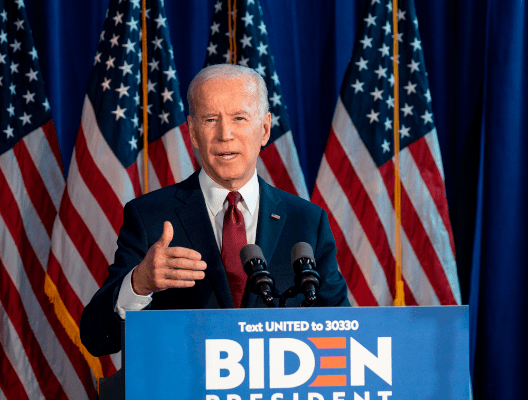

With Biden taking office in January, many advisors are wondering what the future of Regulation Best Interest looks like.

There’s certainly been plenty of speculation on the subject, so let’s take a look at what could change during the transition.

Democrats have generally been unsatisfied with Reg BI, believing that it’s not strong enough to keep broker conflicts in check. They may have a point, because unlike the flurry of legal activity from major industry players that preceded the DOL rule, the advent of Reg BI was met with, well, crickets.

On October 26th, the SEC held a Roundtable on Regulation Best Interest and Form CRS, including regulatory officials from several departments. Several panelists stated that the recordkeeping of many wealth managers is inadequate.

In light of this, the new administration may be poised to intervene. The Democratic platform does mention they will “take immediate action to reverse the Trump Administration’s regulations allowing financial advisors to prioritize their self-interest over their clients’ financial wellbeing.“

Even if they don’t mention Reg BI by name, you can be sure that’s what they’re referring to. It is worth noting that a party’s platform is often more aspirational than realistic.

Other goals outlined in the platform are “Ending Poverty” and “Healing the Soul of America.” With liberty and chicken soup for all. So even though people have taken the language in the party platform to speculate that Reg BI will be completely scrapped, it’s not so simple.

James Lundy, a Faegre Drinker partner and former senior attorney in the SEC’s

Division of Enforcement and the Office of Compliance Inspections and Examinations, states in an article that Reg BI took a considerable amount of resources to enact, and even if democrats oppose the rule they won’t waste those efforts.

I think what we will see… is a more aggressive examination and enforcement approach using Reg BI as a tool in the staff’s arsenal to enforce that new rule aggressively.

Many are also looking to see if aspects of the DOL rule will seep into new enforcement regulations. The President Elect was, after all, the vice president under the Obama administration, and is likely to imbue some of the spirit of the DOL rule into new regulation requirements.

The DOL rule also survived a battery of lawsuits before eventually being thrown out, showing that parts of the rule do have sticking power. We will have to wait and see if these crop up again under the new administration.

Another factor at play is SEC Chairman Jay Clayton’s announcement that he plans to retire and return to private practice in 2021.

This allows Pres-Elect Biden to name a successor whose regulatory discretion aligns with his party’s. Clayton’s leadership at the Commission has also echoed the democratic party’s pro-investor approach, and this legacy will likely continue under the new Chairman or woman.