An Exclusive Case Study from Larkspur-Rixtrema

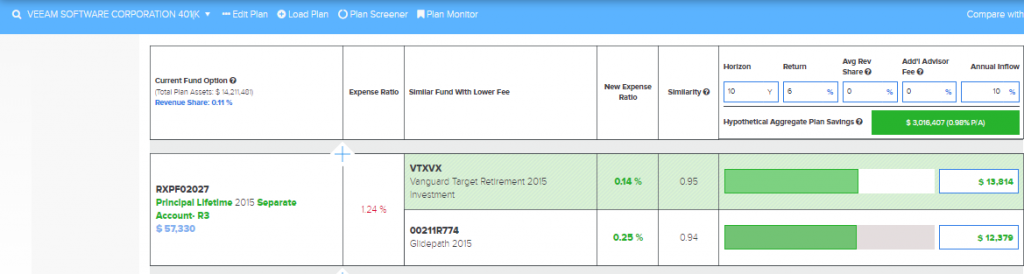

Lets examine one of the plans from the 401k FiduciaryOptimizer tool. For example, if we take a look at VEEAM SOFTWARE CORPORATION 401(K) PLAN, we can see a huge potential to save from taking another look at the alternative funds that the Plan Sponsor can choose from. In this example, the alternative funds are selected from the Open Architecture.

The amount of the saving is staggering as it can be seen on the Low Fee Alternative report:

It is about 3 million dollars for the plan of 14 million dollars. If I would be an advisor and a fiduciary, I would be calling the Plan Sponsor to discuss how to make the plan better for participants and to fulfil my fiduciary duty.

This and more analytical insight can be extracted from the 401kFiduciaryOptimizer practically with any retirement plan. Stay tuned for more blogs and examples on 401k retirement plans.

Fell free to reach out to us at clientsuccess@rixtrema.com.

Explore powerful financial advisor tools Larkspur-Rixtrema has to offer with a personalized tour.

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for June 2018

Pingback : Your 1 minute case study on 401K Retirement Plans: Ultimate Plan Optimization

Pingback : Your 1 minute case study on 401K Retirement Plans: A Rollover to an IRA Account

Pingback : Your 1 minute case study on 401K Retirement Plans: Improving 404(c) Diversification