- The origins of Reg-BI

- Not smooth sailing for Reg-BI – the state of the current legal battle to stop the SEC

- What could happen in these lawsuits?

- Hope for the best but prepare for the worst

The origins of Reg-BI

As we all remember, it has been a few years since governmental agencies were working on a new proposal to regulate the financial services industry with the best interest of investors in mind. The Trump administration opposed the first DOL incentive, the Fiduciary Rule. So, RIAs didn’t need to worry about it after the U.S. 5th Circuit Court of Appeals vacated It on June 21, 2018.

So, the Security Exchange Commission has its own initiative, Regulation Best Interest (Reg-BI). Proposal on April 18, 2018, the SEC approved Reg-BI in a 3 to 1 vote on June 5, 2019. Now, the Reg-BI and its Form CRS rules are on their way to be the new standard starting June 30, 2020. All Broker-Dealers and Registered Investment Advisors who are registered with the SEC should be complying with it in less than 2 weeks.

Not smooth sailing for Reg-BI – the state of the current legal battle to stop the SEC

As with the DOL’s Fiduciary Rule, the SEC’s Reg-BI is encountering a few bumps on its way. First, the House of Representatives voted to block the initiative, but the Senate did not follow suit. However, later in the year, two lawsuits attempt to block the implementation.

Seven states and D.C. filed one in the U.S. District Court for the Southern District of New York. Then, X.Y. Planning Network (XPYN) presented the second. XPYN is the leading organization of fee-only financial advisors who are focused on working with Generation X and Generation Y clients.

Both plaintiffs argued that Reg B.I. evaded the guidelines the Dodd-Frank Act set for a broker conduct rule.

What could happen in these lawsuits?

The legal battle is raging over the meaning of the words. Instead of “may” Congress should have used “shall” to more clearly define Broker-Dealers and Investment Advisor in the Dodd-Frank Act.

Regardless, Reg-BI reflects a new reality of looming change and is not going away. I know many advisors hope that Reg-BI will follow the fate of the Fiduciary Rule, but it is a self-deceiving thought. Even if XYPN and eight Attorney Generals succeed in the court, the compliance delays will only be temporary because both sides of the lawsuits agree that regulating the advisory industry is essential to protect the consumer.

Any new changes to the current Reg-BI proposal will mostly affect the Broker-Dealer side of the regulation. All RIAs will remain on the hook to be compliant with the Reg-BI starting June 30, 2020.

Hope for the best but prepare for the worst

I firmly believe that when you expect something to happen in your life, you should hope for the best but be prepared for the worst. With Reg-BI looming over the entire financial services industry, every firm and advisor should be ready to comply. Compliance means having a Form CRS ready and delivered, no gauzy formulations over handling conflicts of interest and showing that you have taken meaningful steps to resolve any of it.

Staying compliant will determine if the SEC examiners take a kinder view or will be enforcing the law to the letter.

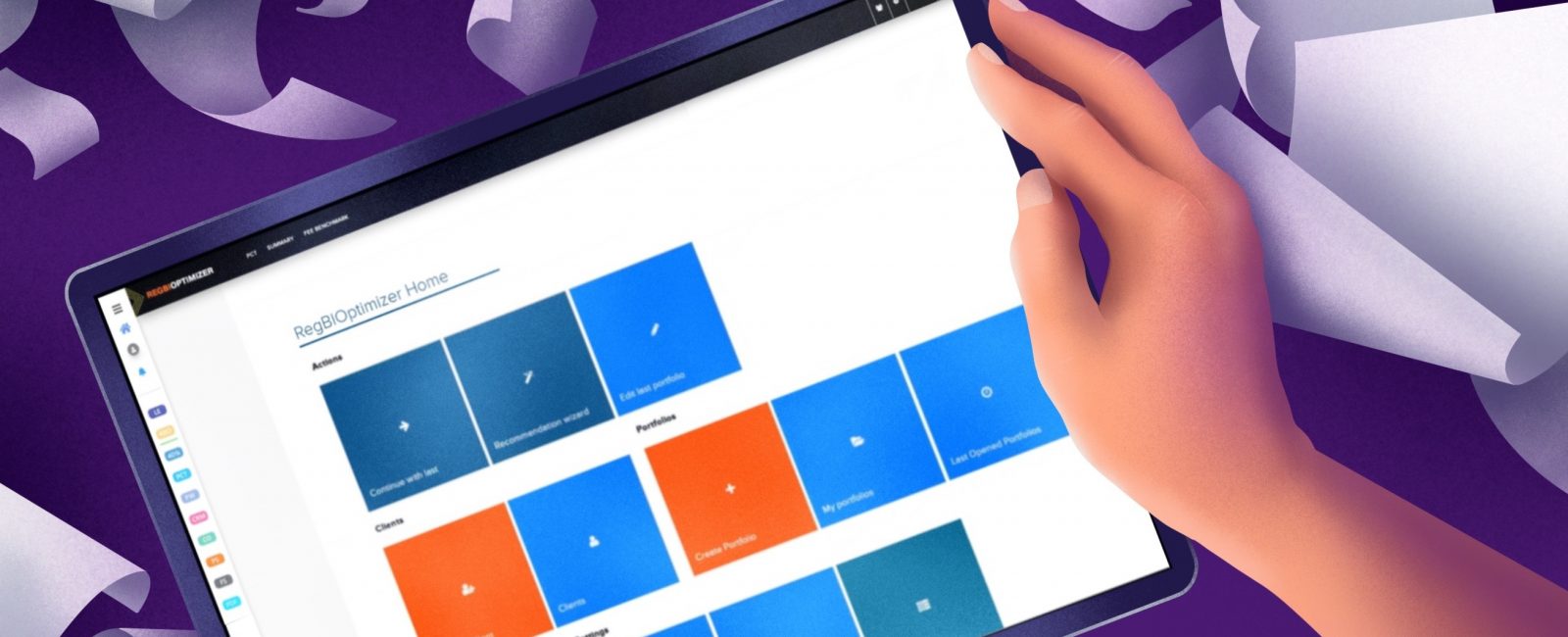

At RiXtrema, we put a lot of thought and effort into coming up with practical solutions for Broker-Dealer and RIA challenges. We built our premier compliance software, Reg-BI Optimizer, to help financial professionals stay compliant with the new regulation. It was reviewed by the Groom Law firm that specializes in advising on financial regulations – experts around Reg-BI and the Fiduciary Rule. They found Reg-BI Optimizer to be more than adequate for RIAs and BDs to meet compliance by containing “many of the key elements that courts and the DOL have traditionally found important” to reach the best interest recommendation. In essence, Reg-BI Optimizer helps financial advisors conduct due diligence by gathering the necessary information to justify a rollover within the client’s best interest. You can read more about Reg B.I. by downloading our short compliance guide, “Reg B.I.: Understanding & Compliance”.

You can also request to see the demo of Reg B.I. Optimizer by clicking on this link.

Be ready. Stay compliant.