Introduction

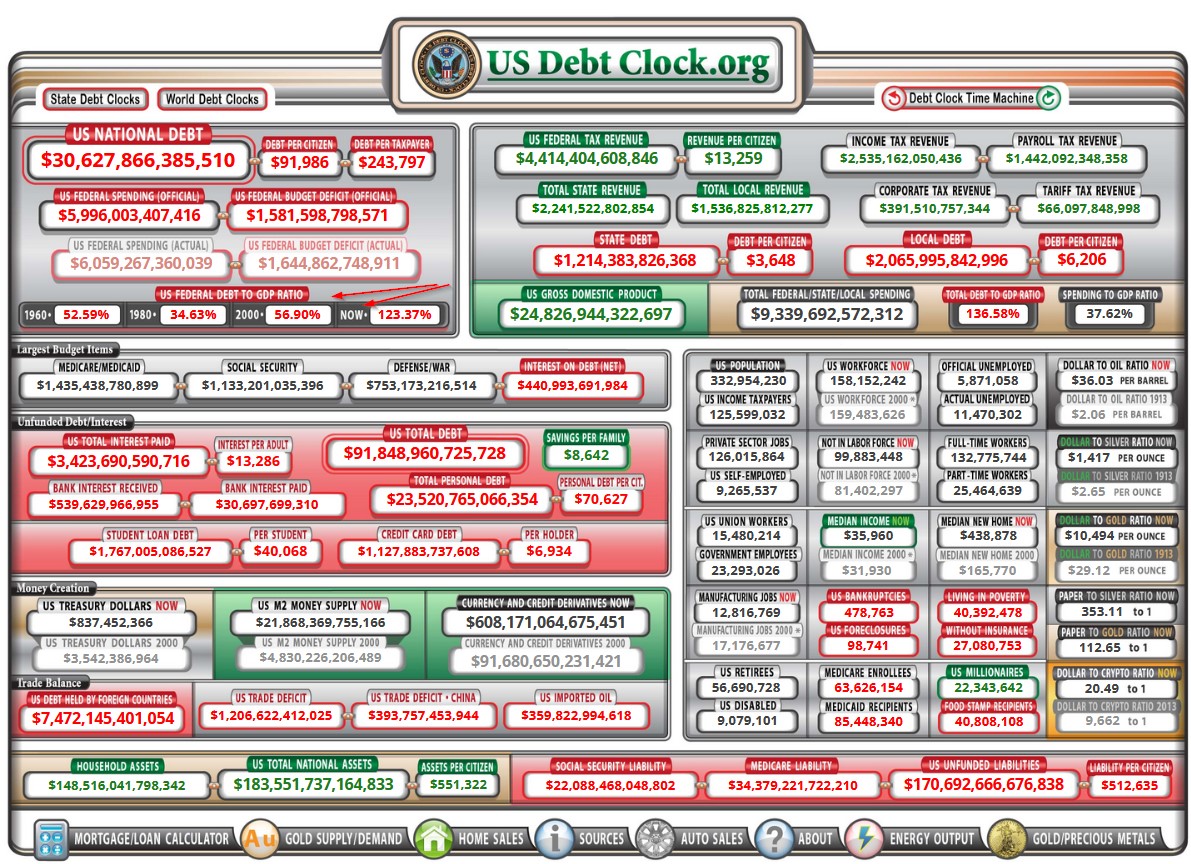

For the past decade or so we went through good and bad times experiencing financial collapse in 2008, COVID-19 pandemic and lockdowns, etc. But these devastating economic and financial hardships were encountered with a relentless and unstoppable fiscal and monetary stimulus created by our government and the Central Bank. The amount of the US national debt rose exponentially over the past fifteen years from 9.4 trillion to 30.6 trillion.

The credit stimulus provided much of support needed to prevent economic collapse that could come from any of extreme events we experienced in the past. However, such money printing comes with big cost, the inflation. The United States is experiencing the biggest inflation over the last 40 years. Currently, the CPI is at 9.1%. Moreover, the inflation is felt throughout global economies and is exacerbated further by the Ukrainian war resulting in the global shortages of various commodities including agricultural products, energy supply, industrial metals, etc. The effect of high inflation forces the central banks to raise their interest rates which will slow down economies throughout the world. New data from EU and US point towards sluggish economic activities already. High prices, monetary inflation, rising interest rates and lack of resources needed to produce goods to keep economies booming will effectively result in possible recessions throughout global economies.

