Telling Your Clients that Investing Early For Retirement Is Vital

The financial education on the importance of starting to save early for retirement cannot be overrated. Saving early for retirement is a must do for everyone and should be emphasized whenever possible.

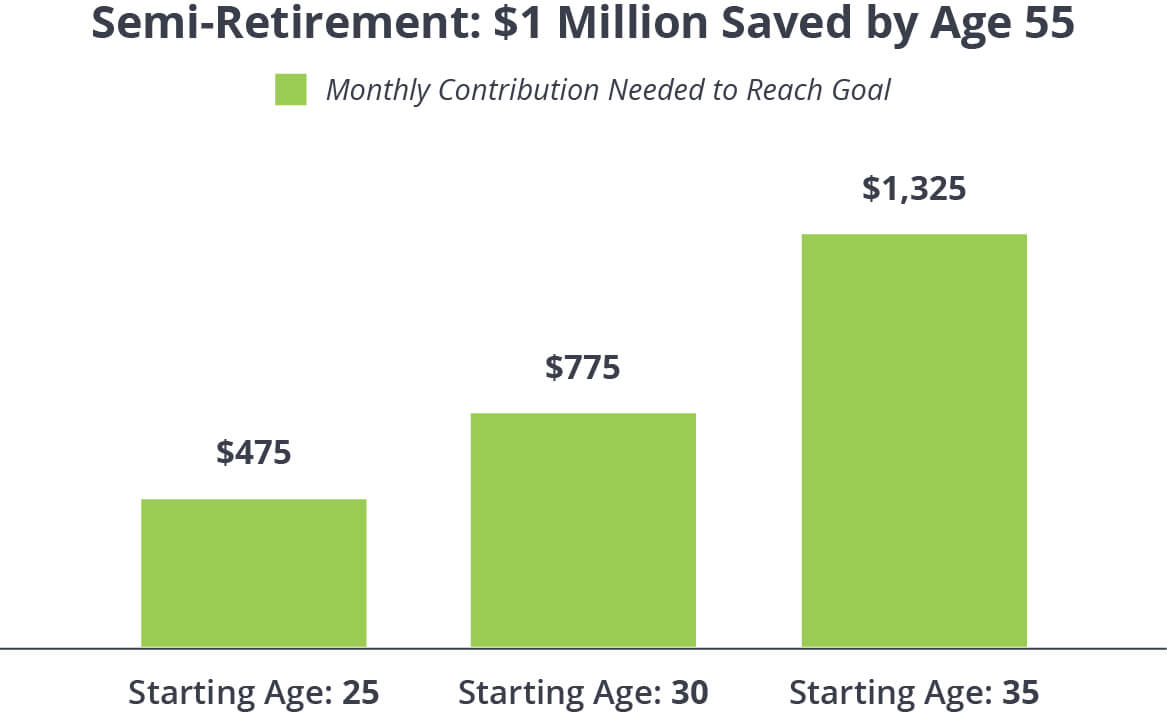

According to BlackRock’s 6thAnnual Global Investor Pulse Survey more than half of 27,000 respondents from 13 countries worry more about their current financial situation than about their retirement in the future. However, all of us hope for a better future, especially when the time will come to retire. If you look at the chart below, you can see that with every year of not saving for retirement now, the financial sacrifice in the future will be more substantial. It becomes clear that thinking about one’s financial situation should also include thinking about the financial future. The big part of it should be careful and disciplined planning for retirement. Here is what you can tell your clients about the importance and step by step process of preparing for early retirement.

The first step in this process is to set your mind on getting started and setting up your first retirement account. It can be either 401 (k) at work or IRA account. The second step is to decide how much money can be contributed to the retirement account on the monthly basis. The amount can be changed as the financial situation changes.

The third step is to put your money to work by investing it. This stage can be the most difficult for a lot of people. You should not be discouraged. There are fee-based advisors who can work with you or as a cheaper alternative you can chose Robo advisors who can also help to lay out the first brick in the foundation of a retirement plan. People who can contribute to a 401 (k) plan at work should take advantage of it. You need to find out about available options regarding 401 (k) plan such as a QDIA or employer matching program. With research and fiscal discipline, most of the people can get on the right path for a better retirement.

Pingback : Up Next: NJ Secure Choice Savings Program