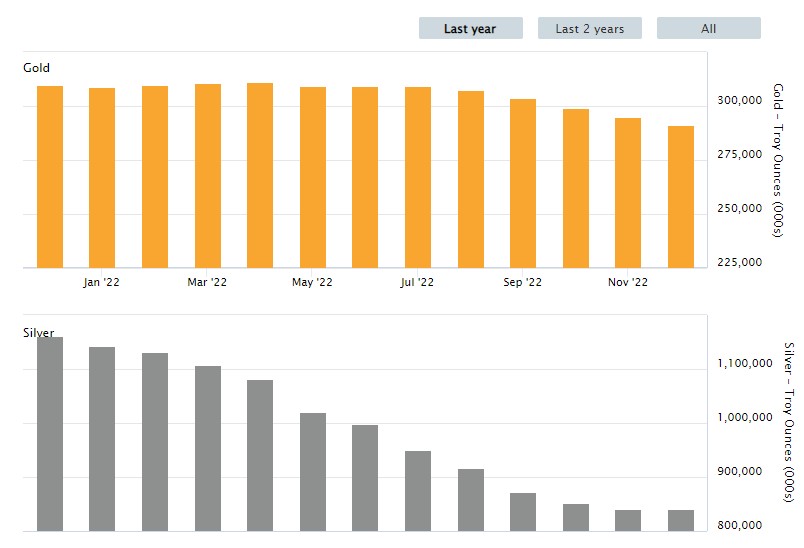

Over the last year around 10,000 tonnes of silver was removed from the London vaults. And if you look at the usual places it might end up, namely Comex the primary futures and options market for trading metals, it hasn’t appeared there or any of the other usual places. Furthermore recent reports have stated that a lot less is actually available now than previously thought, given the fact that so much silver is already spoken for in ETFs.

So where does it go and why?

Bizarrely there is no major news story in silver. So the answer is perhaps troubling when you consider not simply the destination, but who exactly is taking the precious metals out. It is not your average 401(k) or IRA investors; rather what is known as ‘smart money’. This means institutional investors and financial professionals know something that we don’t.

One thing that could be happening is that we are starting to see the decoupling of ‘paper’ precious metals from actual precious metals. But we are not quite there yet.

Is There a Canary in the Silver Mine?

Around 10% of silver is used for renewable industrial purposes like solar panels. However solar panels get more advanced every year and will require less and less silver. Miners did have a tough time in 2020 due to the pandemic when production ground to a halt. But in 2022 and going into this year, there are no obvious impediments for miners.

Precious Metal Inflation Hedge

A big indicator that something is happening in the precious metals market is the fact that central banks are buying up a lot of gold. From a risk standpoint, this looks like a classic inflation hedge. However inflation is clearly slowing down, to the point that we are now looking down the barrel of a deflationary period for financial assets.

Gold To Silver Ratio

In order to decode what the precious metals market is trying to tell us, we can look to historic peaks. Significant peaks occurred in 1914, 1940, 1991 and 2020. These years mark the start of two world wars, the fall of the Soviet Union and Covid. Every time there’s a peak in the ratio there’s a rebalancing, where silver rose much faster than gold, and there was a period of turmoil. So going forward silver looks more likely to maintain value over gold. Investors might be more likely to short gold and go long on silver.

However, the real story here is that if past trends reemerge, and gold and silver stocks remain unreplenished for the foreseeable future, it indicates that we are entering a very unusual period of history.

To get more in depth analysis watch the Investing Counterpoint show now.

Follow us on LinkedIn