With a new year, we have new challenges and ways to grow businesses. Changing political trends, regulations, and new technology could make navigating the 401(k) space challenging. However, that doesn’t mean there won’t be ways to succeed. Here are a few things we came up with that might just help you get ahead in 2019.

A bird in the hand, is worth two in the bush.

In 2019, a large part of growing your business may in fact be just protecting your existing clients. After a long smooth bull run on the market, it is in these tumultuous times that people start to worry. Plans may begin to start accepting calls from a competing advisor out of concern that they need to make sure that they are best positioned for the road ahead.

To protect existing business, advisors could schedule extra meetings with clients, showing them the most up-to-date analysis about the current state of the plan and their risks in the future. This could also involve education, discussing fund selection, and teaching how not to to react emotionally to volatility.

Familiar Ground

Identifying retirement plan prospects is not as difficult as you may think. In fact, one of the best ways to start is by identifying people around you who can provide you with connections.

First, you can reach out to current clients. Some clients may have discretionary authority over a company’s retirement plan. Other clients may be willing to refer you to their plan’s decision-makers. Second, remind your family and friends. Let them know that you not only help individual clients, but you also help companies with their employee retirement plans. Third, you can connect with centers of influence. Look for people with a good community standing or a role that can help open doors to retirement plan sponsors. Officers or directors of your local chamber of commerce are good examples.

Revise Your Marketing Strategy

The most obvious approach is to stay the course and do what you did last year. While it is not the best option, it will help you keep the process going. Next, you need to review results from last year to see where you can optimize your strategy. For example, if your paid social media marketing was effective and the ROI was where you wanted it to be, then it might be a good idea to increase your facebook or twitter budget to keep the momentum going. While optimizers often get a short-term boost, performance figures often revert to the previous ones.

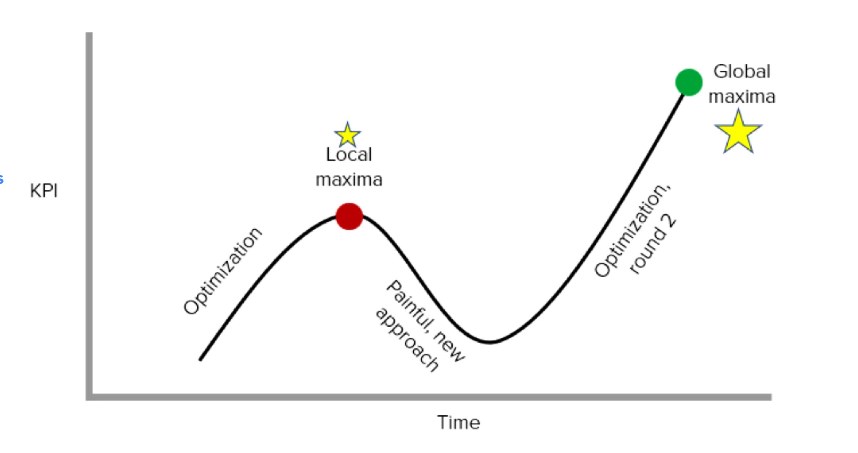

Also, even when optimization works, it may not produce the ‘optimal’ results. Relying on statistical analysis can lead you to what is known as a ‘local maxima’. That is, you may improve an existing tactic to be its very best, but another, radically different approach can improve things even more, and reach a ‘global maxima’.

Judging by the graph above, the best long term results should be coming from making radical changes or at least attempting to try something new. For example, if you have tried only cold calling last year, try to integrate an online newsletter into your plan or if you only sent out newsletters in 2019 then try some paid campaigns on social media to see if it will work for you. Finally, you need to look into online fintech tools that are specifically made for plan advisors, which bring us to the next suggestion on how to grow your practice.

Use More Fintech Tools

It’s already 2019 and new technology is popping up all around us. There are tons of new tools to help advisors both prospect and manage 401(k) plans. If you aren’t taking advantage of all the technology that’s available out there, you’ll definitely be falling behind in 2019. Powerful fintech tools not only make your life easier when managing the plan yourself, it will keep you competitive with plan sponsors and investors. New tools that can help prospect and demonstrate value can make or break your firm’s efforts to gain new clients.

You can see a small preview below:

Not utilizing modern tools to manage the plan, fund menu, and participants will make your life harder when you win the business.

All in all, there are plenty of new trends to look out for and new methods to start using in your practice to optimize your growth. Be sure to take advantage of some of these in the next year to have a great 2019!