In a previous post I explained why most of the common criticisms of cryptocurrency (and Bitcoin specifically) are off the mark or are simply disingenuous. At this point, I would like to explain the real problem with cryptocurrency today and offer a fairly specific solution. Before I do, there is one more criticism that I did not address. It is so vague and yet it is repeated and used by anyone who is against the idea of a currency independent of central banks.

I am talking about the B-word i.e. “BUBBLE”. Bubbles are bad (except in a jacuzzi), right? But this is not a serious criticism. For one thing, bubbles almost always occur when a breakthrough technology reaches some level of public awareness. Internet stocks skyrocketed and then dropped more than 80% in 2000, development of railroads in the 19th century spawned one of the biggest investment bubbles (which goes by the historical name Railway Mania in Britain). By the way, note the deep similarity between internet and railroads, as they are both essentially transportation mediums (of information and physical goods respectively).

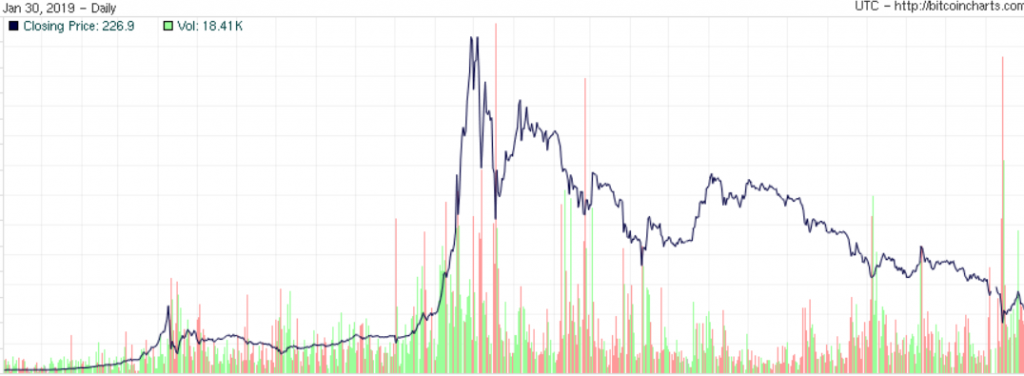

Incidentally, cryptocurrency is also a transportation medium, it transports value over the internet. I doubt you will find a single person that can sincerely argue that internet and railroads were somehow made unimportant by the financial excesses that took place during their expansion. So it is with cryptocurrency. Being in a bubble (and 2018 was a massive bubble for crypto) does not diminish its potential. In addition, Bitcoin is a very atypical bubble. Let’s look at how the 2017-2018 Bitcoin bubble developed and crashed on the graph below.

Source: Bitcoincharts.com

Actually, hold on a second! I grabbed the wrong time period for the chart. This chart is actually from 2012 to 2015.

So, my point is that it is not a typical one-and-gone type of bubble. Bitcoin had no less than three major bubble periods, each more pronounced than the other. And yet it rose again. Are there other assets that go through repeated bubbles? Yes, they are called STOCKS! So, I am not going to dispute the ‘bubble argument’, because it is not an argument at all. Just an appeal to emotion.

But now we can get to the real problem with cryptocurrency. It lies in the extreme financialization of the whole space. What I mean by that is that instead of focusing on the technology, most of the players were focused on the investment mania, asking questions like:

“What if every millionaire owns one bitcoin, how much will it be worth then?”

“How can we make sure that everyone in the world can trade bitcoin?”

I am not even talking here about outright scammers, which were aplenty.

Making sure that everyone in the world buys some bitcoin is not really helpful (other than to massive holders of it). But that approach fed the mania and much investment went into platforms that enable people to buy and sell crypto. This fed enormous volatility and was bound to end badly. If cryptocurrency is truly a currency, it needs to fullfill the conditions of being:

– medium of exchange

– store of value

– unit of account

The approach of trying hard to get some bitcoin into the hands of many people at an inflated price really did not fit any of those three goals.

Bitcoin’s finite supply (only 21 million bitcoins will ever be created) and massive price gains seemed to help the case for store of value. Unfortunately, store of value without the medium of exchange simply drove speculation. And when crypto crashed, the question became what value is really being stored? It certainly cannot be the value of making ever more money on bitcoin’s price increase as that is a cycle that can quickly reverse. Thus, medium of exchange proposition, which should have been the key, was squashed by the madness of 2017/2018.

The Way Forward: Earn, Not Speculate

It seems as if there are two parallel universes in the crypto technology space. One is concerned with finding new ways of investing in or speculating on the price of cryptocurrencies. The other one is where true creators focus on building projects to disrupt industries. Thankfully, builders of potentially disrupting tools got hurt the least in a downturn. Moreso, they might actually be helped by the reduced level of speculation and reduced noise. In my opinion, the ‘disrupters’ must focus on two things:

- Platforms That Disrupt. Build tools to disrupt most inefficient industries first, specifically create platforms that bring producers and consumers of content. Eliminate middlemen.

