Cryptocurrency: Fiduciary Asset or Verrückt[1]

My colleague Daniel Satchkov has put forth a couple of compelling pieces (Why Bitcoin Drop Was Good and Why Cryptocurrency Just Might Become a Fiduciary Asset and 2019 Will Be The Year That Crypto Decouples From Equity Markets) on why the rout in Bitcoin and cryptocurrency should be seen as a positive and why we may be closer to considering crypto a fiduciary asset. While I agree that the rout is good for the long-term prospects of cryptocurrency (for many of the reasons he lists that I won’t go into here), I disagree that it is on the verge of becoming a fiduciary asset.

It is hard to fathom that just weeks removed from one of the most dramatic boom-bust cycles we have ever witnessed, that cryptocurrency is nearly ready for inclusion in a portfolio as something other than a highly speculative asset. After all, outside of big banks exiting the market and a huge price adjustment, not much has really changed.

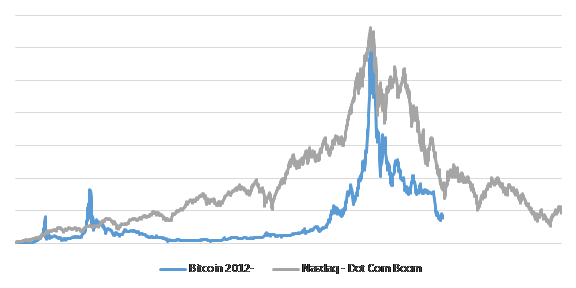

Whenever one thinks of asset bubbles, thoughts invariably shift to tulips or the internet, and maybe now Bitcoin. The chart below shows the recent Bitcoin performance against the Nasdaq during the dotcom bubble.

Exhibit 1: Bitcoin and the Dotcom Comparison

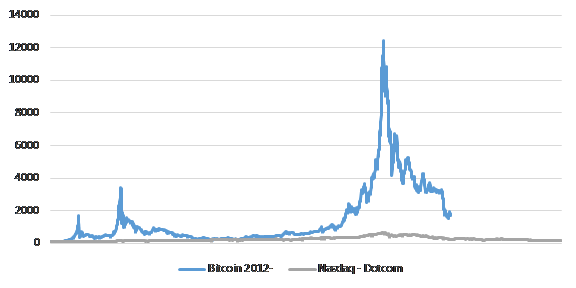

You can see from the chart that the Bitcoin rose logarithmically compared to the Nasdaq with the boom-bust cycle lasting just months. But for me to show that comparison to you, I had to switch Bitcoin to plot on the secondary axis – meaning that the magnitudes of the bubbles are not equal as it seems from Exhibit 1. In fact, the rise in Bitcoin absolutely dwarfed that of the Nasdaq. If I show them on the same axis, the Nasdaq looks like a flat line.

Exhibit 2: What Dotcom bubble?

There may have been a few internet companies that had prices rise 120x, but I couldn’t find one. I remember people talking about the holy grain of getting a “10 bagger” or a company that would increase 10-fold over a short holding period. I never heard of a “100 bagger”, but maybe they were out there. Like Bigfoot or the Loch Ness monster.

Bitcoin was created as an asset immune from central bank interference while allowing for (near) frictionless transfer of value. Cryptocurrency and the blockchain technology that they are built on are great ideas. Just as the internet was a great idea and many of the companies that experienced bubbles in the dotcom era were also great ideas that have changed the world.

But many, if not most, of the companies that contributed to the dotcom bubble were simply ideas that should never have seen the light of day. Investors had to learn how to value internet companies properly and understand their value. When valuations or bubbles were brought up in relation to internet stocks, it was often said that ‘things are different this time’, or ‘valuations don’t matter here’. Things weren’t different, but investors had to learn how to value these companies and these companies had to learn how to actually make money. Some of these companies survived the bubble and thrived in the aftermath (Amazon) and some were created out of the ashes (Facebook), while most simply went away (Exhibit 3). I believe that it will be the same with cryptocurrency.

Exhibit 3: Everyone’s favorite bubble company:

Source: 2000 Superbowl. Yes, Superbowl. An awesome spend for a company that sold most products at a loss. Imagine buying the great idea of buying and delivering a good for a cost of $10 and receiving $9.

Ok, sorry for the diversion, back to crypto. If crypto is indeed a currency then we can transact in it. Indeed, some do. We can agree that I will mow your lawn for 1 Bitcoin. When I am done mowing, you pay me a Bitcoin. If I mowed your lawn in the relatively calm (from a Bitcoin volatility perspective) period of December 2018, that value of that Bitcoin would have fluctuated more than 8% on an average day (measured as the difference between the high and low price). Since a Bitcoin was worth around $3,600 on average, the 8% fluctuation represents about $288. Meaning that if we agreed when Bitcoin was worth $3,600, we may have settled when Bitcoin was worth $3,888 (I win, you lose) or $3,312 (you win, I lose (though if I am mowing your lawn for $3k+, I would argue that I win no matter what)). This is not how normal transactions should work.

But extend the time horizon of the transaction. Assume I the CEO of a software company that sells awesome software that every advisor should have on their desktop. We agree to a 3-year licensing agreement for 1 Bitcoin per year. The price volatility problem becomes even worse. Because you pay for year 1 upfront, that has limited risk. What about year 2 and 3? Who knows how much we will receive and you will pay. But if I take the step of hedging Bitcoin, there is some price certainty. And this is the beginning of a healthy market. The only way Bitcoin and other cryptocurrency really works as a currency is if the volatility calms down to normal currency levels or transactions are set in Bitcoin so that there are natural buyers and sellers of Bitcoin. Likely both because who want to conduct business in or hedge an asset with 80% volatility. And right now, there are no mechanisms to hedge Bitcoin 2 years out, so I can’t agree to that arrangement without significant risk.

So until Bitcoin starts behaving like a currency so that commerce and hedging become a possibility, I can’t think of it as anything more than a speculative asset. But I do think that something good will come from blockchain and/or cryptocurrency, I’m just not sure what. It is for that reason that I think we are a long way from considering Bitcoin or any other cryptocurrency a fiduciary asset.

Oh, and apparently the Tulip mania wasn’t as bad as it has been made out to be: Tulip mania: the classic story of a Dutch financial bubble is mostly wrong

[1] Verrückt is German for insane. It was also the name of a ridiculous waterslide in Kansas City, MO.

Pingback : Where Cryptocurrency Lost Its Way & How It Can Still Take Over Internet?