- A lack of education creates uncertainty which can reduce participation and contribution amounts

- Participant education helps to reduce poor participant behavior

A Plan Sponsor has many responsibilities. A good advisor can assist by helping the plan to reduce fees and meet fiduciary obligations. Ultimately the goal of the plan and the Plan Sponsor is to help set their employees up for a well-funded retirement.

A high-performing and low-fee plan menu is great for the plan participants. The problem however is that not all participants are the same. Here are some of the key reasons why participant education is important for the participants and ultimately also for the plan sponsor when choosing an advisor to work with.

After health insurance, retirement benefits are the next most expensive employee benefit paid by employees. No company would want to see this huge investment in their employees future not optimized. It would be a significant blow to a hard working employees’ motivation if their nest egg, which they have sacrificed to build, bursts.

A lack of education creates uncertainty which can reduce participation and contribution amounts.

Employees who understand the benefit of contributing more, especially when younger, will benefit greatly from the miracle of compounding interest. An employee will appreciate this employee benefit more, at no cost to the company, if they are educated to on the importance of contributing more.

The problem is that the participants are reluctant to invest more if they uncertain. This is where a plan advisor can discuss with the plan sponsor, methods of education to reduce this uncertainty. Participants educated on how diversification can help to reduce risk is a key example of how to reduce this uncertainty. Increasing participant contributions will be a win for the participant, the advisor and the employer.

A survey from Schwab found that 52% of participants didn’t have the time, interest, or knowledge to manage their 401(k) portfolio. The same study found that 56% of participants don’t review plan related education materials.Read about the Schwab study results here. Find some great tips on how to effectively educate participants.

Participant education helps to reduce poor participant behavior.

Research from Columbia Business School found that about one third of participants just allocated evenly across their funds. Other irregular participant behavior is that the more options in the plan menu, the more likely the participant is to choose a money market or equivalent fund. These behaviors result from lack of education and the participants taking decision making shortcuts.

Poor participant decisions and behaviors are not in anyone’s interest. The lack of the necessary understanding to make good decisions resulting in lower employment satisfaction and lower retirement readiness. These are issues that a good plan sponsor will want the plan advisor to help to rectify.

You can read here more about the Columbia Business School study here: “Offering vs. Choice in 401(k) Plans: Equity Exposure and Number of Funds”.

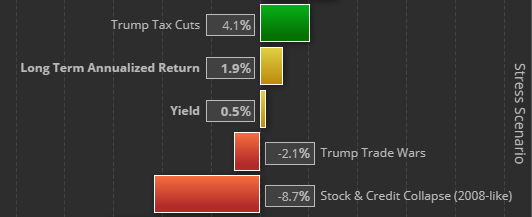

RiXtrema Inc, is known to many plan advisors for their 401kFiduciaryOptimizer which is primarily designed to help reduce the fees in the plan. However, many advisor may not know that the quantitative researchers at RiXtrema originally created stress testing software beforehand. This risk analysis software call PortfolioCrashTest allows an advisor to visually display to client’s how their portfolio is likely to perform under different scenarios. This tool is great for creating an understand of risk with clients. Rather than just vague scores, you can show a client examples of scenarios that they can relate to. This stress testing tool can educate a participant without expecting them to have study finance literature.The participants quickly can receive some practical and relateable information to rely upon to make these decisions.

To view more information about how to use Stress Testing when working with clients, please click here.

Want to see the PortfolioCrashTest live on a demo with one of our specialists? Click below to request your personalized tour: