According to recent data from Johns Hopkins University, at least 21 states have seen a 10% increase in the daily average for positive Covid-19 cases. This indicates that the pandemic is far from over. While the pandemic has wreaked havoc on our mental and physical health, it is also quietly reshaping how Americans will approach retirement and old age in future.

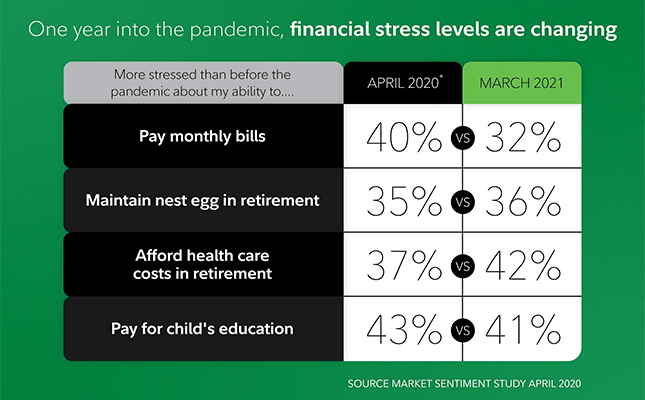

According to a recent press release from Fidelity Investments, a year after the Covid-19 pandemic first devastated the world’s communities and economies, more than 80% of Americans believe the events of the previous year have impacted their retirement plans. The effect of the pandemic has been inconsistent, with some employees benefiting from the newfound flexibility of working from home, allowing them to prolong their careers without the daunting commute, whereas others have lost their employment or chosen to retire early due to health concerns. Still, according to the results, 79 percent of respondents said they re-evaluated their goals in the past year, and while the level of concern has decreased in some areas since the start of the pandemic, people are still more depressed than before on many fronts as compared to the pre-pandemic environment.

Source: Fidelity Investments press release

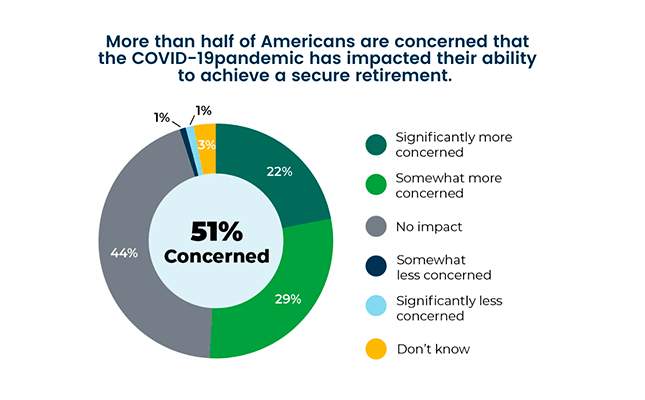

A new “Retirement Insecurity 2021” report from the National Institute on Retirement Security reinstates the economic fallout from the pandemic may generate considerable uncertainty about funding retirement, prompting Americans to work longer or reconsider retirement altogether. Furthermore it reveals the findings of a Greenwald Research online survey of over 1,200 working adults conducted in early December 2020. According to the study, two-thirds of Americans (67%) believe the country is facing a retirement crisis, and more than half (56%) are worried that they will not be able to retire comfortably. 67 percent of Americans who have renewed or considered renewing their retirement plans claim they are planning to retire later than they had expected due to Covid infections.

Source: Retirement Insecurity 2021 report

Many newly retired baby boomers are seeking advice from financial advisers on how to maximize their retirement income.

The first mostly asked question is when and how they can file for Social Security. If deferring insurance is the solution to the issue about applying for Social Security, the next question is how to finance their retirement years before receiving Social Security benefits. Those who do not have enough savings usually apply for Social Security benefits right away, forcing them to live on reduced payouts for the rest of their lives. Others may have enough assets to postpone filing for Social Security benefits, but they need guidance on how much they can afford to spend from their savings each year before benefits begin.

The world has been in turmoil since the spread of coronavirus, wielding nearly unparalleled financial uncertainty. Some also drew parallels between this and the 2008 financial crisis. Depending on the length of the post covid crisis, one may imagine it closely mirrors the financial developments that followed the attacks on September 11, 2001 — a sharp downturn in the economy that stabilized reasonably quickly. In any case scenario it is time to learn from current events and start taking retirement planning seriously. We at RiXtrema developed a line-up of products that helps RIAs and plan advisors to benchmark and fix retirement plan fiduciary standing and reduce their fiduciary liability. We would love to show you how we can help your business grow in the post covid era in a quick 15 minutes call. Click on this link now to book your free demo! And don’t forget to follow us on LinkedIn for more tips on the RiXtrema line-up, best practices and more!