Mughal Empire

Boom and bust that we experience over a past decade is a classical process that economy goes through during a short-term debt cycle. The Federal Reserve and the government stimulate economy through fiscal and monetary policies during the slowdown to re-ignite the growth. Feds low interest rates to make credit available to businesses and individuals. The government provide stimulus, tax breaks, etc. to achieve same goals by giving more money to people to spend and make economy grow again. When economy overheats and inflation is rising, the central banks raising the interest rates to cool it down. However, besides short-term debt cycle, there is long-term debt cycle which results in the rise and fall of new economic and military superpowers which last longer and average from 80 to 100 years. We can take a quick look at few historical examples of such processes.

Mughal Empire came to power in the late 1500s under the reign of Akbar the Great who was able to triple the size and wealth of the Mughal Empire until it included virtually all of India, Pakistan, and parts of Bangladesh and Afghanistan. Akbar also ensured that economic freedom reigned. He cut taxes. The coinage was stable. Infrastructure was highly advanced. People were free to engage in commerce and trade. Akbar also held government bureaucracy to a minimum, and even kept his personal household spending quite low. He famously ruled with a staff of just four ministers, and he set an example of routinely hiring people based purely on their talent, irrespective of someone’s religion, nationality, or class. As a result, the Mughal Empire became a financial powerhouse, responsible for roughly 22% of global GDP. (This is approximately the same as the US is today.) The empire quickly became known for its unimaginable wealth, and European travelers marveled at the Mughals’ high standard of living.

But the wealth did not last long. Akbar’s successors did not continue his policies and instead started spending lavishly on personal luxuries, raised taxes, poisoned the economy with armies of bureaucrats and constantly provoked foreign enemies sinking a great deal of the Empire’s sagging treasury into a never-ending state of costly warfare. One example of such excess was a famous tomb built by Shah Jahan for his beloved consort known today as the Taj Mahal. Shah Jahan spent more than $3 billion in today’s money on it creating a significant dent in the Empire’s treasury. And that is just a single example. It is no wonder that in just slightly more than a hundred years, around 1724, all mighty Mughal Empire had disintegrated into fragments.

Rise and fall of Empires

So, the Mughal Empire is one of the examples of the rise and fall of mighty empires in the history of the humankind. Over the past few hundred years people have seen the rise and fall of a few empires as well. The most significant examples of fallen empires would be the Dutch Empire that ruled the world from early 1600’s to the late 1700’s. The Dutch hegemony was ended by the uprising of new empire, the British Empire. The dominance of the British started to decline in the early 1900’s when Germany and the United States had begun to challenge Britain’s economic lead. It was overtaken by new rising empire, the United States, after the end of the World War I. However, it seems that a new mighty power is on the rise again, and it is China.

Behind Empires’ rise and fall there is a big cycle of events that produce such superpowers. Per Principles for Dealing with the Changing World Order by Ray Dalio the big cycle starts with establishing a New World Order which is the result of rising empire defeating the falling empire either militaristically (British beat Dutch) or economically (USA beat Britain and the USSR). During the New World Order the period of peace, prosperity and productivity lead to economic growth through strong education, innovation (Dutch invented ships that traveled further away and capitalism as we know it today). Strong education and innovations lead to global competitiveness and increased economic output which lead to rising share of world trade (today’s USA and China global output and shares of global trade are roughly compatible). The rising share of global trade lead the country to military buildup to protect its global interest. This prosperity cycle leads to strong income growth, which leads to more investment into education, R&D, military might, etc.

The productive debt growth becomes the driving force of big cycle and rise of the new empire. The savings that come from strong income growth would be used through capital markets like stock market, bond market, lending market to subsidize the expansion of the empire’s global reach. The increasing share of world trade, expanding political and economic reach of new world power would make other nations more interested in using the currency of the dominated country for trading, saving and investing with that country and among themselves. That would make such currency the preferred medium of exchange or reserve currency. Dutch Guilder, British Pound and U.S. Dollar are examples of reserve currencies. Chinese Yuan can naturally become next reserve currency. The status of reserve currency allows the nation of that currency to borrow more from other countries. And that is precursor of the start of the financial bubble, the peak of big debt cycle.

