Welcome to another case study here at Larkspur-RiXtrema. Today, we are going to look at some of the hidden fees behind the LIFESPAN, INCORPORATED RETIREMENT SAVINGS PLAN.

To reconcile the extra fees like record keeping fees, advisory fees, etc. with the 401kFiduciaryOptimizer, we have two different strategies to make sure we get a good and fair comparison.

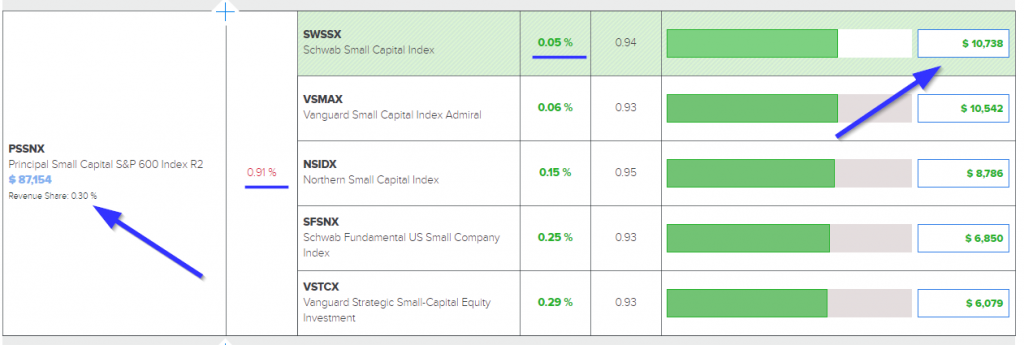

1) The easiest way to make sure you are taking into account any extra fees or revenue sharing structures, we have a default assumption that already accounts for rev sharing! We take the 12b-1 fees of each fund and then subtract it against any savings from a suggest lower feed alternative fund. See the screenshot below:

Figure 1

We can see in figure 1 that the Principal Small Cap S&P 600 Index R2 Fund has a .91% expense ratio, but .30% in revenue sharing (from its 12b-1). The 401kFiduciaryOptimizer will take this .30% and count it against the savings we would have if switching over to the far less expensive, but highly similar Schwab Small Cap Index. Therefore instead of comparing a .91% expense against the Schwab Small Cap Index’s .08% expense, we are comparing .61% vs. .08% to include rev sharing on the original fund. That’s still a lot of savings: $10,738 over 10 years!

2) The second way we can account for hidden fees for a plan is by looking at the information in Schedule C of the plan. Let’s take a look at this plan below:

Figure 2

We can see here in figure 2, this plan is paying $10,805 (0.37%) to Principal life Insurance Company. In the 401kFiduciaryOptimizer we can take these fees and combine them with savings from fund expense to get a clear look at all the fees.

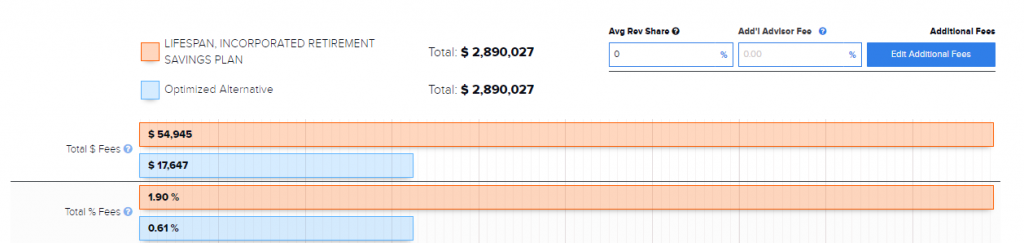

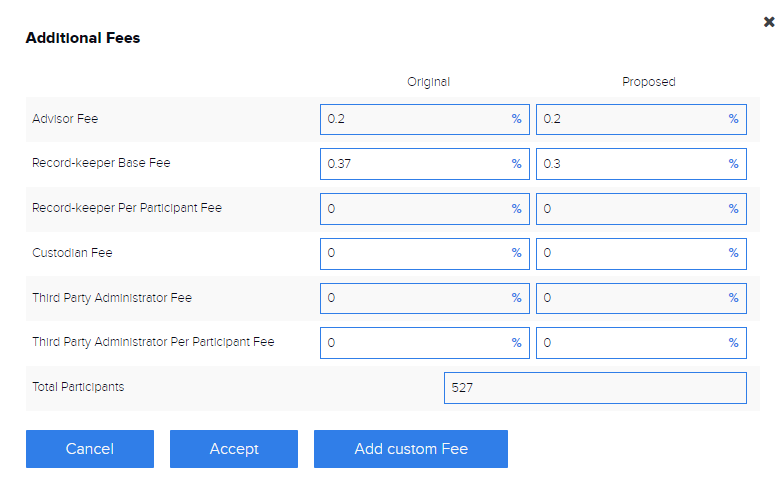

figures 3 & 4

We can take the fees that we found in the Schedule C and now directly compare them with our own proposed fees. Even after accounting for the original recording keeping fee of 0.37% in the original and a proposed 0.30%, as well as identical advisory fees of 0.20& (figure 3), we are still providing over $30,000 in savings to this plan per year by switching over the cheaper alternative funds found in the 401kFiduciaryOptimzer!

These are the two different strategies that we have for taking on ALL of the fees that are in retirement plans to show plan sponsors how much money they could be saving to their plan participants. Stay tuned for more case studies from the Lakrspur-RiXtrema team or don’t wait and schedule you free personal demo below.

Explore powerful financial advisor tools Larkspur-Rixtrema has to offer with a personalized tour.

Pingback : Your 1 minute case study on 401K Retirement Plans: Ultimate Plan Optimization

Pingback : Your 1 minute case study on 401K Retirement Plans: A Rollover to an IRA Account

Pingback : Your 1 Minute Case Study: Improving 404(c) Diversification

Pingback : Your 1 minute case study on 401K Retirement Plans: Maximizing Plan Performance