- Cost of the lack of communication

- The benefit of staying connected

- The Participant Direct

- Connecting the dots

Cost of the lack of communication

Do you know that more than one-in-five participants have no interactions with their plan providers throughout a year? Based on the report published by J.D. Power, there are 29% of the plan participants who unaware of the access to professional financial advice related to their plan.

It is truly astonishing to see such a disconnect between the participants and plan providers. According to the same report, approximately 40% of surveyed plan participants ranked their relationship with the plan providers to be either indifferent or dissatisfactory.

A lot of current discord between plan providers and plan participants has to do with the fact that plan providers have mainly focused on the plan sponsors in the past. However, it becomes more clear to plan providers that the number of interactions with plan participants is directly correlated to their satisfaction with the plan services and plan providers.

The benefit of staying connected

A lot of plan providers start coming to the realization that participants might have more sway than they had in the past. Ultimately, participants are the ones who decide where to move their 401 (k) assets. This notion becomes more critical in today’s world, where unprecedented changes unfold every day right in front of our eyes, with millions of people losing their jobs and many more changing their careers.

The plan providers should be asking themselves what they can do to make participants who forced to change the job or look for another one to keep their money with that firm. According to the J.D. Power survey, only 7% of participants who are unsatisfied with plan providers would keep their assets with the firm.

One of the best and effective ways to be linked is via mobile apps. Those plan providers who communicated with their participants via the firm’s mobile apps were ranked higher in the satisfaction survey than those who interacted with participants only through emails

“… communication satisfaction scores are 70 points higher when participants receive personal communication via their retirement plan provider’s mobile app than when they receive a traditional email”.

Despite that, only 15% of participants received such messages through such apps.

The Participant Direct

Plan providers really need to step up their game and catch up with the plan participants. It will be a mutually beneficial set up for all parties involved. Especially when the current industry trend points at the fee compression for advising qualified retirement plans.

Based on the J.D. Power survey, the top-rated plan providers ranked by participant satisfaction are those who provide educational guidance and have an “extensive program in place to listen to the feedback of customers.” It becomes clear that instead of jacking up the competition by lowering the fees, the plan advisors should differentiate themselves by broadening the scope of their services.

With that in mind, we at RiXtrema continued to build on the success of our marketing and analytical tool, the Larkspur Executive, by adding a new feature called ParticipantDirect.

Connecting the dots

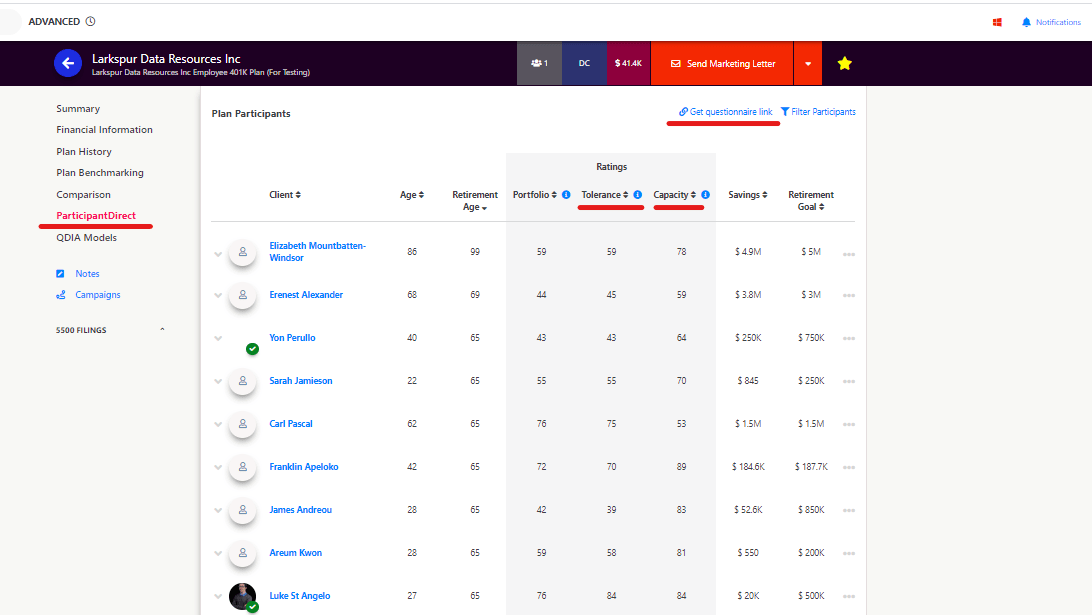

The ParticipantDirect (Figure1) will help to connect with the plan participants by providing them with educational and wealth management services. It allows the plan advisor to reach all plan participants at once with a customized risk questionnaire.

The primary function of the questionnaire is to educate the participant about their risk tolerance and risk capacity (you can read more about the questionnaire HERE). You can look at the results of the questionnaire as a reality check for participants. For example, if the participant’s retirement expectations are out of line with the current amount saved plus regular periodic contributions to the plan, the questionnaire will point that out and suggest if she needs to save more or reduce her goal.

Also, the ParticipantDirect will recommend the most optimal portfolio from the plan menu to achieve the retirement goal. The ParticipantDirect Dashboard will allow plan advisors to find individuals who can be good candidates for more in-depth wealth advisory services to benefit from future rollovers if they close to retirement age. Moreover, the plan sponsor will appreciate additional services provided to plan participants because it will be leading to a higher participation rate in the plan.

Figure 1. ParticipantDirect in Larkspur Executive

As always, the ClientSuccess team is still here to help you interpret Larkspur Executive retirement plan reports and prepare for plan sponsor meetings.

Don’t forget to ask your ClientSuccess Specialists for assistance at clientsuccess@rixtrema.com or calling us directly at 800-282-4567 ext.102.