How to adjust your client’s investment goals and risk tolerance for an ideal portfolio

Risk in itself is neither good nor bad, but it is extremely important that you understand what risk and how much of it you are taking. As advisors are adopting wealth management technology, they seem to be focused on the risk tolerance aspect of risk system implementation.

If we look at guidelines by FINRA, the investment suitability definition goes far beyond risk tolerance: “…include the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs and risk tolerance.” From here, we see that risk tolerance (we underlined it) is only one of the aspects of investment constraints, but there many other constraints. Moreover, we see that besides the investment constraints, there are investment objectives, which are actually the reason why an investor wants to take the risk in the first place. After all, nobody really wants any risk; in an ideal world we would get return with no risk (and as advisors know, some investors seem to demand that). Risk taking is what we do in order to achieve our goals.

Exhibit 1. Advisor value-added: finding the balance

Exhibit 1. Advisor value-added: finding the balance

The bottom line is that building a portfolio by subordinating everything else to the risk tolerance is detrimental. Let’s use car shopping as an analogy to the investing process. When we buy a car we are after certain things like performance, handling etc. In order to obtain things that we desire, we must incur risks. For cars, those are usually measured as crash test ratings from the Insurance Institute of Highway Safety. Let’s imagine what it would be like to buy a car with a view only to targeting our tolerance for risk and forgetting why we are tolerating risk.

Car Shopper: “I am considering these two cars, can you explain to me the difference between them?

Car Salesperson: “Sure thing. The one on the left will give you a whiplash when hit from

behind and the airbag will break your nose. The one on the right will actually break a

number of bones, including a collar bone and will possibly give you back pain for a good

long while. Now, which risks are you ready to tolerate?

Car Shopper: “I’ll take the broken nose please…”

It seems absurd, yet something like this happened when risk management systems that were created to target specific levels of risk for institutions began to be used by advisors. Admittedly, some risk management is much better than none. But the advisor should not forget to discussthe “goals”, i.e. “Why exactly is my client incurring this risk… which specific goals is he reaching for if his portfolio is risking a large loss? And if we reduce his risk, what is the trade off, what does he need to give up?”

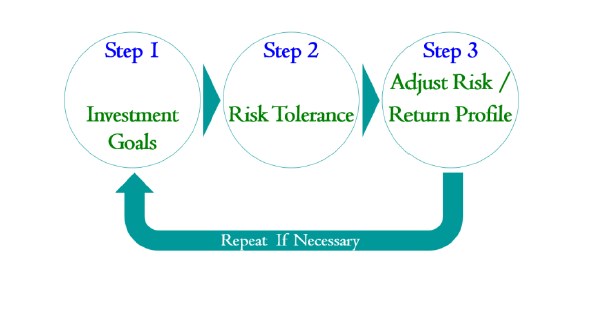

Exhibit 2. Iterative Process of Building the Right Portfolio

Look at the diagram (Exhibit 2). You start with Investment Goals. Only after that comes Risk Tolerance, because risk is something we tolerate to achieve that goal. If Tolerance and Goals are mismatched, one or the other must be adjusted and the client must evaluate the whole loop form the beginning.

In order to do that you need a tool that will estimate both risks and the long term return of the portfolio (in order to fulfill both steps 1 & 2 from the diagram above). With risk and return estimated you can now show to your prospect the interplay between the two and how much future cash flow any given risk/return level will sustain. Consider this example and Exhibit 3 below:

