Fintech for Retirement Plan Advisors: Larkspur-RiXtrema in the age of “Big Data” & AI

Currently, we live in the age of “Big Data”. “Big Data” is a field that assists with data analysis, data extraction, information processing using huge data sets that are too large or complex to be dealt with by traditional data-processing application software. Analysis of data sets is highly applicable in any sector of the modern economy due to exponential growth in technology usage. Data is streaming constantly from everywhere. It is now collected and stored to be used for various purposes such as to spot business trends, prevent diseases, combat crime and so on by businesses and governments alike. The boom Fintech is partially based on the ability to deal with “Big Data” in an efficient way. Every time we use our smartphone, laptop or computer new data is generated about us. This data processes such information as our age, location, our consumer choices, spending habits, etc. This intelligence used by Fintech to offer better, more reliable products to consumers and also to decrease various risks the Fintech companies face while working with consumers.

A few examples can illustrate “Big Data” at work in the Fintech industry. One of the biggest risks consumers and banks face today is the risk of fraud. How many times each one of you who uses a credit card experienced the unpleasant reality of dealing with the stolen credit card. Probably most of us. “Big Data” processes help to flag fraud by understanding spending habits and usual online patterns of a consumer and if the fraudulent activity is detected a consumer can be reached to confirm if it is a legitimate transaction or not. Also, financial services offered by companies can be personalized for the consumers based on their interest when browsing through the website of the bank, i.e. a consumer loan or home mortgage.

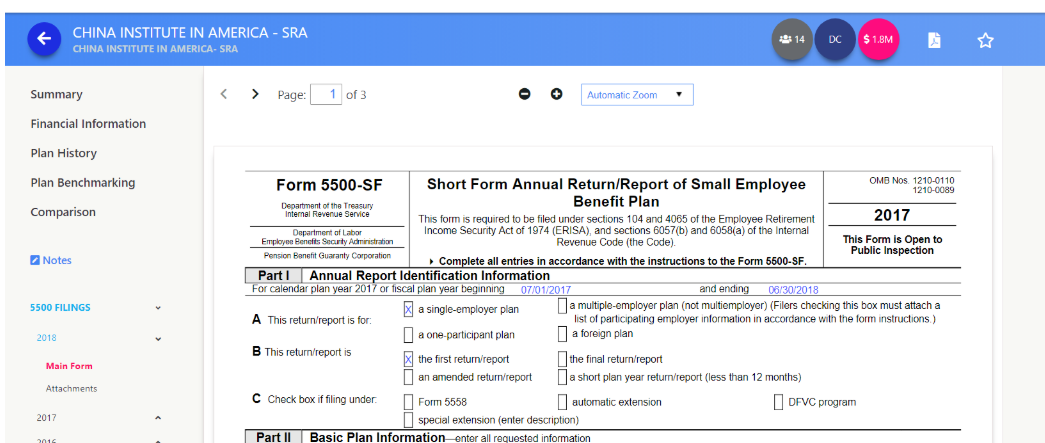

At Larkspur-RiXtrema, we use “Big Data” and Artificial Intelligence to process vast amounts of data when working with the Defined Benefit and Defined Contribution plans. Annually we process more than 1,5M of 5500 forms filed by US-based companies with the Department of Labor. The format of the form can be either short or long. The long form usually contains a lot more information than a short form including names of the funds offered by the plan to the plan participants. If anyone saw the abbreviations used by the companies to identify the names of the funds would know it is sometimes close to impossible to decipher it. Besides, a lot of forms are photocopies which treated as pictures and pictures are treated differently by software than PDF file. Our “Big Data” process built around Neural Network learned to decipher the name of the funds from reports, match them with existing funds in the database with 99% accuracy resulting in the quick plan turnaround from the point when it is posted on the DOL website to the point when the plan is available in our 401kFiduciaryOptimizer, Larkspur Executive and Planisphere software.

The platform based on machine learning technology provides the end user with a great advantage over similar platforms but without the “Big Data” process. In particular, the time lag between the filing of the report and its availability on the DOL site can range from a couple of weeks to a month. It also takes a few weeks to process it and make it available to the user. We created Real-Time Updates in the new Larkspur Executive, 401k Fiduciary Optimizer and Planisphere to allow our clients to get an early jump on the competition (you can read more about it HERE) and to win new business with the cutting edge technology.