How to Become an Expert on 404c Safe Harbor For Your Plan Sponsor Clients

Do You Really Qualify For 404(c) Safe Harbor From Liability?

Summary: Under ERISA plan sponsors or advisors who exercise discretionary authority are fiduciaries with significant liability in case of fiduciary duty violation. Section 404(c) provides safe harbor protection fiduciaries in case plan participants experience investment losses. How do you obtain that protection? We will focus on the Investment Menu Requirements section of the 404(c). Many plan sponsors are unaware of the fact that 404(c) expressly requires plan fiduciaries to consider underlying holdings of the funds that they offer. The analysis they do and tools that they use focus on fund’s return history without considering the underlying positions of the fund. We will show how that problem can be fixed by using the established investment management science, SEC databases and latest technology.

Background

There are number of requirements under 404(c) such as Investment Menu Requirements, Control Requirements & Information Disclosures. Information disclosures is a very complex topic and we will leave that discussion for another time.

Control requirements section essentially that that the participants must have actual control over trading decisions, and plan sponsor follows their instructions. In this review we will focus on Investment Menu Requirements, since they require the most knowledge and understanding of the financial markets.

Investment Menu

Under ERISA a 401(k) plan is required to offer a ‘broad range of investment alternatives’. They must satisfy the following criteria:

- There are at least three alternatives that satisfy the following criteria:

- Each alternative is itself a diversified investment

- Enable the participant to achieve any level of risk & return that is appropriate for him or her

- When combined with others, each tends to minimize risk of the overall portfolio and minimize risk of large losses

How do you practically ensure that your investment menu satisfies these criteria?

Look-Through Investment Vehicles: Hidden Danger

The 404(c) has a special rule for any Plan that includes “Look-Through Investment Vehicles” in its investment menu. For purposes of determining compliance with both Core Menu Requirements and Risk Minimization Requirements, the underlying investments of the Look-Through Investment Vehicles must be considered.

This special rule means that Plan Sponsors and fiduciaries who hope to reduce liability through 404(c) must take into account Fund’s underlying positions. Many Plan Sponsors and RIAs are not aware of this requirement and analyze funds using history of fund’s returns without regard for what the fund holds. But fund’s holdings are readily available from a number of sources including mutual fund’s SEC filings on forms N-Q and N-CSR. How can you take advantage of this information and better protect yourself from the recent wave of ERISA lawsuits? Let’s look at the three requirements above in more detail considering the look-through provision.

Requirement A: Each Alternative is Itself Diversified

Diversification within a fund can be achieved by spreading investments across asset classes, geography, industry, and by adding large number of instruments. The strength of diversification benefits decreases in each of the three levels above, i.e. asset class diversification offers the most benefit, while diversification by number of similar instruments offers least (but still offers some and is a crucial component). Concrete steps for a fiduciary to take:

- Do not rely exclusively on the asset class description from the fund provider. Utilize a service that can show you weights of different asset classes, countries, industries and number of assets based on the latest SEC holdings from the fund.

- Make sure that your plan investment lineup covers different possible asset classes, countries (at least US vs. International), and industries.

- If a fund only diversifies by number of holdings i.e. a sector fund, then make sure it has a large number of names, preferably over 100 . Also, make sure you offer other sector funds to balance the concentration in that one sector, if you have it.

Requirement B: Choices Enable Different Risk/Return Participant Portfolio Construction

In order to enable creation of different risk/return profile your investment choices must have different volatility profiles and correlations that are significantly below 1 and negative for at least some funds. Concrete steps:

- Examine standard deviations of funds in your menu. Broadly, you should have some funds with annualized standard deviations that fall into buckets such as 1-5%, 5-10%, 10-15%. Make sure that this standard deviation is estimated both using the history of fund’s returns, as well as predicted standard deviation using fund’s holdings to satisfy the Look-Through requirement.

Requirement C: Participants Can Construct Portfolios to Minimize Risk of Large Losses

This requirement overlaps with requirement B above. Essentially, to create a portfolio to minimize risk of large losses, participants need to see a menu of options with different risk/return characteristics that have low or negative correlation with each other. In practice, all equity funds will have positive correlation with one another (for example, correlation between Dow Jones Industrials and S&P 500 is close to .9 and correlation between different equity sectors will still be above .7). So, your only source of persistent negative correlation will likely come from portfolios containing US Treasuries. It is important to include US Treasury funds with various durations because they are just about the only type of investment that can consistently offer a negative correlation to decrease risk of large losses in crisis environments, as 404(c) requires. Steps to take:

- Examine correlations of your menu options. Ensure that there are enough funds with correlation less than .5 and at least one fund that has negative correlation with the rest. Make sure that this correlation is estimated both using the history of fund’s returns, as well as predicted correlation using fund’s holdings to satisfy the Look-Through requirement.

