Today we are going to tackle one of the most difficult data challenges you will encounter in creating a best interest report. You are obligated to act in clients’ best interest and document that whenever you onboard IRA assets after June 9, 2017. As part of acting in the client’s best interest when doing a 401k to IRA rollover, the new DOL fiduciary rule requires advisors to assess what are the fees and expenses. This included the fees and expenses of both the client’s existing 401k and the IRA which they are rolling into. The underlying investment expenses and the advisory fee for the IRA are relatively simple to find out. But how can an advisor find out what the admin fee is that the client is currently paying in the 401k? And what fees and expenses are included in the 401k admin fee?

What the DOL said:

“The documentation must take into account the fees and expenses associated with both the existing plan and the IRA; whether the employer pays for some or all of the existing plan’s administrative expenses; and the different levels of services and investments available under each option.

“To satisfy this requirement, the adviser and financial institution must make diligent and prudent efforts to obtain information on the existing plan. In general, such information should be readily available as a result of DOL regulations mandating plan disclosure of salient information to the plan’s participants (see 29 CFR 2550.404a-5). If, despite prudent efforts, the financial institution is unable to obtain the necessary information or if the investor is unwilling to provide the information, even after fair disclosure of its significance, the financial institution could rely on alternative data sources, such as the most recent Form 5500 or reliable benchmarks on typical fees and expenses for the type and size of plan at issue.”

(DOL CONFLICT OF INTEREST FAQS PART I- EXEMPTIONS Oct 2016)

The DOL has said that there are 3 options for an advisor to obtain the admin fee the client pays in the 401k. Each of these creates a unique problem.

- 404a5 disclosure: This disclosure is the first preference and advisors are required to make a prudent effort to obtain this and make a fair disclosure to inform the client of the significance in obtaining this disclosure.

- The plans SEC filing of the form 5500: This form would need to be the most recent filing and it can be used if despite prudent efforts, the financial institution is unable to obtain the necessary information or if the investor is unwilling to provide the information.

- A reliable benchmark: This would be a benchmark of typical fees and expenses for the type and size of the plan.

The 404(a)5 disclosure

Sponsors of participant-directed ERISA plans (defined contribution only) must provide active and eligible participants with disclosure of plan-level information (including fees and expenses that may be assessed against their accounts) and investment level information (including fees and expenses and performance data) at multiple times (initially, annually, quarterly and upon change)

(Prudential.com Fee Disclosure Guide)

- General Plan Information: General plan information consists of information about the structure and mechanics of the plan, such as an explanation of how to give investment instructions under the plan, a current list of the plan’s investment options, and a description of any “brokerage windows” or similar arrangement that enables the selection of investments beyond those designated by the plan.

- Administrative Expenses Information: An explanation of any fees and expenses for general plan administrative services that may be charged to or deducted from all individual accounts. Examples include fees and expenses for legal, accounting, and recordkeeping services.

- Individual Expenses Information: An explanation of any fees and expenses that may be charged to or deducted from the individual account of a specific participant or beneficiary based on the actions taken by that person. Examples include fees and expenses for plan loans and for processing qualified domestic relations orders. (DOL Fact Sheet Feb 2012)

Importantly, this fee disclosure is required quarterly and to be reported in the dollar amounts charged against the participant’s account. (Cornell Law LII Fiduciary requirements for disclosure in participant-directed individual account plans.) The annual disclosure also includes available investment option in the plan. This will also be a useful part to assess what is the best interest of the client by examining what all of the options are available to them in their current plan.

Example 404(a)5 Disclosure: SAMPLE 401 (K) PLAN FORM from October 2015

“Plan Fees and Expenses An explanation of fees and expenses for general Plan administrative services (e.g., legal, accounting and recordkeeping) that may be deducted from a participant’s account and the basis on which such charges will be allocated is provided below. An annual administrative fee of 0 basis points is charged to Participant accounts or paid by the Plan Sponsor quarterly. This fee is less than the total cost of the services, which is 19 basis points, because it has been offset by the anticipated Indirect Compensation received by VRSCO and affiliates. This fee will change in future years if Indirect Compensation is more or less than was anticipated. If the Indirect Compensation received is greater than 19 basis points during a year, VRSCO will deposit the amounts of such excess into an administrative expense account under the Plan, which amounts are available to the Plan Sponsor to pay certain administrative expenses of the Plan. In addition, VRSCO will pay an annual revenue sharing amount not to exceed $25,000 to the Plan Sponsor for Plan administration expenses The Plan may incur charges or fees outside of the investment alternative product(s) that may be deducted from participant accounts as directed or authorized by the Plan Administrator. These fees may include third-party administration, consultant, legal, audit, and other fees directly related to the operation of the Plan. Any such charges or fees deducted from VALIC participant accounts will be reflected on quarterly participant account statements.”

The Form 5500

The Form 5500, is the annual report used to file an employee benefit plan’s annual information return with the Department of Labor. In general, a form 5500 must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2016.

The amount to be reported for expenses involving administrative service providers:

- Salaries to employees of the plan;

- Fees and expenses for accounting, actuarial, legal, investment management, investment advice, and securities brokerage services;

- Contract administrator fees;

- Fees and expenses for individual plan trustees, including reimbursement for travel, seminars, and meeting expenses; and

- Fees and expenses paid for valuations and appraisals of real estate and closely held securities.

