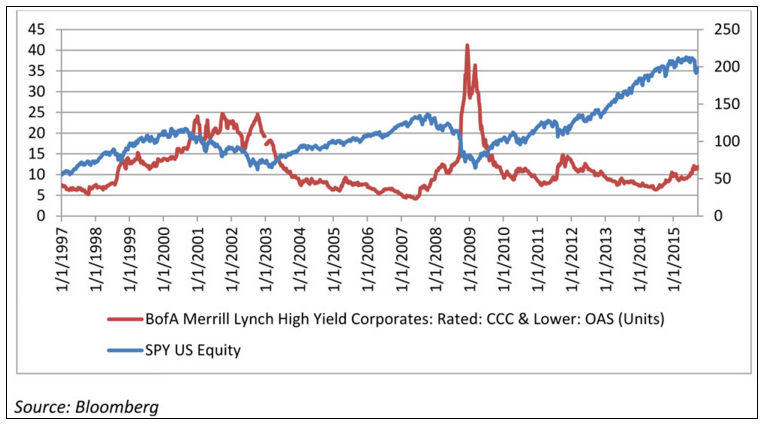

Increases in junk credit spreads have historically been predictive of the stock market moves, especially after a prolonged period of very low spreads. And so today, the junk debt market is in serious trouble with contagion spreading. If your clients own high yield, make sure they understand that it is a very risky investment. Read about the theory behind this predictive indicator, see how it worked in the past market crashes, and review today’s implications for financial advisors in our article published by ThinkAdvisor.