How 401kFiduciaryOptimizer Software Helps Improve Diversification As Required By 404(c)

Recall that a good Investment Menu under 404(c) is the one that helps “minimize risk of the overall portfolio and minimize risk of large losses”. According to Modern Portfolio Theory (a theory featured prominently in ERISA law cases), there are essentially two criteria that the Investment Menu needs to satisfy to enable participants to minimize risk of large losses. The first is that menu choices need to have different risk levels, from low to high. The second is that correlation between menu choices cannot be close to 1. For each of these two criteria there is a special report in 401kFO that shows how well the plan fares.

Criteria 1: Investment Menu Has To Have Some Low Risk Investments

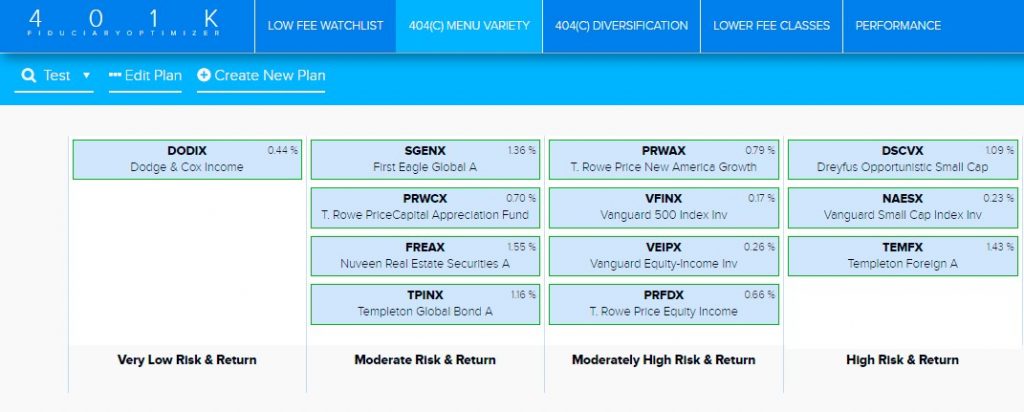

If the investments you offer to participants are all high risk, then it is hard to minimize risk of a loss. You need to have some high risk assets to grow retirement savings, but you also need to provide enough low risk choices. Consider Exhibit 1. It shows a 404(c) Menu Variety report from 401kFiduciaryOptimizer for a sample 401(k) plan. All plan investments are separated into risk categories from Very Low Risk/Return to High Risk/Return based on past and holdings based standard deviation of each fund . This particular plan fills Moderate, Moderately High and High Risk/Return buckets pretty well.

Exhibit 1 – Sample 401(k) Plan Investment Menu By Risk Level

But the Very Low Risk bucket includes only one fund, Dodge & Cox Income. This is a potential problem, since naïve participants frequently spread out their investments evenly across many options. In such a case, their investments would be mostly concentrated in high risk assets and risk of large losses would be very real.

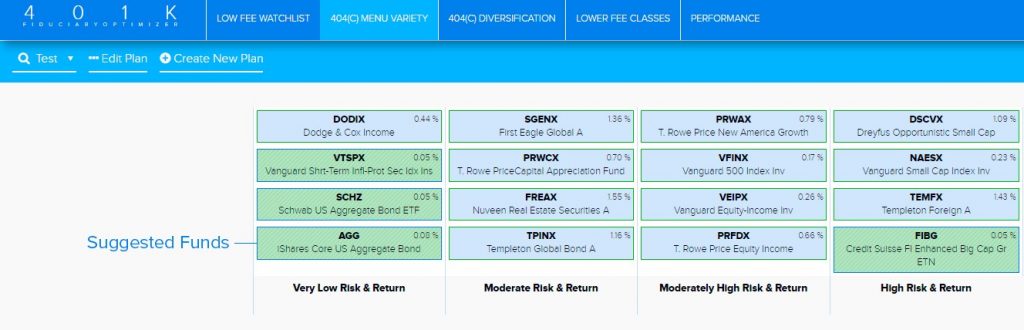

In addition to uncovering the problem above, 401kFO also provides suggestions to fill the empty bucket(s) as shown in Exhibit 2 below. In addition to original funds (in blue boxes), you can see suggested funds in green dashed boxes. These funds are low cost suggestions from the 401kFO engine that are based on plan provider universe selected for that plan.