- Other expenses (paid and/or payable) include other administrative and miscellaneous expenses” (DOL – Instructions for Form 5500 2016)

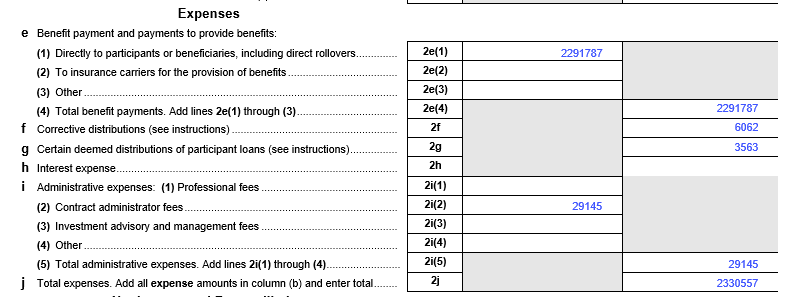

Example form 5500: SAMPLE 401 (K) PLAN year end 2015.

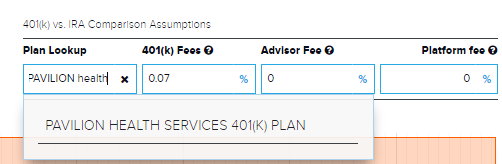

Below is an example of the Plan Lookup feature of RiXtrema’s IRAFiduciaryOptimizer, which looks up the admin fee from a database of nearly 400,000 form 5500s. This feature makes the 5500 data instantly available for the advisor when assessing a rollover.

The Figures from this form 5500:

- Total Size of plan = $42,427,188

- Total fees = $29145

- Number of Participants = 1925

- $29,145/1925= $15 average fee per person

- $42,427,188/1925 = $22,040 average portfolio size

- $29,145/ $42,427,188 = 0.06527 401k admin fee

- 401k fee automatically calculated in IRAFiduciaryOptimizer = 0.07

What are the problems?

If the fees appeared exactly the same on both the 404(a)5 and the 5500 then there would be no reason for the DOL to require a prudent effort to obtain the 404(a)5. So what are the differences and what situations can cause a variation between the two?

Recency

The 404(a)5 is reported quarterly with a longer annual version but the form 5500 is reported annually, 7 months after the end of the relevant period. So the data on the 5500 can be more than 18 months old.

Data

The 5500 reports the fees for an entire plan without any respect to how the fees will be charged to the participants. For example, in the 404(a)5 it may disclose that the plan divides the fees amongst participants on a pro-rata basis based on the size of the participant’s portfolio or sometimes it will state a set fee per participant. However, when calculating the admin fee from the 5500 it is just an average across the entire plan, which would differ from the real fee if the plan actually charges a set fee per participant

The problem of the fees listed in the 404(a)5 is that it seems that they aren’t designed to be displayed graphically or in a user-friendly manner. Often the fees are just listed in the middle of a paragraph of text. Sometimes they can even be vague and unhelpful, for example “check Third Party Administrator Annual Disclosure”, rather than providing the figures you need.

Who Pays the Fees

Does the employer pay some or all of the fees? Sometimes the employer will pay the fees for the participants, so there won’t be any admin fee on the 404(a)5 but on the 5500 it will still show the total admin fee. Sometimes there are no fees on the 5500 because the admin fees are paid for by the 12b-1 fees, and there also won’t be an admin fee on the 404(a)5 either.

What are the solutions

The first solution is client education. At points of contact with the client, the advisor should use the opportunity to remind them to keep their quarterly statements. If the advisor has access to this 404(a)5 disclosure it will make the fee analysis easier. The 404(a)5 also includes the entire plan menu of all of the funds available in the plan. This entire plan menu will enable the advisor to assess what options are available to the client in their existing plan.

Another solution is to become familiar with how the client’s plan reports their data, for instance, maybe the plan reports electronically. The client can be encouraged to forward any 401(k) emails they receive from the plan to the advisor, and also remind the client to keep their online account details, in the event that these disclosures are available to them online. Of course, these are only applicable for existing clients.

For new clients and existing clients who don’t have the disclosure, advisors are required to make a prudent effort to obtain the 404(a)5 disclosure and to advise the client about the importance of obtaining it. This can be framed to the client as an important opportunity to be able to assess the plan’s performance, to best ensure the advisor can help the client to obtain their objectives.

Even if the client has the 404(a)5 disclosure, it is still possible that it won’t have the data required. For example, it may just refer you to another document. Sometimes it still may be necessary to use the 5500 data when the fees can’t be calculated from a vague 404(a)5. If an advisor chooses to use the admin fees from the form 5500 it is important that they have a paper trail to demonstrate that they have actually made the required effort to obtain the 404(a)5 disclosure.

DOL Fiduciary Rule is in effect after June 9, 2017. After that date any advisor working with new IRA assets is effectively an ERISA fiduciary. Onboarding IRA assets requires advisors to create best interest documentation that must take into account plan fees. However, in the absence of transparent fee reporting by retirement plans, advisors must really understand how to obtain appropriate data, as well as limitations of different sources.

Important Note: On 10/12 at 11 AM we will run a webinar on DOL Fiduciary Rule Best Interest Reporting Requirements.

You can sign up for the complimentary webinar HERE.

This research does not constitute legal advice and is for informational purposes only.