As anyone following Brexit knows, it is a mess. With the March 29, 2019 deadline for the United Kingdom to leave the European Union fast approaching, there is a real chance that no deal will be struck. British Prime Minister Teresa May is looking for a way to secure the votes needed in the House of Commons to approve the deal that she negotiated with the EU. This looks unlikely, which is why May pulled the vote back on December 11. Just days later, PM May faced a ‘no confidence’ vote (which she survived) that would have effectively ended her leadership. Frankly, the situation is changing so quickly that this whole blog might be out of date by the time I publish it.

As a provider of risk analysis software, one of the things that we do is create scenarios for certain stress events. With any risk scenario, the importance often lies in understanding the drivers that will impact portfolios. Since no one will ever correctly forecast all the factors impacting a scenario, the exercise of thinking about what might happen and how that will impact client portfolios is very important to positioning given these geopolitical events. Getting the stresses exactly right would be great too, but it is rare for anyone to forecast anything with high accuracy.

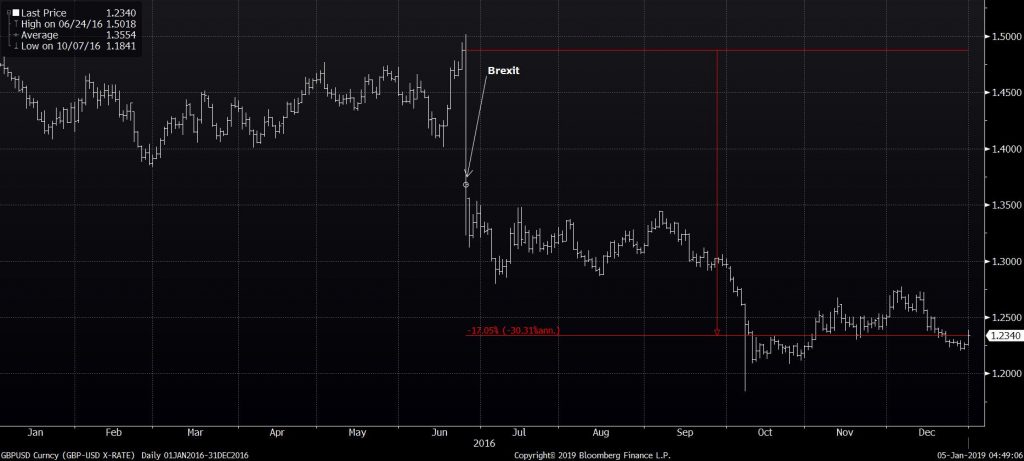

Before the June 23, 2016 Brexit vote we created a Brexit scenario that hypothesized that if the UK voted to leave the EU, the British Pound would decline 17% and property values would decrease 37%. We felt that the event would be short term in nature (less than 1 year) as the impact would be felt shortly after the vote and before the implications were really known. Implied in these stresses is that UK and EU area interest rates would fall along with global equity markets.

We were partially correct, as shown in Exhibit 1, below. The Pound fell rapidly on the day after the vote and through the end of the year, and interest rates fell in the UK and Euro area. Property prices rapidly declined 30% (using the iShares UK Property Index) in the days after the vote (though property prices did rebound strongly off of the lows through year end 2016 and have remained resilient). And the equity markets didn’t decline as implied by the stresses, though indexes throughout Europe did decline (in USD terms) after the vote. So though the scenario assumed a greater than realized decline in the property index, the scenario was still very useful in that it implied that one should avoid the UK and Euro area, even if the magnitude of declines was not spot on. That has remained true through 2017 and 2018.

Exhibit 1: British Pound decline Relative to the US Dollar:

Source: Bloomberg, LP.

So last week when one of our clients asked if we still thought that our Brexit risk scenario in our Portfolio Crash Test (PCT) application was valid I decided to take another look. And remarkably, I think that there might be more risk to Brexit now than there was prior to the vote. The two most likely paths forward in my opinion, are Hard Brexit, where there is no deal struck and the UK leaves the EU with no agreement on how exactly that will play out, or another Brexit referendum is put to the people for a vote.

If the UK Government fails to approve the deal negotiated by PM May before March 29, 2019, that could trigger “Hard Brexit”. This would potentially cause severe short term (and even long term) market disruption for the UK and Euro region. We believe Hard Brexit has the potential to be very damaging to the UK, likely pushing the economy into recession and having significant negative impacts to the UK stock market (-40%) and currency (-20%).

Of course, the UK won’t suffer in a vacuum, and if a country like the UK is pushed into a recession, others will suffer too. The Euro area could see a -15% decline in the Euro, but a more muted -25% decline in equity markets. Much like we have seen the past few years, the US would fare relatively well, but not come out unscathed. While the US Dollar would appreciate, the equity markets would take a bit of a hit at around -10% and long-term bond yields would fall as investors seek safe havens.

Recently there has been more talk of holding a second Brexit referendum for the UK to stay in the EU and thereby reverse the 2016 popular vote. This would have to be done quickly, though another referendum could allow the March 29 date to be relaxed. Even though a new vote on the Brexit referendum is not on the table, it has been starting to gain momentum. I believe that there will be another Brexit vote in 2019. With seemingly no path forward, a new vote in favor of Brexit would reaffirm the position of those negotiating the exit and potentially give them the political capital to force the existing deal through. Or, a vote to stay in the EU would cancel the whole need for negotiation.

A vote to overturn the 2016 Brexit decision would be very good for both the UK and EU currencies and global equity markets and would provide some much-needed clarity. Even the announcement of such a new vote would likely be seen as bullish for Great Britain and the Euro area.

Pingback : Hard Brexit vs Cool Brexit: How Will Each Impact Your Clients' Portfolios?

Pingback : Brexit Update – Boris Johnson Edition