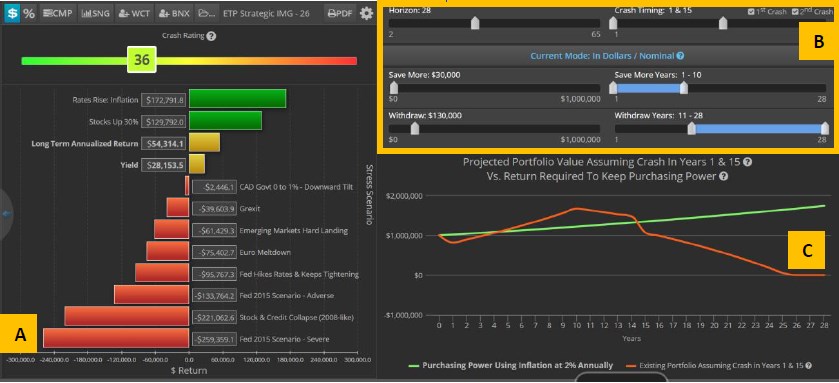

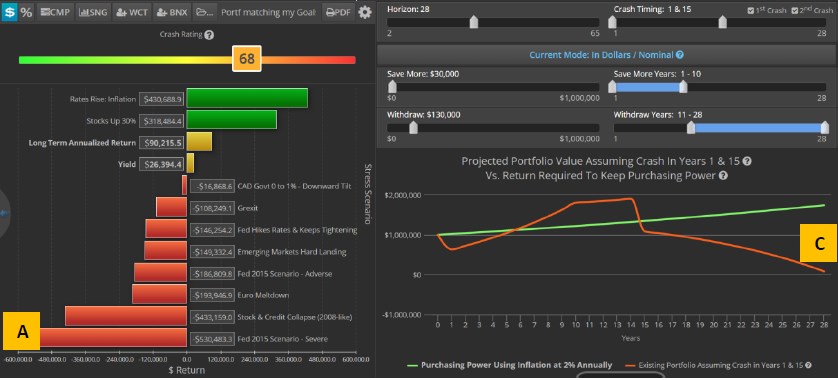

Exhibit 3. Goals and Risk Tolerance are out of sync

I am a client with $1m to invest. I expect to retire in 10 years. During the 10 years prior to retirement, I will invest additional $30k per year, and once my retirement starts, I would like to collect $130k per year over the duration of my retirement, which is 18 years (the average retirement duration in the US). I am talking to my advisor who identified all my investment constraints and now we are discussing the key remaining constraint – risk tolerance. The advisor is asking me how much risk I can take in order to achieve my goal. I am willing to take risk of potentially losing no more than $260k (26%) within any one year period in order to achieve my goal. After we established all that, I would like to know whether it is possible to achieve my goal given this risk tolerance level. And my advisor tells me “No. We have to adjust your goals or investment constraints” and points to Exhibit 3.

The portfolio that meets my parameters (my goals and my risk tolerance i.e. ~26% loss) will support my goals up to the year 25 from now, i.e. the 15th year in my retirement, after which its value will likely drop to zero, so during the last 3 years of my 18-year expected retirement it will not be able to support me.

Legend for the picture:

A – My risk tolerance level expressed in the maximum amount of loss I can take – about 26% or $260k

B – My Retirement Goals (Time horizon: 28 years, Withdrawals: $130k per year in years 11-28), Savings: $30k per year in years 1-10, Major market crashes assumed in years 1 and 15

C – The value of my portfolio (red line), which becomes zero at the year 25 (15th year of my retirement)

The advisor found the portfolio for me that would lose close to 26% (my risk tolerance level) in the worst possible stress scenario. All other scenarios will produce a smaller loss or gain. Note, that this advisor is using the stress testing concept to identify my risk tolerance level. I may be worried about many potential crisis scenarios after reading WSJ and watching CNN recently, but I do not know how any of those will impact my portfolio. And the Stress Testing just puts the price tag on my fears, and now I know in which of those scenarios I will lose the maximum amount.

So, now I have to re-evaluate my goals and risk tolerance to find a portfolio that is likely to support me through the whole average retirement. As shown in the Exhibit 2, this is an iterative process.

So, I can either adjust my goals:

– time horizon (retire later)

– save prior to my retirement

– reduce my withdrawals in retirement

– increase my initial investment (invest more than $1m)

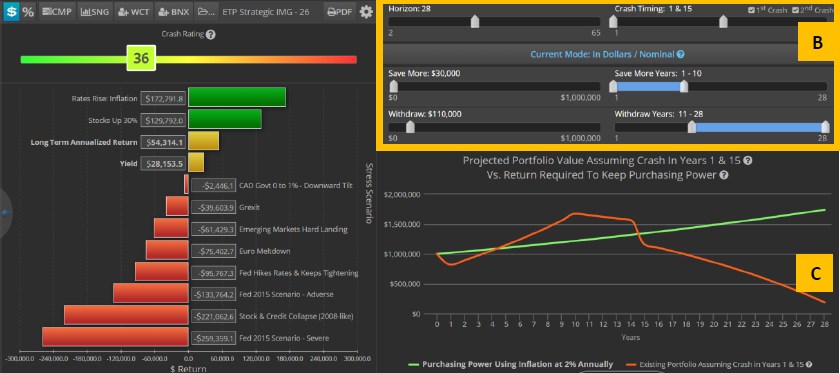

Or, I can adjust my risk tolerance, i.e. if I am willing to accept more risk there could be a portfolio that will likely meet my goals. Let’s consider adjusting the goals first. I am keeping my risk tolerance level as is (“A” in Exhibit 3 is unchanged, and I am moving the slider that controls the annual withdrawal amount (it was $130K per year “B” in Exhibit 3) to find the goal combination that will match my risk tolerance. Exhibit 4 shows one such combination – I have adjusted my withdrawals from the original $130K per year to $110K, and now I have enough money to go through the retirement (my portfolio goes to slightly above zero at the end of my retirement at the year 28 – see “C” in Exhibit 4).

Exhibit 4. Adjusting the Goals

Alternatively, I can adjust my risk tolerance level. I am keeping my goal parameters unchanged (we do not change “B” in Exhibit 3), but I am now accepting the loss of 53% instead of the original 26%. And there exists a portfolio that has that maximum loss level, and it will meet my original goals. See Exhibit 5, where A is now 53% (or $530K), but B is my original goals, and we can see in C that I my portfolio lasts through all years of my retirement and gets down to zero at the end of my last year in retirement.

Exhibit 5. Adjusting Risk Tolerance Level

Note that adjusting risk tolerance upward should be done as a last resort and only if the client is confident that they can live with the higher tolerance. If there is any doubt about that, you should compromise on goals or consider the mix of the two (some goal sacrifice and some risk increase).

In the conclusion, it is important for the advisor to discuss goals and risk tolerance together and identify the right portfolio that will match these two elements. Finding the match may be an iterative process where either the goals or risk tolerance have to be adjusted, but it is a necessary process in order to have the right portfolio for the client.

Pingback : A list of core beliefs every financial advisor must have.

Pingback : 5 Things You Can Do Right Now to Be a Better Financial Advisor