- Plan Sponsors are changing management styles of 401k plans

- Plan Sponsors know something is wrong

- Advisors need to show holistic involvement

- Advisors need to be stewards and educators

- Advisors need to teach plan participants

- ERISA Compliance

- Financial Education is Key

- Converting Prospects to Clients with Customized Trackable Marketing Letters

Anyone managing even one 401(k) retirement plan understands that it is essential to know what services plan sponsors want and expect you to provide. In this blog, I report some recent trends in the financial industry, adding to the first blog written in 2017, “The One Thing You Must Do As a Retirement Plan Advisor.” If they want to grow, small independent advisors need to stay informed about what topics plan sponsors care about and their concerns. In today’s industry, that means combining financial education with your service for plan sponsors.

Plan Sponsors are changing management styles of 401k plans

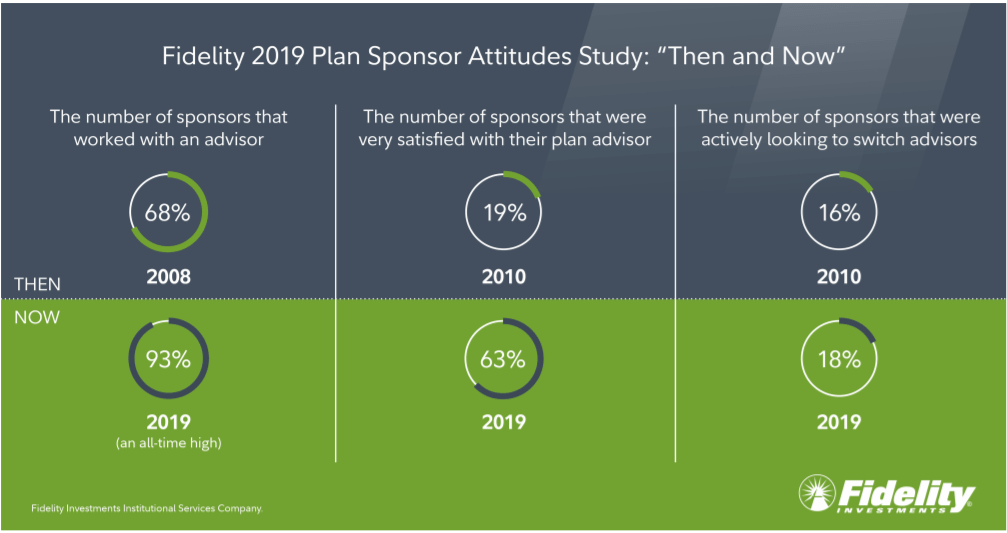

Fidelity Investments’ 2019 Plan Sponsor Attitudes found that:

“75% of plan sponsors report making a change to their plan design or investment menu in the past two years”.

This change is, in part, because plan sponsors understand their responsibility to help employees reach their retirement goals. Skilled employees must be happy with their 401k plans because, otherwise, they may leave to find better options.

While advisors may think it is easier to sit back and meet the expectations of plan sponsors, it is not the way to cultivate long, sustaining relationships. Plan sponsors are more educated about their investment plan than ever before, and professional advisors need to market and educate themselves to show their initiative.

Plan Sponsors know something is wrong

Last year more plan sponsors reached out to advisers to solicit new management (2008 to 2019 Figure 1). The Fidelity survey found that plan sponsors shifted from an annual plan performance review to a quarterly report. Regular reporting leads to oversight, but it is also a tremendous opportunity for advisors to present their ideas and discuss how to reach retirement goals throughout the year.

Advisors need to show holistic involvement

Employees are more inclined to seek employers who provide an enriching culture that accepts and guides them to reach their goals. But, as MetLife found, they seek 401k plan sponsors who follow the same vision. Their study found that employees are looking for a holistic workplace with plan sponsors who strive to improve the climate in the workplace to attract, engage, and retain top talent in the workforce.

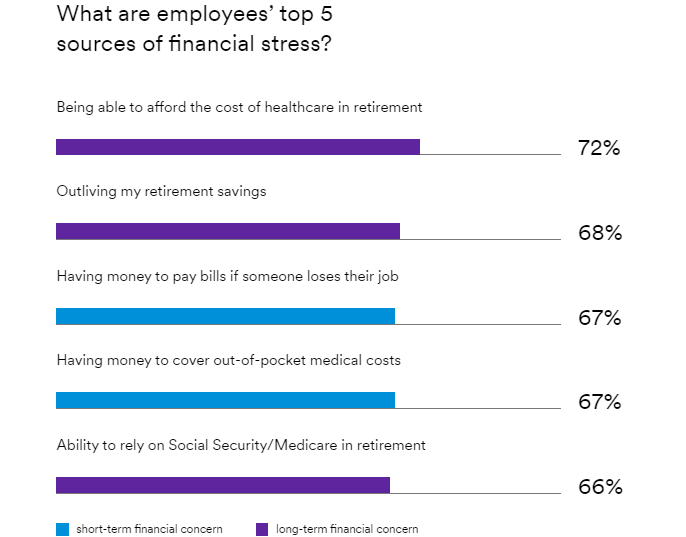

Besides a comprehensive view of the workplace, employees are expecting the companies and leadership teams to provide meaningful financial support to help them deal with their number one source of stress – personal finances. The top two financial concerns for employees in the 2019 survey are the cost of health care and outliving retirement savings (Figure 2).

Advisors need to be stewards and educators

Financial education can remedy most sources of financial stress and make employees more productive. A study by OneAmerica found that employee education was the number one priority of surveyed plan sponsors (69%). Advisors need to be educators as much as fiduciaries because plan sponsors are looking for professionals who can communicate goals and help people sleep easier at night. Engaging with employees is another huge opportunity for advisors to step in as educators for the plan participants.

Advisors need to teach plan participants:

- how to save for retirement;

- how to cover their financial needs if something comes up;

- their investment options in their employer plan; and

- how to start saving for retirement, saving for college for kids, etc.

John Hancock Financial Services found a significant information gap between what plan sponsor participants need to know and what they know.

“The majority of participants have a relatively low level of investment skill and understanding and are largely unprepared to manage their retirement portfolios successfully by themselves… only eight percent of participants knew that money market funds only contain short-term securities. And respondents rated their familiarity with money market funds as second only to company stock.”

Financial education benefits both the company and its because it leads to better work efficiency and productivity, improving the firm’s bottom line. It can also help attract interest from participants who care about sustainable investing. Educating employees about contributing to their 401k plan keeps participation rates high and raises the cap on employer contributions.

ERISA Compliance

Employee education helps plans remain compliant with ERISA Section 404(c). 404(c) provides significant protection to plan fiduciaries against frivolous (but often costly) lawsuits in participant-directed retirement plans.

Read about the 8 Mistakes Advisors Can Make When Approaching a Retirement Plan.

Financial Education is Key

It is still essential that advisors make a long-lasting impression on the plan sponsor during an initial presentation. But it is equally important to maintain that relationship after committing to advise them. In the 21st Century 401(k) plan space, Finacial Education is fundamental for advisors to cultivate a sustaining relationship.

Helping Advisors convert prospects to clients is central to RiXtrema’s mission. We actively keep track of all recent surveys and industry studies to understand the current needs of plan participants and plan sponsors. Our rigorous approach to analyzing these trends becomes a foundation for developing cutting-edge tools used by advisors to propel business growth.

Converting Prospects to Clients with Customized Trackable Marketing Letters

With a growing number of plan sponsors looking to change their advisor, it is crucial to make plan sponsors aware of weak areas in their plans. Our financial planning software, Larkspur Executive, provides powerful retirement plan analytics along with a relentless marketing process that can be used to win the business of plan sponsors. It allows advisors to analyze retirement plans and send and prepare illuminating reports for plan sponsors. Moreover, Larkspur Executive offers a new marketing feature to streamline your prospecting to plan sponsors, Customized Trackable Marketing Letters (CTML). CTML lets you easily highlight those areas and market with trackable emails in just a few clicks.

Please reach out to RiXtrema’s Client Success Team to learn more about our Financial Planning and Risk Software Platforms that can help you spend more time with clients and less on administration and compliance. Call 212-513-7070 or email us at clientsuccess@rixtrema.com. You can read about other features in Larkspur Executive and our financial planning software platform at rixtrema.com/blog.