3 Steps to Growing Your Financial Advisory Practice With Portfolio Crash Testing

What is Risk Management?

Risk management is top of mind for RIAs and their clients these days. No longer an exclusive province of quant managers, it is discussed regularly in the popular press. From the shortcomings of value-at-risk to the latest stress tests imposed by the Fed on banks, risk management has gone mainstream.

But what is risk management? Many market observers and a surprising number of financial professionals seem to think that risk a manager must somehow know the future, peer into the crystal ball with some magic mathematics, or possess inborn clairvoyance.

This is a fundamental misconception that drives people to devise ever new ways of predicting the nature and especially the timing of future crises. However, only a very small percentage of people have any ability to time the crashes, and inevitably risk management gets a bad reputation.

The best metaphor for understanding risk management is that of car crash testing. The tradeoffs between performance and safety are analogous to the world of investment management, and the consequences of getting the balance of these two wrong can be dire both in driving and investing.

Risk management is not about knowing the timing of the events or even what the event will be like in detail. Institute of Highway Safety does not forecast the detail of each possible accident. For example, if we are studying a frontal impact, we are not concerned with the specifics of accidents that this car might get into. We are simply concerned with the category of the frontal, rear, side, rollover impact and vehicle’s vulnerability to it. How can this be related to portfolios?

Importance of Stress Testing

Stress testing is widely used by institutional investors. However, with recent advances in computing power this tool has become accessible to advisors as well. Stress testing allows the user to specify different scenarios and to measure how they will impact the portfolio return. It is a perfect tool for financial advisors to educate their clients about risk and improve portfolio construction decision making.

The main reason stress testing is useful to advisors is that it is not a rear view mirror tool – it is a forward looking tool. For example, stress testing can show what is likely to happen to the portfolio when rates rise, something we haven’t seen in decades. Adoption of stress testing is also crucial because investors do not want to hear statistical jargon (e.g. standard deviations or Value-at-Risk quartiles). They want to hear clear explanations of the strengths and weaknesses of each portfolio.

For example, a portfolio can be hurt by interest rate changes, by interest rate changes and stock movements, by commodities prices; or by changes in diverse geographic markets, such as the US, Europe, Japan or emerging markets. RIAs need to design for all of these impacts to see how the portfolio responds. Combinations of any of these stresses and magnitudes manifest themselves in scenarios that can be named in a math jargon-free manner, using every day descriptions such as Global Stock Crash, Inflation, Global Recovery, Euro Meltdown, etc. Most clients will understand what these scenarios mean and an effective measurement and discussion of risk tolerance can take place.

What exactly must advisors do to understand the risk of client portfolios? How can they use this information to add more value to clients and prospects? How can they communicate the results to the client to demonstrate that the value that has been added?

We will consider three steps that advisors must take to incorporate risk management, specifically stress testing, into their daily process. These steps will introduce structure and predictability into the process, and add significant value for clients in a way that they can observe and appreciate.

Incorporating Stress Testing Into the Client Interaction Process

FINRA states in Rule 2111 that “…a customer’s investment profile would include the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs and risk tolerance.”

We could generalize these points into two categories:

- investment goals (objectives, time horizon, financial situation and needs, liquidity needs)

- investment constraints (risk tolerance).

How do we create a framework for finding a perfect balance between goals and constraints?

Any metaphor has some flaws, but the car crash testing metaphor will help us shed some light on this process. When we are looking for a car, we will also consider two categories of questions: performance and safety. These are more or less analogous to the investment goals and risk tolerance categories above.

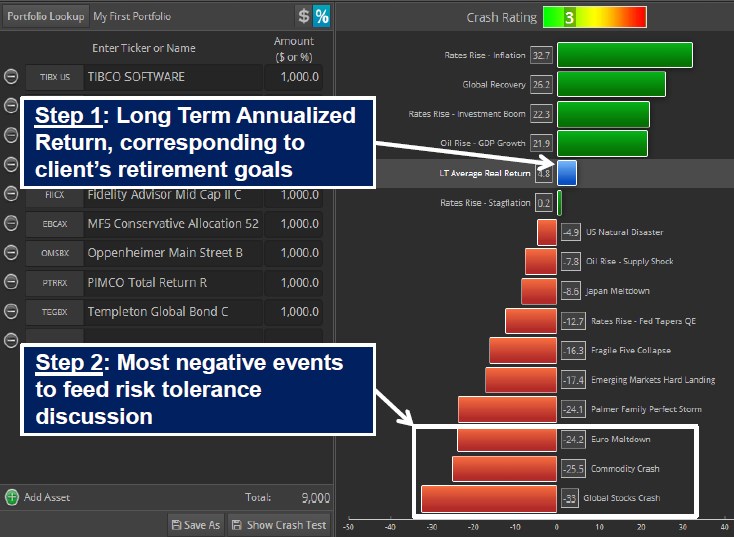

Let’s consider Exhibit 1, a portfolio crash test report:

Exhibit 1 – Portfolio Crash Test For a Sample Portfolio

Step One:

The first step of our process will be supported by the blue bar in the graphic that shows the Long Term Average Return (annualized). This is the starting point of the discussion; does this annual LT Average Real return match the long term annual return the portfolio needs to produce in order to meet the long term income and retirement goals of a client?

