Risk Modeling in the Past and Future with Portfolio Crash Testing

The previous blog posts (From Client to CEO: Does Portfolio Crash Testing Really Work? & The Proof Is In The Pudding: How Portfolio Crash Testing Worked for Me.) in this series delved into the DNA of PCT and my personal experience utilizing the Riskostat application that the PCT technology is based. In this post I will shed some light on how past events were modeled, and how we create scenarios around events that have not yet (or have never) taken place.

How PCT Works

Our model has a lot of factors. The US Equity Markets, Australian 10Y Bond, British Pound and most other factors that you can think of are in our model. It is not an equity model that has been modified to accommodate fixed income and other asset classes, it was constructed from the ground-up as a true multi-asset class model.

Any factor in our model can be ‘stressed’. When I use the word ‘stress’, I simply mean that the factor can be changed by some amount in any direction – we aren’t limited to extreme scenarios. If I ‘stress’ a factor, US Equities for example, reactions are inferred for every other factor in the model. If create a scenario where US Equity markets fall, this will imply that I am expecting the yield on the US 10-year bond to fall (bond prices will rise). But if I think that equity markets will fall and US 10-year rates will rise, I can create a scenario that looks at the effect of falling US Equity markets and rising US 10-year bond yeilds by overwriting the implied impact on the US 10-year bond (or I can start with desired yields and overwrite US Equity markets). This will, of course, have implications to the rest of the implied factor movements and the model will adjust accordingly. In this way we can look to what we think will happen in the future without being limited to what has happened in the past.

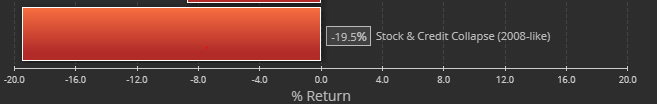

In PCT, we have modeled over 100 scenarios for our clients to utilize. Every scenario is different in one way or another. Some scenarios model what has happened in the past (the Stock & Credit Collapse is similar to the 2008 Financial crisis), while others model what may happen in the future (the 2018 Fed Severe Scenario is based on documents published by the US Federal reserve – discussed later in the post).

Both past and forward-looking scenarios are useful in different ways.

Modeling the Past

Modeling involves uncertainty. Even past events contain some uncertainty – how do we know how a company that went public in 2015 would have performed in back in 2008-9? We don’t, we have to make some assumptions, and assumptions create uncertainty. The only thing we know with 100% certainty is that the 2008-9 financial crisis will never be repeated in exactly the same way. So why use it?

Since almost all clients have an understanding of the severity of the 2008-9 financial crisis event, it helps to provide a context for the expected losses the portfolio would endure. To a lesser extent, events like the dotcom bust and the LTCM meltdown can provide context of less severe events, but fewer clients will have such strong memories of those events. And because we can get very close to modeling the impact a past crisis would have had on a portfolio held today, the analysis is useful, even if it isn’t perfect. The impact of the financial crisis would have been on a standard simple 60% Equity/40% Bond portfolio is shown in Exhibit 1.

Exhibit 1: Impact of a Credit Event Similar to 2008-9 on a 60/40 Portfolio

Even when we model the past, we don’t simply look at what an asset did during the crisis and use it, we look at the makeup of the asset today and get a feel for what it would do if the crisis repeated itself. It is a very subtle but important difference.

While past events can be very useful in conversations with clients, they are not the most powerful way to illustrate potential impacts on the portfolio. For that we look to the future.

Modeling the Future

If we can’t get 100% accuracy in modeling the past, we surely can’t be perfect modeling the future. But that isn’t the goal – the goal is to get an understanding of the ways that portfolio will act given certain events and adjust the holdings if required. And even if we can’t get the factor stresses of the event exactly right, we gain a valuable understanding of how the portfolio will perform in a similar event.