Exhibit 2 – 404(c) Menu Variety Report With Low Cost Suggestions To Balance Plan Menu

In this case using Open Architecture setting, 401kFO suggest Vanguard Short-Term Inflation Protected, Schwab US Aggregate ETF and iShares Core US Aggregate Bond as potential low cost additions to the Very Low Risk bucket. Advisor has the ability to remove these choices and show other alternatives to a plan sponsor.

Criteria 2: Diversification

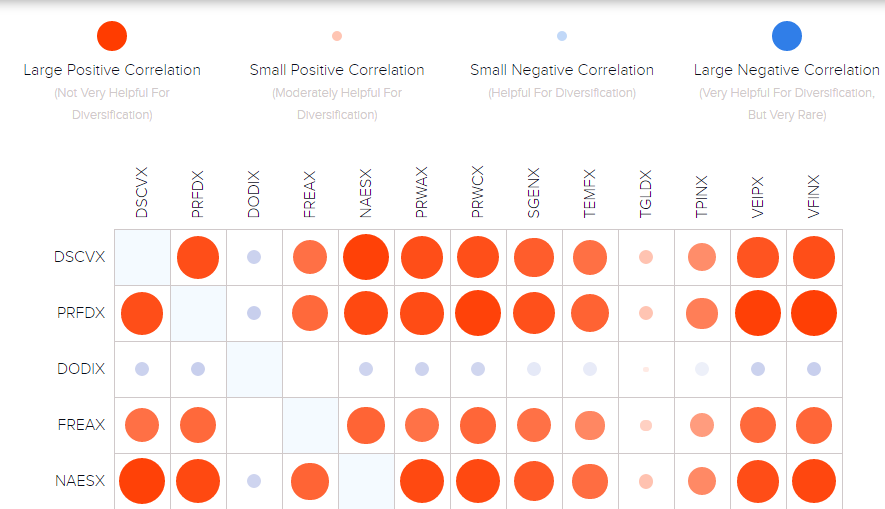

Considering risk levels as we did in Exhibits 1 and 2 is very important. However, the real meat of the 404(c) requirement has to do with diversification of choices in the Investment Menu. For this 401kFO presents a novel report that gets right to the issue and will help you stand out in the eyes of the plan sponsor. It is called a 404(c) Diversification report. Basically, it is a correlation matrix of funds in the menu. Correlation is not just based on the past history, but also on the holdings based that is derived from a multi-factor risk model and fund’s underlying holdings (as required by the Look-Through Investments criteria discussed earlier in the paper). In Exhibit 3 you can see a top portion of that matrix.

Exhibit 3 – Visual Correlation Matrix of Plan Investments

Visual correlation matrix shows correlations as circles, with large red circles representing large positive correlations, small red circles representing small positive correlations, and small blue circles representing small negative correlations. Clearly, this plan has a diversification problem. Only two funds (DODIX and TGLDX) show any real potential for diversification. You can explain to the plan sponsor that if participants combine these large red circles, they may think that they are diversifying, because they are not putting their eggs into one basket. But they are really not diversifying anything and sooner or later will experience large losses due to high correlation of investments in the portfolio. The 404(c) protection would be unlikely in such a case, precisely because Investment Menu has not been structured to enable participants to minimize risk of large losses.

Conclusion: Section 404(c) has specific requirements that must be fulfilled to obtain safe harbor protection against investment losses by plan participants. We focused on three Investment Menu Requirements and described how each of the requirements relates to the Look-Through special rule. 401kFiduciaryOptimizer software contains specific reports to address diversification problems that are prevalent in many plan menus. Financial advisors can use 401kFiduciaryOptimizer to educate plan sponsors and to significantly improve diversification in the plan’s Investment Menu.

Be sure to schedule your personal tour below:

Pingback : 5 Signs indicating that you might have fiduciary liability.

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for September 2018

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for May 2018