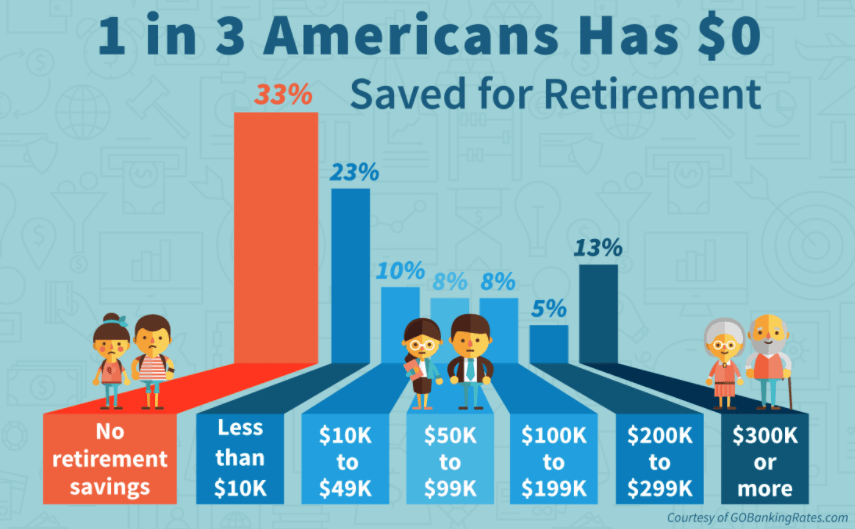

It’s no secret that many Americans don’t think enough about retirement, but they should. Especially, if they have no savings, which is true for 33% of the population, and 23% only have 10K put away for retirement (see Figure 1). There are many reasons why retirement savings are in such bad shape. For example, student loans, credit card debt, the need to save for down payment, a college fund, all contribute to a seemingly hopeless situation. However, no matter what the situation, we all need to plan for retirement. Our social security system cannot be relied upon, because we cannot be sure where it will be in 5, 10 or 20 years from now. So, we need to count on ourselves to take care of our own retirement With a little incentive and education, anyone can start saving for retirement today.

Figure 1.

Financial education and early retirement saving are invaluable life skills, which you shouldn’t put off forever.