- Earn, Not Speculate. Ensure that these platforms enable participants to obtain cryptocurrency tokens by earning them in exchange for producing value.

The two items really go together. A platform is a kind of business that brings producers and consumers together and has the potential to create immense value. For example, social networks bring together producers and creators of content, ride sharing services bring together producers and consumers of rides and apartment sharing brings together …. etc. etc.

If such a platform is built on the blockchain, it can be much more efficient than traditional platforms. That is because in traditional platforms the middlemen eventually start clawing back most of the value (see our posts on Facebook and Amazon for details). In the absence of middlemen, the value can be redistributed to those who actually create it: creators and consumers on the platform (yes, consumers also create value paradoxically). This means that a cryptocurrency token that powers the platform can actually be earned by users. And it will have intrinsic value, because it will be closely tied to the value that the platform creates. Let’s use an example of a social network like Facebook or Twitter. Everyone who posts something on those platforms acts as a volunteer creator of content on the platform. The users that tune in actually complete the circle by consuming that value.

The nature of publishing means that this value can be monetized by offering advertising to the consumers of content (and that is how they also create value just by being there in large numbers). Now let’s picture a social network built on a blockchain. This means users interact through the blockchain, all advertising is also paid for and posted on the blockchain using a cryptocurrency token native to such a platform. Users simply log into a web application that reads the blockchain and shows the feed, likes, posts, tweets, appropriate advertising etc. etc. Forget for the moment the technical issues in building such a platform (they are not trivial). If we have a platform like this, then an enormous amount of value can be distributed to participants (instead of handing it to platform owner). And if advertising is actually transacted for in the platform’s cryptocurrency on the blockchain, then that cryptocurrency has actual value (even intrinsic worth, if you will). This would create a cryptocurrency that would immediately be ahead of 99.9% of Bitcoin clones out there. Allowing the users who produce value to earn this cryptocurrency makes it a medium of exchange.

Note how we fulfilled two out of three most important characteristics of money by creating value first and building a cryptocurrency into it as a way to exchange value. This does not mean that a pure cryptocurrency like Bitcoin is not useful. Far from it, it is indispensable. But we don’t need another Bitcoin, we need cryptocurrency tokens that are tied to real value. And Bitcoin can serve as the central gateway of exchanging significant amounts of value across those tokens, extremely securely and efficiently.

To summarize, we need cryptocurrency platforms that disrupt existing inefficient industries and unlock value to be passed to the users. These platforms need to create value, allow sharing of value and most importantly enable users to earn that value. Thus, cryptocurrency native to those projects would automatically gain important qualities of money (medium of exchange and store of value), as long as there would be enough participants on the platform.

According to Metcalfe’s Law, the worth of a telecommunications network grows as a square of the number of the users. Double the number of users, get four times the value. The simplest example of a telecommunications network is a telephone. Clearly, if there is only person in the world with a telephone, the value of that telephone is close to zero. But give one more phone to someone else in the world (who speaks the same language), and some value can be created via the connection.

The False Dilemma

And how do you know that you’re mad?’

‘To begin with,’ said the Cat, ‘a dog’s not mad. You grant that?’

‘I suppose so,’ said Alice.

‘Well, then,’ the Cat went on, ‘you see, a dog growls when it’s angry, and wags its tail when it’s pleased. Now I growl when I’m pleased, and wag my tail when I’m angry. Therefore, I’m mad.’

Lewis Carrol, Alice in Wonderland

There is an ideological problem that is preventing many of the brightest minds in the Bitcoin community to consider the value creating platform with the cryptocurrency component. I would call this “Bitcoin vs. Blockchain” false dilemma. The reluctance of some crypto enthusiasts to work on projects like this stems from their sincere defense of Bitcoin against yet another kind of disingenuous attack. Many critics of Bitcoin do not attack it outright, recognizing that denying the impact of just about the coolest technology to emerge during the past 25 years is not a winning position. Instead, they use the mantra “Blockchain, But Not Bitcoin”. A great example is this interview by Michael Bloomberg and Lloyd Blankfein:

Let’s do away with Bitcoin and just keep the blockchain. M. Bloomberg does not really explain what he wants with a blockchain (seems like he can hardly remember the word), but let’s do away with Bitcoin anyway and then we can figure it out. The response from the Bitcoin community is equally hilarious “Only Bitcoin, Not Blockchain”. They will deny any and all benefits of the blockchain outside of Bitcoin. This ideological rigidity slows down the progress of true adoption of cryptocurrency. Creation of blockchain value-creating platforms will not harm Bitcoin. In fact, Bitcoin can be the hub between different cryptocurrencies and actually fullfill a role of convenient unit of account in a crypto economy (note, that this is the last property of money we were still missing in our scenario). A crypto economy that would actually be growing.

In the next post I will tell you about some really cool blockchain projects that are aiming for major disruption of inefficient middlemen ridden industries. Until next time.