Case Study: Growing Your 401k Business with the Right Prospecting Strategy

The Ask:

Every advisor is constantly thinking about ways to grow their business. There are many options available to achieve this goal. However, there is no cookie-cutter formula on how to make prospecting a successful endeavor. It is a creative process where different strategies and tactics must be tried to find the one that works best. Using fintech tools should be one of the goals in the prospecting process since more advisors and clients alike are becoming tech-savvy and rely on the latest technology to make decisions about their retirement.

The Problem: How to find a suitable prospect?

There is a myriad of questions about how to find a prospect, but it is more essential to find a good prospect who can become a client in the future. There are many old-school ways and new tech tools available to let anyone start prospecting. However, not every tool is designed to be equally helpful in this quest. For example, what if you, as an adviser, have a relationship with a specific broker-dealer, or a recordkeeper, whose funds and services are more competitive than other funds and services offered to the plan sponsors. You want to find plans whose funds line-up are more expensive and the fees paid for the services are high. A low fee alternative plan can be designed to compare fees, performance and other important metrics of two plans. The comparison report is a perfect introductory letter that can be sent to a prospect, followed by a phone call to set up a meeting.

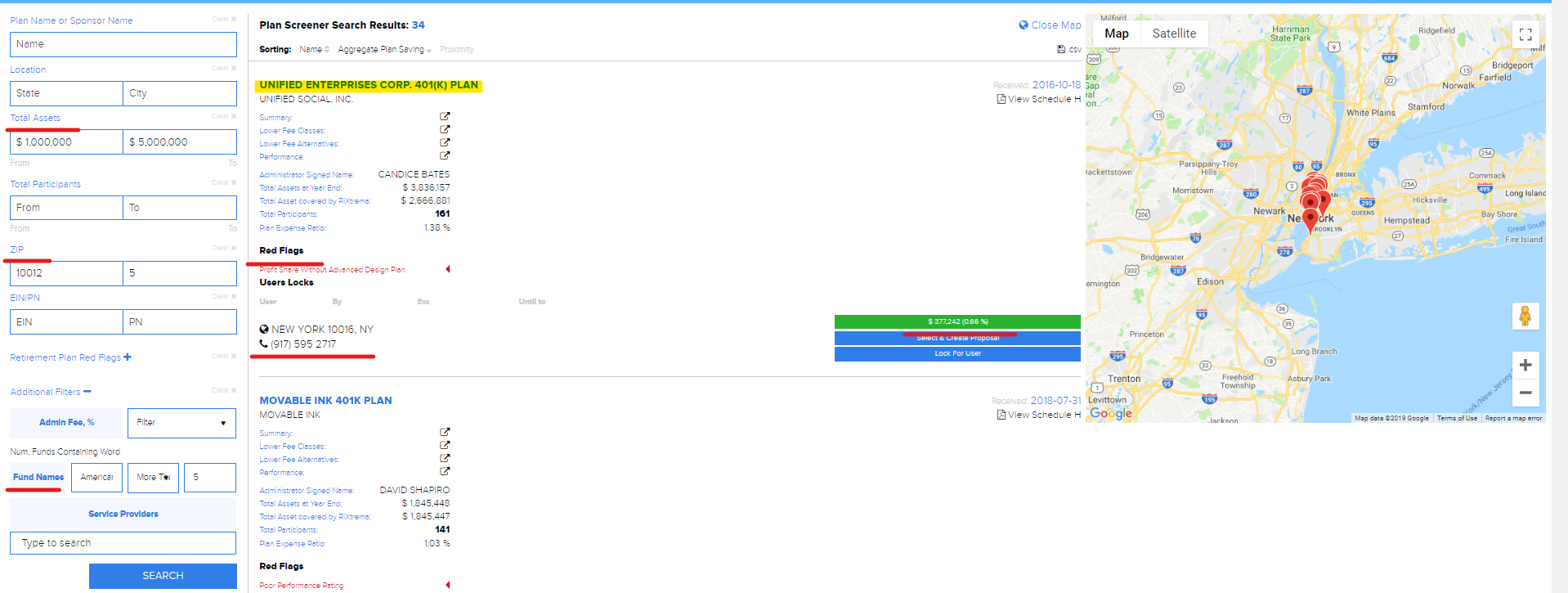

The Solution: Step by step walkthrough in 401kFO.

The 401(k) Fiduciary Optimizer can be indispensable prospecting tool giving you access to over 85.000 qualified plans that file long form 5500 which contains important information about the plan menu. Its quick and easy search filters allow to zoom in on the area and plans within the area suitable for prospecting. By selecting such criteria as Total Assets, Total Participants, ZIP code, Admin Fees, Red Flags, Fund Name, and Service Providers, the user of the tool can be specific about what kind of prospect they are looking for. Furthermore, the query results can be filtered by the most savings that can be generated with funds optimization process. The best prospect(s) can be loaded for further analysis to investigate plan fees, performance, red flags, etc. The alternative low fee proposal can be generated to share with the prospect. The ability to quantitatively justify the reason why it is important to revise the plan and provide a better service to participants can be a game changer when you are looking to grow your business.