Step one has to do with long term goals that the portfolio is tasked with achieving. The investment goals category is similar to the performance we seek in a car (speed ~ return, handling ~ liquidity needs, durability ~ time horizon etc.).

Step Two:

The second step is to analyze the red bars at the bottom. These are the most negative events for a portfolio (crash tests). Crash tests will help the advisor and the client discuss and agree on a risk tolerance profile that is suitable. These crash tests have macroeconomic names that can be discussed with a client using the news and the well understood economic concepts (e.g. Inflation). This is the step that will allow us to better understand the client’s risk tolerance, which is defined by the SEC and accepted by FINRA to mean a customer’s “ability and willingness to lose some or all of [the] original investment in exchange for greater potential returns”.

When looking at Exhibit 1, disregard for now the Palmer Family Perfect Storm scenario, we will discuss it in the Advanced Steps section with the bespoke scenarios for High Net Worth Individuals (HNWI).

Step Three:

The third step in our process is to adjust the risk profile in accordance with the client’s risk tolerance, while still meeting long term return goals. These two may be contradictory, in which case goals will likely need to be reassessed.

The client may not be happy with a crash test profile of the portfolio; the losses may be too big. The advisor can then offer a modified portfolio that has lower losses in bad scenarios (more on efficient risk profile adjustment in the section Risk Aware Rebalancing below). But the client must understand that by changing their crash profile they are also affecting both the long term average return (the blue bar) and the possibility for the upside in bull markets (the green bars).

This simple three step process connects both investment goals and risk tolerance into one interconnected workflow. More importantly, this process is transparent to the client, who will see clearly the tradeoffs that are made. This transparency will ensure not only that portfolio is appropriate for the client, but also that clients are educated on the risk/return tradeoff.

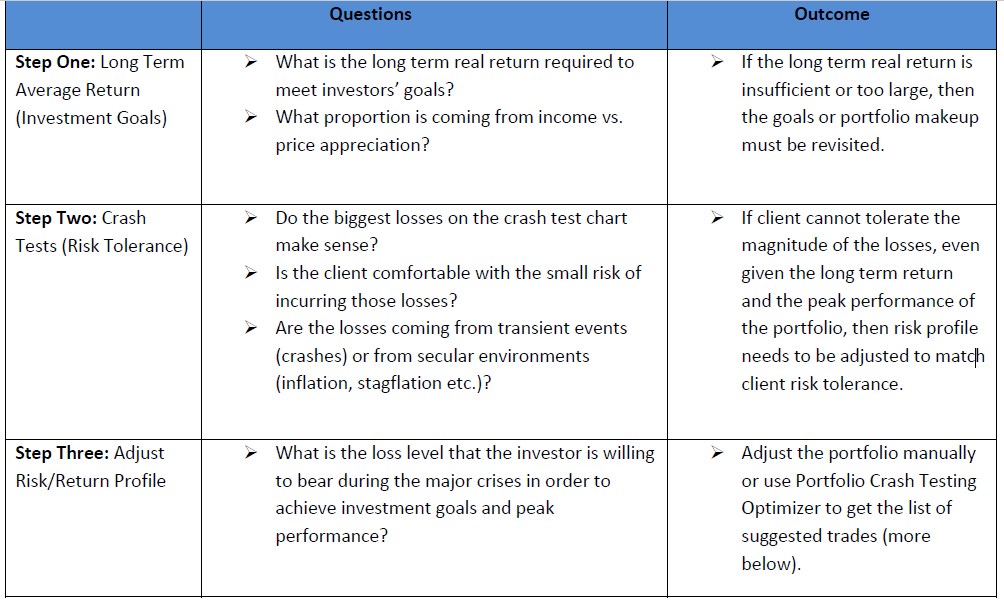

Let’s look at the three steps in more detail. Exhibit 2 shows the three steps that advisors need to take to include risk management, and specifically crash testing, into their client interaction.

Exhibit 2 – Three Steps to Effective Risk/Return Profile

Everything that the advisor needs to implement a robust risk management process is right there in Exhibit 1 (crash test report) and Exhibit 2 (the three steps). These steps are a more precise, simple, and efficient way of doing the things that advisors seek to do on a daily basis.

Advanced Steps: Customized Scenarios and Portfolio Crash Testing Optimizer

With our next higher level service “Portfolio Crash Testing Pro”, you can create customize scenarios used in Step Threein Exhibit 2. You can also adjust the risk profile to match goals and risk tolerance. Note that portfolio adjustments can be done manually with a basic service as well. We will focus on the way to perform it using the Optimizer feature, because that is the more scalable and precise solution for large practices.

We will combine the description of the Optimizer with another advanced risk management tool, customized scenarios for high net worth individuals. Let’s go through the steps with a sample HNW family, we’ll call them the Palmer Family.

