How 401kFO Software Helps Improve Diversification As Required By 404(c)

Recall that a good Investment Menu under 404(c) is the one that helps “minimize risk of the overall portfolio and minimize risk of large losses”. According to Modern Portfolio Theory (a theory featured prominently in ERISA law cases), there are essentially two criteria that the Investment Menu needs to satisfy to enable participants to minimize risk of large losses. The first is that menu choices need to have different risk levels, from low to high. The second is that correlation between menu choices cannot be close to 1. For each of these two criteria there is a special report in 401kFiduciaryOptimizer that shows how well the plan fares.

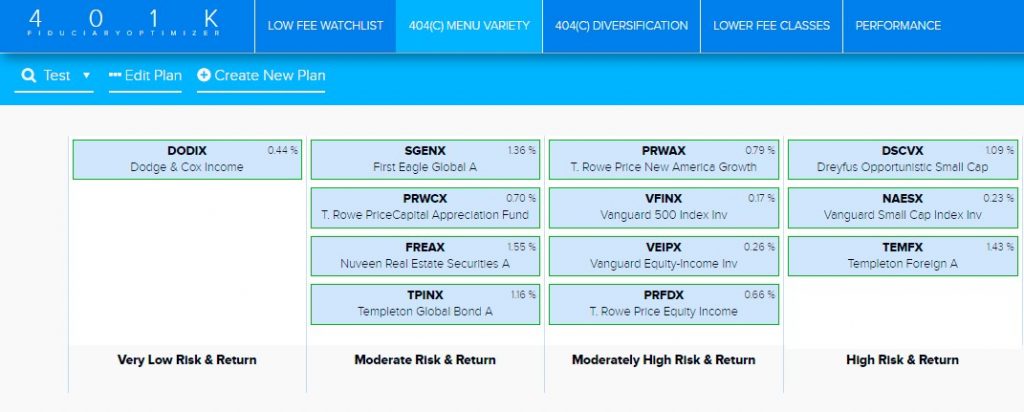

Criteria 1: Investment Menu Has To Have Some Low Risk Investments

If the investments you offer to participants are all high risk, then it is hard to minimize risk of a loss. You need to have some high risk assets to grow retirement savings, but you also need to provide enough low risk choices. Consider Exhibit 1. It shows a 404(c) Menu Variety report from 401kFiduciaryOptimizer for a sample 401(k) plan. All plan investments are separated into risk categories from Very Low Risk/Return to High Risk/Return based on past and holdings based standard deviation of each fund . This particular plan fills Moderate, Moderately High and High Risk/Return buckets pretty well.

Exhibit 1 – Sample 401(k) Plan Investment Menu By Risk Level

But the Very Low Risk bucket includes only one fund, Dodge & Cox Income. This is a potential problem, since naïve participants frequently spread out their investments evenly across many options. In such a case, their investments would be mostly concentrated in high risk assets and risk of large losses would be very real.

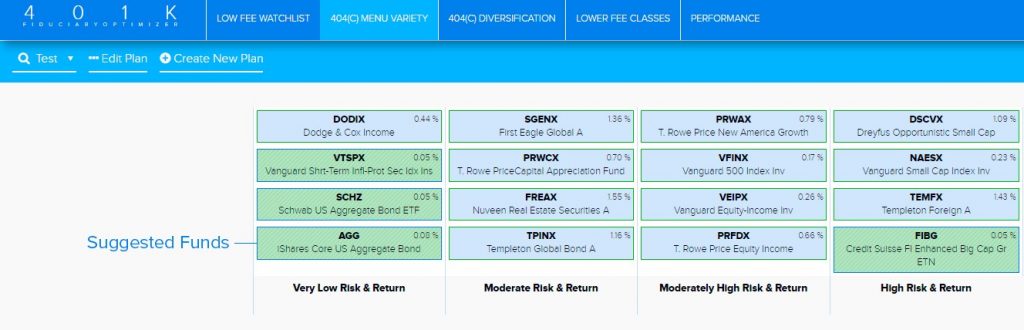

In addition to uncovering the problem above, 401kFO also provides suggestions to fill the empty bucket(s) as shown in Exhibit 2 below. In addition to original funds (in blue boxes), you can see suggested funds in green dashed boxes. These funds are low cost suggestions from the 401kFO engine that are based on plan provider universe selected for that plan.

