10 Social Media Marketing Mistakes Financial Advisors Make and How to Avoid Them

More and more financial advisors are turning to social media marketing every day. More than 81% of financial advisors use social media for business purposes. 79% have acquired new clients directly through social media, with an average gain of $4.6 million AUM annually through their social media marketing campaigns. Such success also comes with a need to make sure certain mistakes are not made to stay a step ahead of the competition. Here are our top 10 mistakes and proposed solutions for social media marketing:

Joining Too Many Platforms

A very quick way to burnout with social media is by joining too many platforms at once. Here are over 60 Platforms to just to give you a better idea how vast the options are. Being on too many social media networks will end up being overwhelming and result in a waste of time.

What you can do: Join the platforms where your top customers are. Facebook should be a given as it is the largest platform around. After that, choose 1-2 more networks where you are sure to find potential clients. For example, according to a recent study the top 2 social networks for millennials are Facebook and Instagram.

No Game Plan

Another common mistake is a lack of a set plan. Failure to ask and resolve questions such as “How often will I Post?” or “Where will I get my Content?” can lead to a disorganized and scrambled account which will get you nowhere.

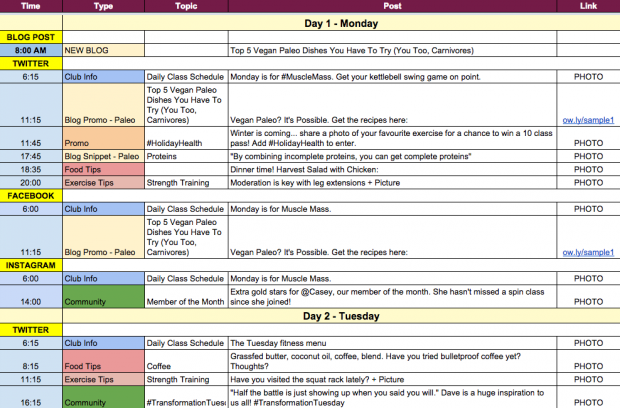

Solution: Create a simple spreadsheet or draft a plan. Drafting a plan outline on a weekly or bi-weekly basis will allow you to plan ahead and feel comfortable about your marketing strategy. Here is a sample plan template but you should create one according to your needs and preferences:

Not Catering to the Needs of Your Audience

A recent ThinkAdvisor article analyzed a study with a focus on 3 different aspects of content creation and delivery:

- what clients or followers prefer,

- what corporate marketing teams produce,

- what wealth advisors put out

The overall conclusion was that if the potential clients do not see the content to their liking, then the other two aspects need to be improved upon and properly matched with the preferences of the prospects.

Solution: The goal here is to know what will interest the clients, which if done properly will increase post engagement on social media and your brand recognition as a financial advisor. This particular study places emphasis on posting more lifestyle content which has a tendency to engage the largest audience.

Download the full 2018 Social Media Content Study (with collected data from over 77,000 advisors) here.

Only Selling Yourself

Talking about yourself and your product should be integrated into your strategy. However, if that is all you do then you are bound to have people lose interest. The end result will not just drive away potential clients but may lead to a loss of existing ones and a lower overall following on your pages.

Solution: It is important to diversify and posts on social media should be about others— promoting other complimentary services, interacting with questions and comments, posting relevant industry news, linking to valuable posts from other blogs, and so on. Some recommend 25% of self-promotion while others say 1 out of every 8 posts should be promoting your business. Trial and error might works best here to get a ratio that works for you.

Not Enough Content Diversity

If you’re only posting your articles or a few sentences about the market trends or why clients should go with your services then you are well behind everyone else. This is a surefire way to have prospects quickly scroll through your content for something a bit more interesting.

Try this: Be sure to always mix it up. Here are 7 Types of Content that can help attract the attention of your audience.

Post First, Ask Questions Later

Its easy to get carried away in the fast paced world of social media. Posting content too quickly without giving much thought can make the content go viral but rather in a negative way. Another mistake in this field is posting too much, too quickly. This can overwhelm the audience and people will certainly unfollow you, as you will be cluttering their newsfeed.

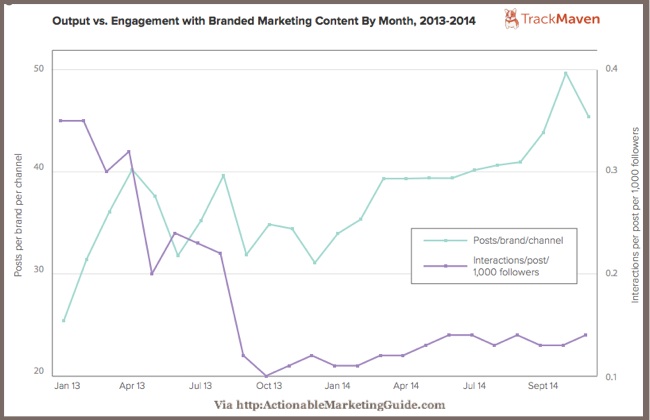

Try This: Reduce the number of times you post each day, and you can focus on the quality of the posts rather than the quantity. Take a look at the graph below. The research proves that as the number of posts increases, the engagement drops sharply. Where on the other hand, lower posting trends generated much more activity:

Not Having a Blog

The importance of a website or a landing page should not be underestimated. Basically, a blog provides multiple landing pages with original content that will redirect your prospects and clients to your site while giving them the information they seek. This will establish you as an expert in your field and help you increase traffic to your website.

What to do: Here are just a few platforms that allow you to create your own blog and in most cases you will be able to integrate it with your website, if your website doesn’t have a blog page already:

Not Using Paid Advertising

We are at a period in the social media timeline where the organic reach is just not what it used to be as it continues to be more and more limited by the mainstream social media platforms. Without additional promotions your original and worthy content may never see the light of day on any of the platforms.

What to do: Obviously, you need to set aside a budget for paid advertising. But the important feature here is the ability to target the right audience and be able to do it in a variety of ways. Lets look at one example in particular. According to an article in Wealth Management, “Facebook has a massive 2.2 billion monthly users, and an overwhelming 82.3 percent of baby boomers actively use Facebook, making it a great platform to market to retirement-ready, aged 50-plus prospects in your market.” Not only is your target audience there but you can control your spending, location and even tailor your audience based on emails, phone numbers and more.

Not Following the Rules

It is common knowledge that FINRA and the SEC have applied existing rules to the new social media format. Social media should be a source of new prospects and business growth, not a source of headaches and lawsuits.

What to do: Review notices and policies set in place to stay in compliance with the regulations:

- FINRA 10-06 – Guidance on Blogs and Social Networking Web Sites

- FINRA 11-39 – Guidance on Social Networking Websites and Business Communication

- SEC Risk Alert – Investment Advisor Use of Social Media

Failure to Analyze the Numbers

When you do not analyze the statistical results of your campaigns and daily statistics on social media you will be left in the dark. It will be impossible to know if you are on the right track or if you need to change course to increase your ROI.

What to do: A lot is already done for you. Every major social media platform offers their own analytics that you can easily access and track your progress. When that is not enough you can use a variety of alternative social media analytics tools that will help you see the big picture and not just one network.

Making sure social media marketing is integrated into your marketing strategy is a must. However it is important to avoid obvious mistakes and instead maximize the potential of available platforms to your advantage. Whichever personalized strategy you choose, remember to keep the return on your investment in social media in mind and optimize your path to successful acquisition of clients and overall business growth.

Pingback : Top 10 Articles from the Larkspur-Rixtrema Blog in 2018