This RiXtrema blog entry is published in the Financial Advisor Magazine Expert Views

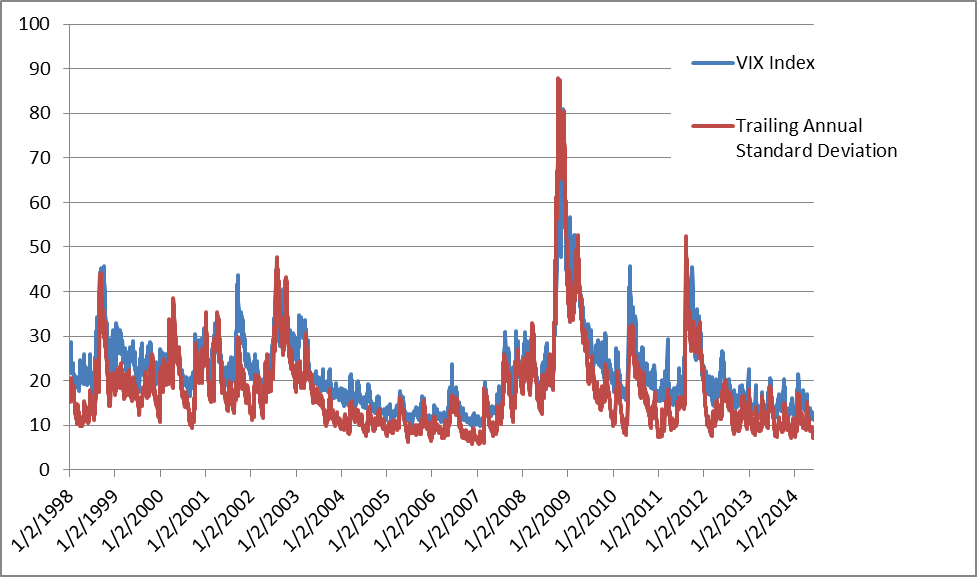

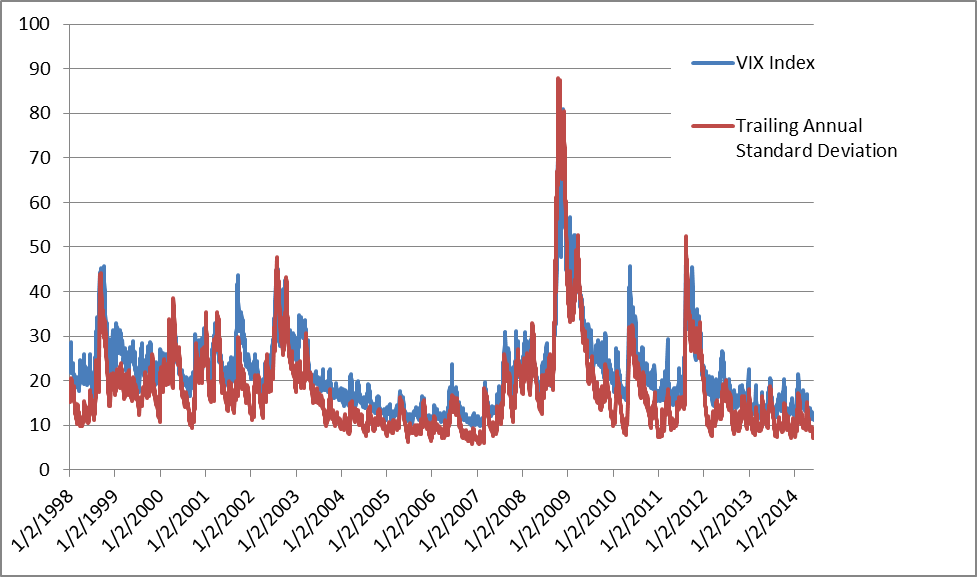

As the VIX tumbles to lows not seen since before 2008, we must ponder the meaning of this complete disappearance of volatility. Are we really witnessing historically low levels of risk?

Forward Looking Risk?

VIX is supposed to be a measure of forward-looking volatility. It is based on decisions made by option traders from big investment houses with a lot of money on the line and that is quintessential “smart money,” isn’t it?

In fact, their opinion of the future seems to look a lot like the recent past. Let’s consider the below chart, which shows VIX and exponentially weighted annualized standard deviation (decay weight of .9). So, traders do not have any more collective knowledge of the future than pharmacists, truck drivers or astrologists (though traders and astrologers get paid for their predictions).