Case Study: Understanding Risk Capacity

The Problem

Measuring the risk tolerance of an investor is an absolutely crucial piece of any financial advisor’s arsenal nowadays. Not considering your client’s tolerance to risk, and also how aligned their current investment portfolio is to that is a fatal misstep. However, it’s become more and more apparent that risk tolerance is just not enough of an indicator to really understand an investor’s situation. Oftentimes, an investor may be especially averse to risk on an emotional level, but their need to take more risk in order to reach investment goals may be lost on them. Advisors need a way to reconcile this concept to their clients. How do you make a client understand this relationship between risk and return in a constructive way?

The Solution

With our brand new Portfolio Crash Testing PRO, we have committed to giving advisors a new way to reconcile this very problem. Sometimes the hardest discussion can be convincing your client that taking either more or less risk may be in their best interest, even if it’s not what they want. The way we’ve done this is through our measure of Risk Capacity.

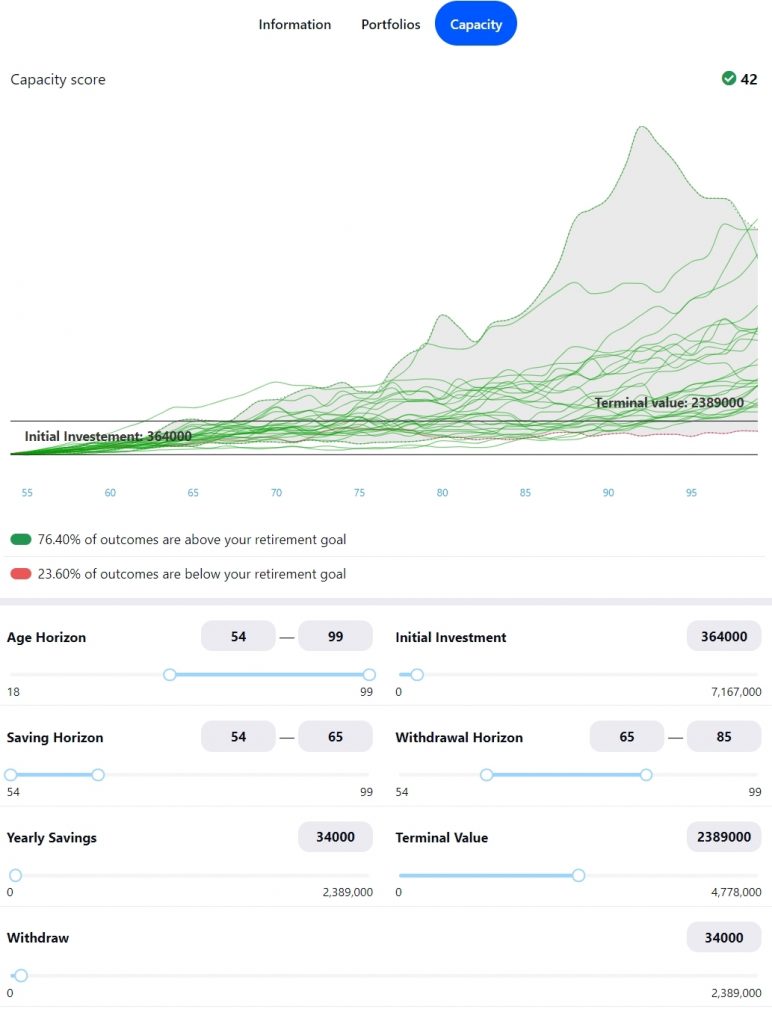

Our Risk Capacity number allows advisors to measure a client’s objective capacity to take certain risks based off of their age, goals, and the amount they already saved in their account. After we take a look at these factors, we use a Monte Carlo simulation to see how many possibilities are there in which this investor reaches their retirement goals. From these calculations we are able to provide a number that will tell a user how much actual capacity for risk they have to take.

From these calculations we are able to provide a number that will tell a user how much actual capacity for risk they have to take.

After checking the Risk Capacity, we can see how in-line a client’s portfolio risk, risk tolerance, and capacity all fall. If these numbers are all very far away from each other, this indicates that an investor needs more realistic expectations. If their risk tolerance is much lower than their capacity, this means you may need to have a conversation explaining to the investor that they can take much more risk than they may believe. Additionally, they may even need to take this risk in order to reach their retirement goals. Likewise, if their tolerance is higher than their capacity, they may need to reel in some of their ambitious ideas about investing to ensure a safe retirement. It is no longer sufficient to measure risk tolerance alone to gauge an investor’s suitability to their portfolio. Knowing their objective capacity for risk is a critical piece to understanding the whole picture. When it comes to summing up an investor’s complicated life and priorities into numbers, it’s definitely in their best interest that we make sure we are taking not only their tolerance, but also capacity for risk too.

Pingback : Reg-BI Is Along The Line Of Fiduciary Rule -