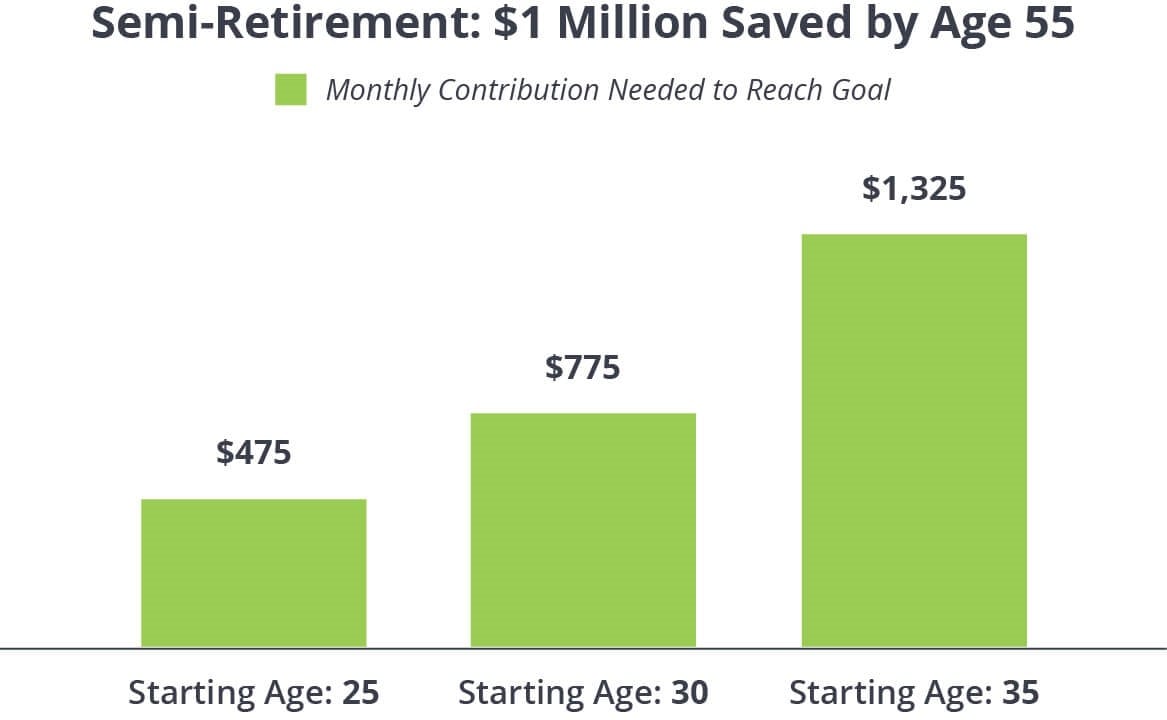

According to BlackRock’s 6thAnnual Global Investor Pulse Survey more than half of the 27,000 respondents, from 13 countries, worry more about their current financial situation than about retirement. If you look at the chart below (Figure 2), you can see that with every year of not saving for retirement, the financial sacrifice in the future will be greater. So, thinking about your financial situation should also include thinking about your financial future. A big part of the thinking about your financial future should be taking a careful and disciplined approach to retirement planning. The first step in this process is getting started with your first retirement account. It can be either a 401 (k) at work or an IRA account. The second step is to decide how much money can be contributed to the retirement account on a monthly basis. The amount can be adjusted as your financial situation changes. The third step is to put your money to work by investing it. This stage can be the most difficult, but don’t be discouraged. There are advisers who can guide you. If you are on a low budget, robo-advisors can help you on your retirement journey. People who can contribute to a 401 (k) plan at work should take advantage of it. You need to find out about available options regarding 401 (k) plans such as a QDIA or employer matching program. With research and fiscal discipline, most of the people can get on the right path to a better retirement.

Additionally, it is good to be aware of the most efficient ways to put your money to work, using various tiers of tax differed investment vehicles. The good thing about these investment options, they are available to most people who are looking for an opportunity to save for retirement. When it comes to a tax subsidy there are a few different types of account available. They all fall into two categories: accounts which provide a tax deduction for contributions (traditional IRA, 401(k) retirement plan) but get taxed at the distributions; or accounts that are not tax deductible when contributing (Roth IRA, Roth 401(k) retirement plan) but are tax-free when a distribution is made. So, these type of accounts can be called “double-tax-preferenced” accounts, because they let assets in the account grow tax free, plus either tax-deduction upfront or at distribution.

However, there is a better retirement saving account available to those who qualify. The Health Saving Account (HSA) which is also known as “triple-tax-free” account. This is our number one choice for picking a retirement saving vehicle. The HSA provides tax-free contribution, tax-free growth and tax-free distribution for qualified expenses for up to $3,450 for individuals or $6,900 for families (plus a $1,000 catch-up contribution). Such a generous tax-free status of the HSA comes with certain limitations. Firstly, you need to be qualified to enroll in the HSA by having a high deductible health plan (HDHP). Second, you need to spend distributions from the HSA on qualified medical expenses. Ironically, people usually have no problem with that, usually medical costs tend to rise when people retire.

Our second tier for retirement saving options are “double-tax-free” accounts, briefly touched upon above. These are traditional IRA, Roth IRA, 401(k) retirement plans. It should be a given if your employer offers to enroll into retirement plan you should do it right away. Employee 401(k) contributions for plan year 2021 will once again be limited to $19,500, with an additional $6,500 catch-up contribution allowed for those turning 50 or older. The contributions to 401(k) plan is free of tax and can grow tax-free. If you plan to go beyond employee retirement plan, the traditional IRA and Roth IRA could be your next step. The total contributions you can make each year to all of your traditional IRA and Roth IRA combined cannot be more than $6,000 ($7,000 if you’re age 50 or older). Both are “double-tax-free” and the only difference is when they are taxed. The traditional IRA is taxed when it is distributed and a Roth IRA is funded with the after-tax contribution.

Also, those who run their own business and/or file Schedule C, can contribute annually to a retirement plan for businesses. There are two types of plans, the Simplified Employee Plan (SEP) and the SIMPLE IRA. These plans work like an IRA but contributions to them are similar to 401(k) plan contributions. For example, the SEP maximum annual contribution is under $57,000 or 25% of participant’s compensation, which is 10x larger than with the traditional IRA. The SIMPLE IRA’s contribution can be either employee based (salary reduction contribution up to $13,500; $16,000 is age 50 or over) or employer based (either dollar-for-dollar matching contribution, up to 3% of employee’s compensation, or fixed contribution of 2% of compensation). You can find out more about it on the IRS website.

Of course, those who are saving for their kid’s college, the 529 plan is one way to go. It also offers double-tax benefit if a contribution is spent on education. In addition, some states set up 529 college saving plans that provide you with the tax savings on the state level. The biggest benefit of the 529 plan is that the beneficiary can be changed to anyone in the family, for example from son to grandson. No RMD with the 529 plan and after the beneficiary of the plan changed, the contribution can continue to grow tax-free.

Our third tier for retirement saving options is basic tax-deferred accounts. These type of accounts include various annuity products which provide tax-deferred growth for the invested money. However, both contribution and distribution are taxed. The annuity products are broad and complicated world. Any consideration to invest into these products should be carefully reviewed with a financial adviser. A lot of annuities sold in the bundle with the insurance products like whole life, variable annuity life insurance. These products are very valuable in terms of providing a safety net for unexpected life events.

In conclusion, It would be a good idea, at this point, to mention a traditional brokerage account, that can also provide you with tax-deferred growth if you invest long term because capital gains are not taxed; unless sold. The best option in this category belongs to growth assets that do not pay dividends. If you pick a growth stock and stick with a buy and hold strategy, the growth of the asset price is tax-free until the capital gains are realized. Also be aware, the long term capital gains are taxed at a lower rate than short term gains.

Happy Saving!