Exhibit 2 – 404(c) Menu Variety Report With Low Cost Suggestions To Balance Plan Menu

In this case using Open Architecture setting, 401kFO suggest Vanguard Short-Term Inflation Protected, Schwab US Aggregate ETF and iShares Core US Aggregate Bond as potential low cost additions to the Very Low Risk bucket. Advisor has the ability to remove these choices and show other alternatives to a plan sponsor.

Criteria 2: Diversification

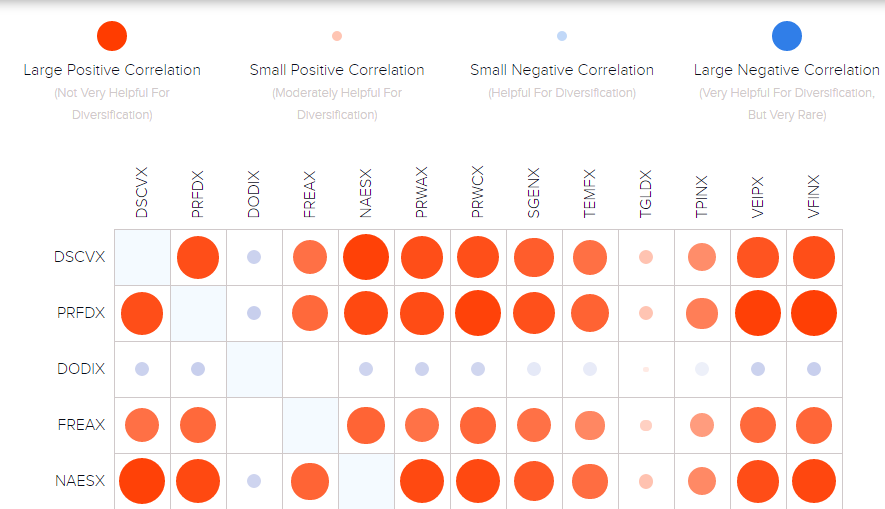

Considering risk levels as we did in Exhibits 1 and 2 is very important. However, the real meat of the 404(c) requirement has to do with diversification of choices in the Investment Menu. For this 401kFO presents a novel report that gets right to the issue and will help you stand out in the eyes of the plan sponsor. It is called a 404(c) Diversification report. Basically, it is a correlation matrix of funds in the menu. Correlation is not just based on the past history, but also on the holdings based that is derived from a multi-factor risk model and fund’s underlying holdings (as required by the Look-Through Investments criteria discussed earlier in the paper). In Exhibit 3 you can see a top portion of that matrix.

Exhibit 3 – Visual Correlation Matrix of Plan Investments

Visual correlation matrix shows correlations as circles, with large red circles representing large positive correlations, small red circles representing small positive correlations, and small blue circles representing small negative correlations. Clearly, this plan has a diversification problem. Only two funds (DODIX and TGLDX) show any real potential for diversification. You can explain to the plan sponsor that if participants combine these large red circles, they may think that they are diversifying, because they are not putting their eggs into one basket. But they are really not diversifying anything and sooner or later will experience large losses due to high correlation of investments in the portfolio. The 404(c) protection would be unlikely in such a case, precisely because Investment Menu has not been structured to enable participants to minimize risk of large losses.

Conclusion: Section 404(c) has specific requirements that must be fulfilled to obtain safe harbor protection against investment losses by plan participants. We focused on three Investment Menu Requirements and described how each of the requirements relates to the Look-Through special rule. 401kFiduciaryOptimizer software contains specific reports to address diversification problems that are prevalent in many plan menus. Financial advisors can use 401kFiduciaryOptimizer to educate plan sponsors and to significantly improve diversification in the plan’s Investment Menu. In the next paper we will focus on minimizing fund expenses, one of the hottest aspects of fiduciary litigation.

Request your personal tour here: