A New Way to Provide Massive Aggregate Plan Savings

Using 401k Similarity Based Quantitative Algorithm to Provide Massive Aggregate Plan Savings in Low Fee Alternatives Report

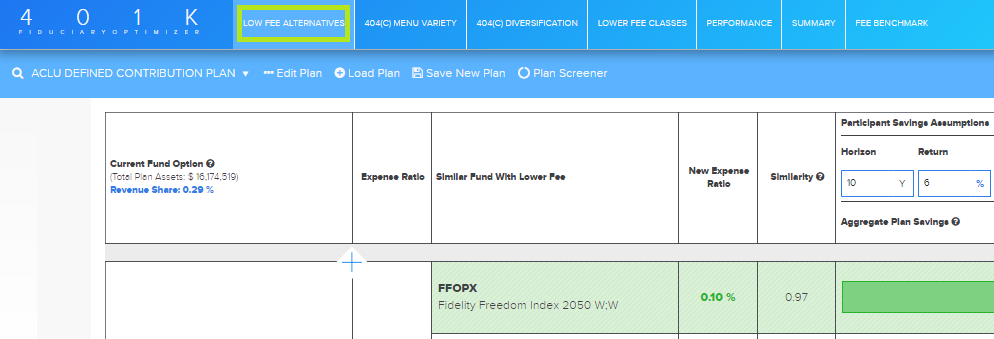

The first optimization report that you will face using 401k FiduciaryOptimizer is called Low Fee Alternatives. The system automatically prompts you to this screen after you choose any 401(k) plan in the Plan Screener or load your own plan in the Load Plan section.

This report is designed to provide financial advisors with lower fee alternatives to the funds filed in original 401(k) plans based on the assumption called Similarity. For calculation of this measure, the following assumptions are taken into account:

- Historical correlation of returns for over 30,000 funds taken from Bloomberg, Yahoo and Quandl API sources

- Fund objective based on Bloomberg source

- Position data for mutual funds and ETFs taken from SEC EDGAR and ETF provider websites correspondingly

- Multi-factor multi-asset class factor model used to forecast correlation for those funds where holdings are available

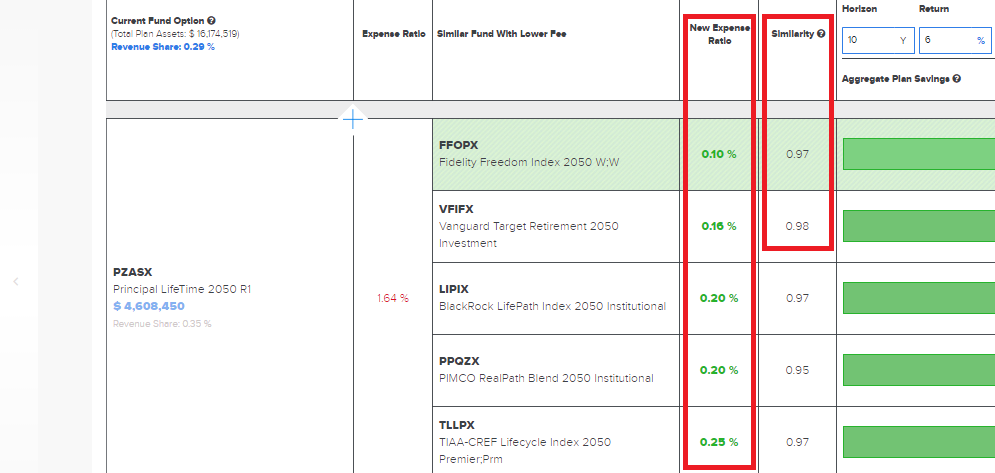

Thus, Similarity is an average correlation calculated over two methods: returns based correlation and holdings based correlation on the fund holdings basis. The Similarity should be 0.9 or higher for a fund to get on the list of alternatives, which means that all provided funds are almost identical to those of the original plan, although the new expense ratio is significantly lower for all of them.

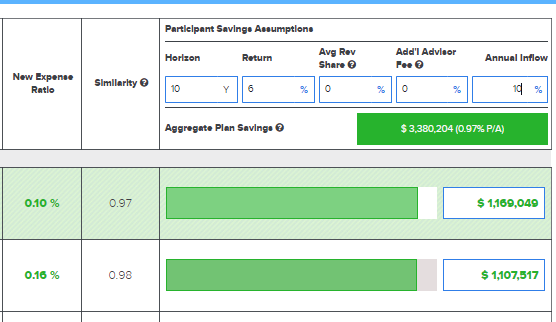

You can find Aggregate Plan Savings for the plan in the upper right green field based on the assumptions of 10-year horizon (including basis points per year) and 6% return by default. All fields are customizable and affect the aggregate plan savings. Average Revenue Share field includes additional plan management fee, which is equal to 12b-1 fee by default, but can be changed later in the Edit Plan section. The Add’l Advisor Fee field is the difference between user’s advisory fee and advisory fee for the current plan. The Annual Inflow is advised to be set as high as 10% to get the most precise data.

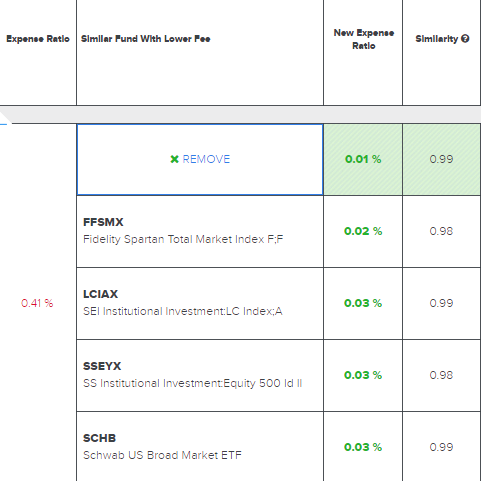

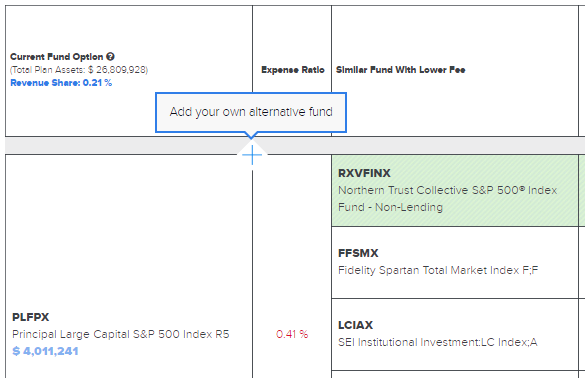

The list of provided funds is taken from the whole universe of funds (Open Architecture) by default. The upper highlighted green alternative is your current selection. Thus, in order to choose any other fund from the list, you need to remove all the funds located above your desired fund to move it all the way to the top.

You can also add virtually any fund to comparison picture by clicking on the + button in the upper right corner of each box of your original fund list column. When you type in the ticker you’ll be able to choose it from the fall down menu and eventually compare it with any original fund in terms of similarity and expense ratio.

EDIT PLAN

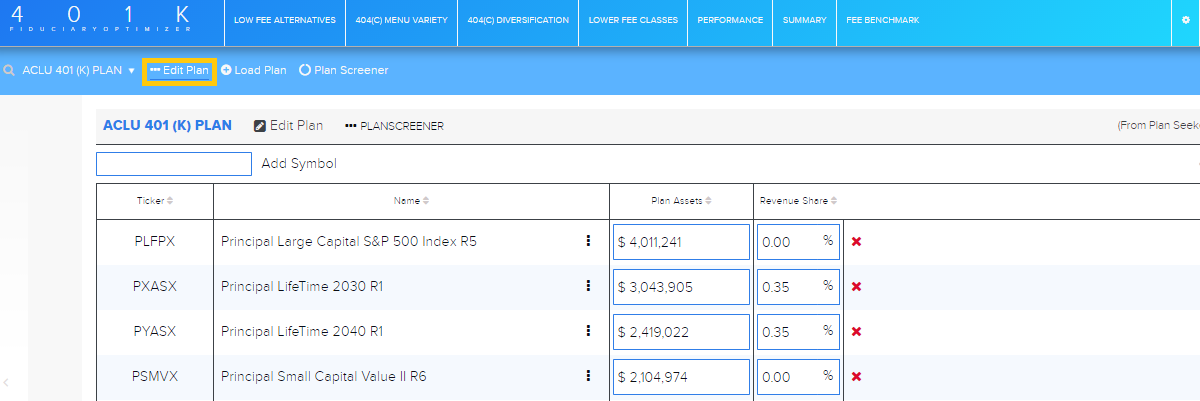

The plan optimization settings are highly customizable, and you can configure them in the Edit Plan section.

First, you can completely restructure your current plan by deleting funds or adding new ones into it.

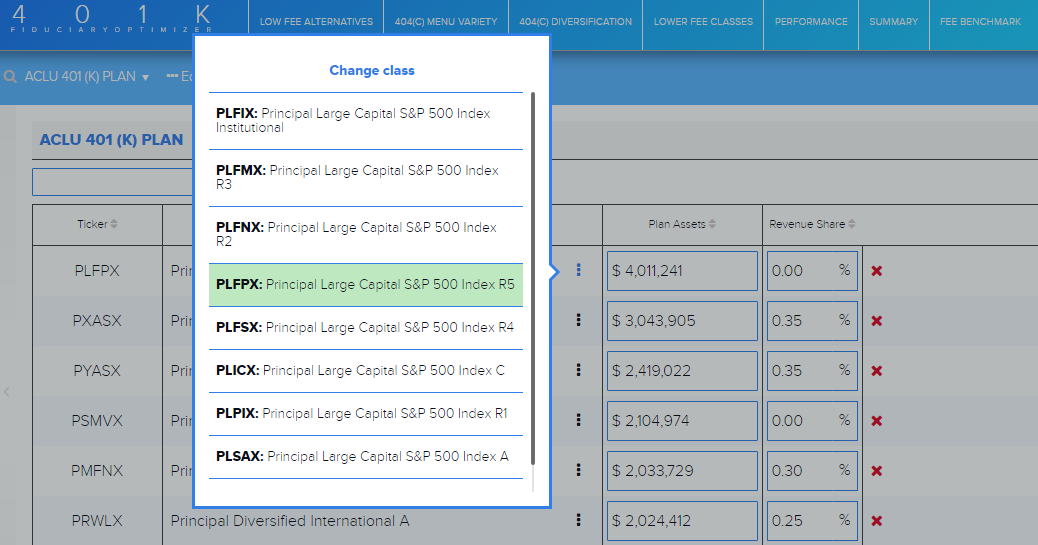

Besides, you can simply change a share class for any of the funds of the original plan by clicking on three vertical dots next to each one of the provided fund names and selecting another share class from the list.

In order to change the revenue share amount you should uncheck the Equal To 12b-1 box and type in your own values manually for each fund or the average value for the whole plan in the Low Fee Alternatives report.

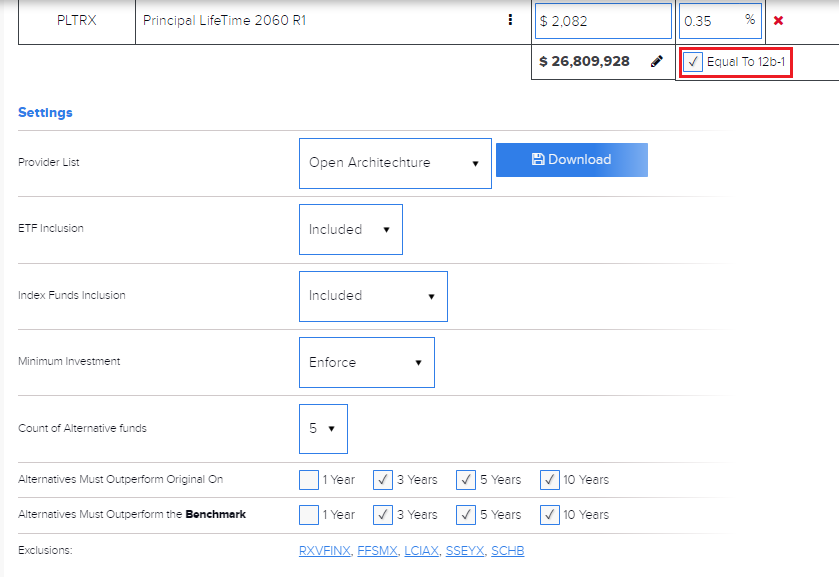

If you have specific requirements for the list of funds you may use, please check your options in the provider list fall-down menu. You can also compile your own provider list (in Excel format) and send it to us at support@rixtrema.com so our data team will upload it to your personal account shortly and make it available for you only.

ETF’s and Index Funds are included in the optimization fund list, which can be changed.

Minimum Investment is enforced (parameter can be changed) and Count of Alternative funds (5 by default) can be reduced or enlarged.

When looking for cheaper alternatives it’s always a good idea to get better performing funds as well. By checking one (or some) of the boxes in the Alternatives Must Outperform Original On field, you demand only the best of the best funds for alternatives that not only going to be better in terms of cost efficiency but will also overcome originals on 1, 3, 5, 10 year performance scale as well.

If you mistakenly removed any funds that you needed for your optimization report, don’t worry. You can always get them back to the list by clicking on them in the Exclusions field at the bottom.

All changes are automatically applied and your Aggregate Plan Savings might change a bit after you edit your settings and get to the Low Fee Alternatives report.

Finding the best ways for your plan optimization is our priority. So we are proudly presenting this quantitative similarity based algorithm to our clients for their self-benefit and the benefit of their clients.

Request a preview of all the features of 401k FiduciaryOptimizer, a Quantitative diagnostics/improvements for retirement plans to accelerate your plan sponsor AUM growth:

Pingback : The 4 Key Benefits of 401kFiduciaryOptimizer