Having to manage several retirement plans at once is a challenging task at the best of times. Add to that 2020, a year that saw a pandemic threaten retirement plans nationwide, and the task becomes that much more difficult.

With this in mind, The 2020 Plan Sponsor Study allows plan advisors to look at the statistical evidence that deals with individual plan sponsors’ concerns. With this knowledge, advisors are better equipped to handle their clients’ needs.

Here are the four key steps financial advisors need to take, for success.

Uncover Prospecting Opportunities

Matching the sponsors’ key focus areas will uncover new opportunities and prospects. The goals of various businesses, even across the same industry, may vary significantly.

Larger plans may require a financial advisor to better understand how the plan works and how to improve it. On the other hand, smaller plans might need an advisor to help manage a plan that gets increasingly more complicated. In fact, in 2020 ‘an increasingly complicated plan’ accounted for 29% of plan sponsors seeking an advisor’s help according to Fidelity.

While it is true that a referral from a trusted contact is the main reason for an initial meeting with an advisor, it is the need for help or desire to improve the plan that are most important when considering an advisor’s services.

In order to decide on an advisor, plan sponsors typically weigh up two factors: 34% for retirement plan expertise and 31% for investment knowledge (Fidelity, 2020). This combination allows plan advisors to meet retirement deadlines and fulfill their fiduciary responsibilities.

Show Your Worth

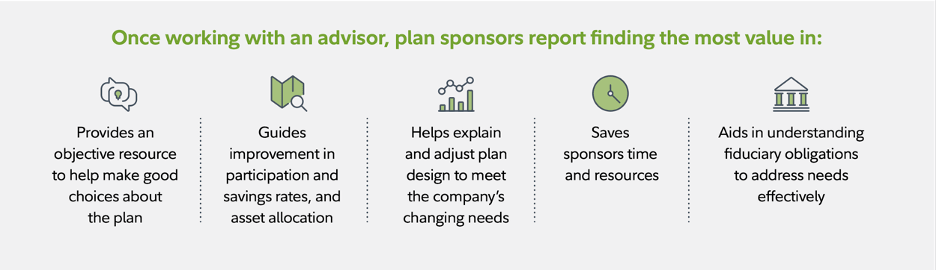

When a financial advisor establishes a relationship with a plan sponsor, the main objective should be to show their worth. They can do this by identifying what the sponsor values the most; performance, time, compliance, or guidance.

The sponsor needs to be able to see an advisor’s worth not only in terms of knowledge but also in terms of plan performance. In order to evaluate a financial advisor’s performance, 61% of plan sponsors review the plans’ performance annually, and 25% more than once a year (Fidelity, 2020).

An Employee’s financial well-being is the most crucial factor for plan sponsors evaluating a plan advisor’s effectiveness. With the onset of Covid, sponsors are compelled even further to safeguard financial wellbeing in terms of retirement preparedness. 41% of sponsors in 2020 believed that the plan participants were unsure or not on track with their retirement savings (Fidelity, 2020).

The problem of insufficient retirement savings escalated due to a combination of forced or voluntary early retirement and lay-offs as a result of the pandemic. The current economic crisis only emphasized the importance of financial stability for financial advisors.

In challenging times like these, plan sponsors seek reassurance and guidance from advisors to help identify ways to improve retirement plans and bolster their employees’ financial health.

Consider Plan Design Changes

A well designed plan with realistic retirement goals is crucial to successfully close the savings gap. In the past two years, 82% of plan sponsors reported modifying the plan design and making constructive changes (Fidelity, 2020). However, 41% of plans in 2020 still don’t have a retirement income goal for participants (Fidelity, 2020). An investor needs to integrate more target-date funds based on their performance and costs, to create a secure plan that aligns with a participant’s goals.

The company match was also one of the biggest concerns for plan sponsors. According to 401khelpcenter, two-thirds of 401k participants in 2020 admitted they would increase contributions if the employer increased the match formula. Thus, changing the matching formula, adding a matching contribution, and increasing the matching contribution amount becomes one of the advisor’s most important tasks. This is vital because plan sponsors with advisors make better, more constructive changes than those without.

Focus on Investment Menu

The desperate need for better plan participant outcomes and performance, often drive plan sponsors to make rushed decisions. 74% of plan sponsors reported making changes to their investment menu in the past two years (Fidelity, 2020).

Good Investment performance is the main goal for financial advisors, especially during periods of market volatility. Plan advisors need to be more active in reviewing the plan’s investment menus and addressing the plan sponsors’ concerns. The main changes in 2020 were targeted to increase the number of investment options (28%), remove underperforming funds (23%), and add target funds (23%). Thus, it becomes instrumental for a financial advisor to show their value through a plan’s investment performance.

Knowing these principles allows the advisor to leave a lasting impression on the plan sponsor and further maintain a professional relationship.