Custom Scenario Design

This family, we’ll assume, owns a chain of restaurants along with significant wealth in real estate. The customized scenario can be seen in the Crash Test Report in Exhibit 1 (which we reproduce here) and is called Palmer Family Perfect Storm.

The idea behind this ‘perfect storm’ scenario is that the Palmer Family cannot afford to incur large losses in the investment portfolio at the same time as their sources of wealth and income are under pressure. Thus, we designed a bespoke scenario that includes a decline in the restaurant business (a 30% drop in the S&P Food and Beverage Index) and a significant decline in the real estate prices (300 bp rise in US Home Equity securities spread).

Step One: Investment Goals

From the impact summary above we can see that the long term average real return for current portfolio is a hefty 4.8% (close to the US Equity long term real return of 5.13%). This return has to be compared to the return required by the client’s investment goals.

Step Two: Risk Tolerance and Bespoke Scenario

This significant long term appreciation potential must be weighed against the potential for large losses along the way.

For example, this portfolio is expected to lose 33% in a Global Stocks Crash (the very bottom scenario). It is important to note that the portfolio is expected to gain close to 26%+ in a Global Recovery, a more likely scenario than the Global Stocks Crash.

The projected loss in the Palmer Family Perfect Storm is 24.1%. The Crash Rating of the portfolio is 3, which means that is just below the risk of S&P 500 (which has a crash rating of 4).

This client may very well be able and willing to tolerate much risk to get the required return, but they have to understand the implications for the rest of their wealth base.

Step Three: Risk Aware Rebalancing

For many clients Steps One & Two are going to be sufficient. They have quantified their goals, their fears and found that the sky is not likely to fall on them. Whatever risk they take is acceptable and known to them. They will be pleased for education.

However, for some clients or prospects you will find that there are scenarios which are unacceptable. Scenario must be thoroughly discussed and the target return should be set. In that case, let’s hypothesize that the Palmer Family can’t accept potentially losing more than 14% in a ‘perfect storm’ and is generally more risk averse than their portfolio. We will use RiXtrema’s Risk Aware Rebalancing feature to select the desired scenario, add our constraints (target loss of no more than 14%, turnover, max position size, max/min weights) and run the optimization.

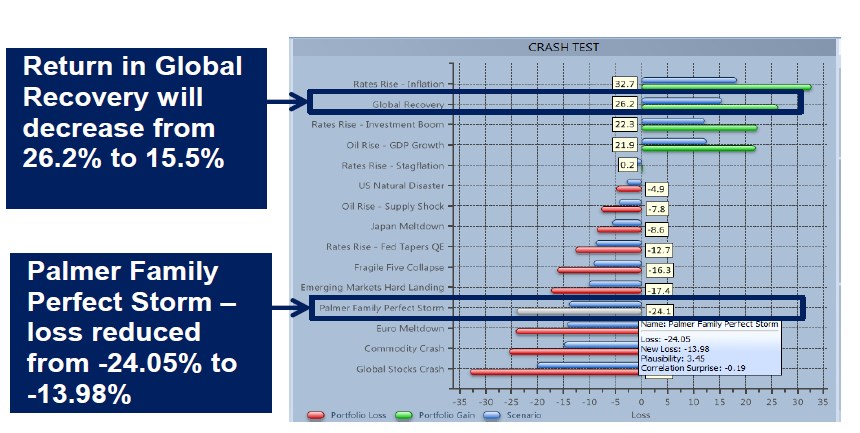

Exhibit 3 shows the new portfolio in blue bars on the same chart as compared to the original portfolio. Note that the new loss in Palmer Family Perfect Storm is only 13.98%, in line with client’s risk tolerance.

The client should understand that this risk reduction will affect all scenarios and the return in a Global Recovery scenario is also going to decrease from 26.2% to 15.5%. Long Term Average Return will also decrease and that may affect the goals.

Exhibit 3 – Pre/Post Optimization Results for Palmer Family

If client likes the results, the trade list (list of trades to get to desired risk profile) can be used to rebalance the portfolio.

If not, then the loop can start over to come up with an acceptable compromise that the client can live with.

Summary

We have described a three step process for inclusion of Portfolio Crash Testing into an advisor’s risk workflow. The process will aid advisors in two key ways:

– Value Added: It will demonstrate to the client the specific value added by the advisor. As the competition between advisors heats up, those who are able to not only add, but demonstrate value, will be on the top in terms of client growth.

– Client Acquisition and Retention: It will increase client retention specifically in times of financial stress. The client will know the possible losses before they occur (as well as potential gains that make that risk worthwhile) and will be more likely to stick with the advisor. It will lead to less dissatisfaction and legal risk related to alleged ‘unsuitable’ investments, because potential risks, as well as potential gains, will have been explained to and discussed with the client.

Be sure to request your personalized demo below for a complete tour of Portfolio Crash Testing and your free risk consultation with RiXtrema risk experts.

Pingback : Why Participant Education is Vital for Plan Sponsors

Pingback : As a Fiduciary, How Well Do You Know Your Risk?

Pingback : Case Study:Options Can Help To Diversify Risk