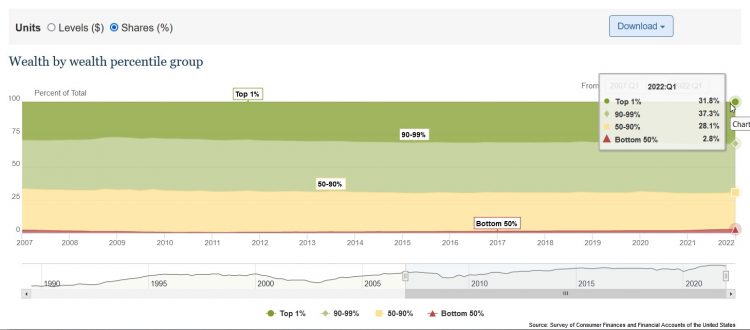

Becoming a superpower, making more money, saving more and having a privileged status of a country that controls the reserve currency usually sow the seeds of its own destruction. Everything becomes more expensive in the country from goods and services to labor wages leading to less competitiveness with the rest of the world. Naturally, other countries will copy new technologies and make the same goods for less and making them more competitive than the dominant country. On the other hand, people in the dominant country become less hard working and more leisure prone, their values change making them more accustomed to the easier life and more vulnerable to the challenges. The debt growth cycle benefits people disproportionately, benefiting most those who have more assets and resulting in the wider wealth gap. For example, in the US top 10% owns 70% of the wealth (Source: Federal Reserve).

Moreover, the urge to continue live comfortable makes people to borrow more to afford such lifestyle. As long as it is possible to borrow to live such lifestyle, the wealth gap is not a big social issue. However, as we saw in 2011, the wave of protests against the Wall Street, a.k.a. “Occupy Wall Street”, shook the country. It was when the common folks who suffered financially after the financial collapse of 2008 took their anger against the bankers to the streets. That financial collapse was a threat to their livelihoods and prompted them to action. Superpower country, same as people, becomes accustomed to a different way of how to run its business. It uses its status of the country with reserve currency to borrow a lot from other countries to spend on consumption, military and other things. It can boost its economic growth in the short term but hurt it in long run. Maintaining its global reach by projecting its military and political powers throughout the world is very expensive and leads the empire country to borrow beyond the repayment which weakens the country and makes it lose its privileged status.

Debt Cycle

Hopefully, I was able to paint the picture in a few words of how countries rise and fall. So, it is absolutely not enough to understand that process in comprehensive way, but you can read up on it Principles for Dealing with the Changing World Order by Ray Dalio, which explains in the great details this process. What I would like to do is to continue drawing the parallels between historical debt cycles that took place multiple times in the history to our current dilemma. As I mentioned above, it is stunning how our national debt spun out of control in the past two decades. Per www.USDebtClock.org our national debt grew 150% from 2000 to 2022.

Having such big debt raises a lot of questions among lenders. For one, if the borrower will be able to pay it back in the future. As a result of this suspicion countries are less willing to lend. Currently, we can see that some of biggest lenders like China are trying to reduce the amount of dollars they hold in reserves. Per wolfstreet.com, “Over the past 20 years, since 2001 – just before the official arrival of euro banknotes and coins – the dollar’s share has dropped by 12.7 percentage points, from 71.5% then to 58.8% now.” Even though, the dollar is still the biggest currency in the most countries wallets, the diminishing trend must be paid attention to. Moreover, the global overstretch of the American reach is having a boomerang effect as well. As of recently, chaotic pull out from Afghanistan was not perceived by the world as sign of strength. If we combine together all these manifestations such as widening wealth gap, social inequality, growing national debt, growing personal debt, international tensions, new challengers of global dominance, we can see the continuity of the historical rise and fall trends. Recognizing these trends and dealing with them can help with correcting the course to some degree but the history is relentless.

Here, at RiXtrema, we help financial professionals improve their clients’ portfolios by carving out a thoughtful, appropriately sized position for each fund that fits the client’s risk tolerance and risk capacity. Feel free to learn more about our Portfolio Crash Testing tool on our main website.