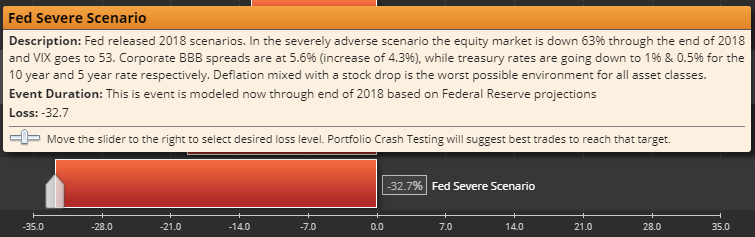

My favorite scenario in PCT for demonstration purposes is the 2018 Fed Severely Adverse Scenario. Every year the Dodd-Frank Wall Street Reform and Consumer Protection Act requires the Board of Governors of Federal Reserve to conduct supervisory stress tests of various financial institutions. They publish three supervisory scenarios (Baseline, Adverse and Severely Adverse, all of which are available in PCT), which detail how they expect the markets to react against various macroeconomic backdrops.

As the Fed describes, the Severely Adverse Scenario:

“The severely adverse scenario is characterized by a severe global recession that is accompanied by a global aversion to long-term fixed-income assets. As a result, long-term rates do not fall and yield curves steepen in the United States and the four countries/country blocks in the scenario. In turn, these developments lead to a broad-based and deep correction in asset prices–including in the corporate bond and real estate markets. It is important to note that this is a hypothetical scenario designed to assess the strength of banking organizations and their resilience to unfavorable economic conditions. This scenario does not represent a forecast of the Federal Reserve.”

The Fed goes on to detail each expected market factor reaction in this scenario, from US Equity markets and the VIX to Treasury yields and the dollar to international markets.

This is where we see the true power of PCT. These factors can be modeled exactly as the Fed describes, and the impact on the portfolio can be seen. Exhibit 2 shows the Fed Severe scenario on our 60% equity/ 40% Bond portfolio.

Exhibit 2: The Impact of the Fed Severe Scenario on a 60/40 portfolio

The factor stresses seen in the Fed Severe scenario are not unlike those that would be naturally implied by the model if we simply put in 63% decline in US Equity markets. But we are still required to overwrite the implied stresses with the values supplied by the Fed to accurately model the scenario.

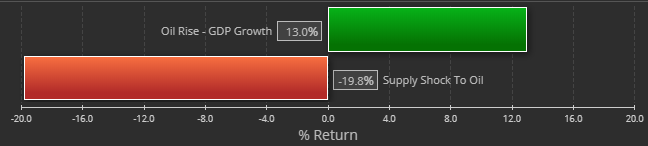

The ability to overwrite implied factor stresses is extremely important, particularly when modeling secondary factor scenarios. A great example of secondary factor modeling can be seen using oil prices. One can’t simply model a rise in oil prices and accept the model results. For example, if I want to model an increase in oil prices, am I assuming the increase is due to supply constraints or demand dynamics? It is important to consider what the expected impacts on other factors may be in a given scenario. Exhibit 3 shows how the assumptions can alter the results of each scenario.

Exhibit 3 – Scenarios in which oil prices increase when examining a 60% stock/40% bond portfolio.

These scenarios clearly illustrate that not all oil price hikes are created equally. If an oil price rise occurs as a result of a robust economy, we would expect our 60% stock/ 40% bond portfolio to increase in value due to strong equity returns (primarily). But we would expect damage to the economy and markets if oil prices rose due to a supply shock, a war in the middle east that disrupts extraction or delivery, for example. Thought must be given to why a scenario is occurring and how other factors will be affected.

PCT has scenarios that never happened but had some degree of likelihood (we modeled a LePen victory in France) or have happened in a way that is was unexpected (our Trump Trade Wars scenario has arguably begun, but the markets have not reacted as modeled, possibly overwhelmed by another scenario that has begun, Trump Tax Cuts that is playing out closer to as expected) and events that may one day happen (a China Corporate Credit event). This flexibility to create ‘what if’ scenarios is part of what makes the tool so useful.

We can model scenarios that are important to both you and your clients. We can work with you to incorporate your macroeconomic scenarios into PCT so you can incorporate them into your client conversations. The thought you put into your scenarios can be used to gain a more complete understanding of your client’s portfolios and encourage more robust conversations with your clients. And hopefully this will help you obtain better portfolio outcomes for your clients.

We think about this stuff a lot and we would like to help make a robust risk conversation a part of your business. Contact us if you would like to learn more.