- How Advisors Can Help Next-Gen Clients

- Next-Gen will inherit Baby Boomers’ wealth

- Build relationships with low-AUM clients and your trust may pay off

- Financial advisors can help during transitional stages

How Advisors Can Help Next-Gen Clients

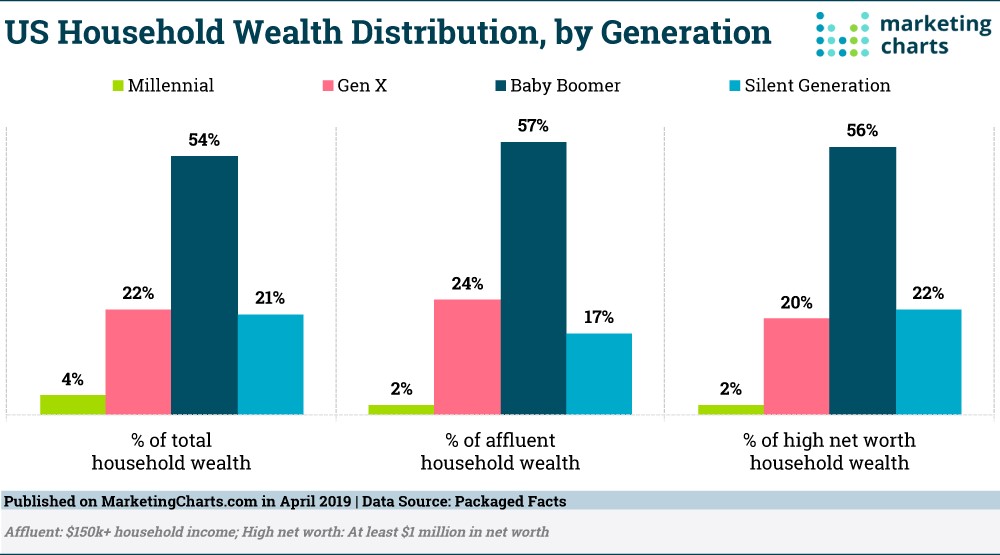

Currently, the majority of financial planners focus their business around serving the most affluent and rich segment of the US population, namely the Baby Boomers. As the bar shows below (Figure 1), the Baby Boomers accumulated a hefty 55% of the entire household wealth in the United States. It is quite logical to direct your efforts where the money is. However, it is strategically unwise to neglect the clients from the next generation – Gen X, Gen Y, and Gen Z.

Next-Gen will inherit Baby Boomers’ wealth

We wrote previously about how simple marketing changes can put you in touch with Millennials. Though Next-Gen clients may not have as much wealth accumulated as of yet, they will in time. So, it is important to dedicate time and resources to cater to their needs before they inherit wealth from their parents. The FIRE (Financial Independence Retire Early) movement has been a rallying cry for young people, according to the study, and it speaks to this mindset change. A survey conducted by Principal Financial Group found that there is a new group of young people willing to save up to 90% of their take-home pay in retirement accounts like 401(k) or IRA – the Super Savers. These savers are most often motivated towards financial security, an early comfortable retirement, a safety fund, and financing travel.

A new group of young people willing to save up to 90% of their take-home pay in retirement accounts like 401(k) or IRA – the Super Savers.

Figure 2

Build relationships with low-AUM clients and your trust may pay off

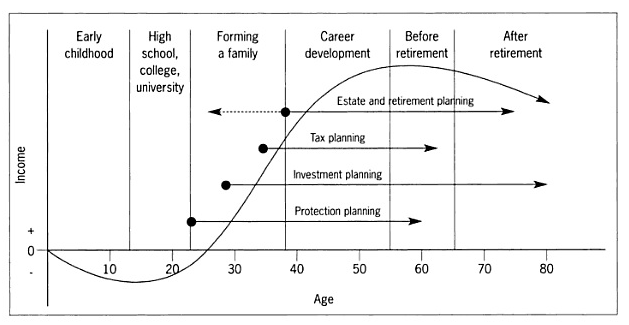

Some financial consulting firms argue that it is not profitable to plan for clients with such low AUM because they can’t generate enough fees for the firm. Firms can work with low-AUM clients by applying different fee-for-service models such as minimum fees based on the percentage of income or flat monthly fee. The financial needs of next-Gen investors and baby boomers are different. The Baby Boomers are at the stage of their life when deaccumulation is important to their financial planning, while Next-Gen clients focus on accumulating wealth and managing cash flow. Financial advisors can help provide advice during these moments.

The Baby Boomers are at the stage of their life when deaccumulation is important to their financial planning, while Next-Gen clients focus on accumulating wealth and managing cash flow.

Financial advisors can help during transitional stages

For most of their lives, the main focus of Next-Gen clients is to save as much as they can for their retirement. It is more important for them to make regular contributions to their retirement savings than finding alpha to grow through compound interest. Though building a nest egg portfolio for young people may look simple, their financial lives are not. Anyone who lived through their 20’s, 30’s and 40’s can attest to the difficult financial decisions one must make – taking a loan to pay for college tuition, getting a first job, moving out from parent’s house, getting married/divorced, starting a family, buying a house, etc. (figure 2). All these events are significant transitional stages in the life of Next-Gen clients and require careful financial planning.

Usually, a transitional event happens every two years in the life of a young client. With every transitional event, the cash flow allocation changes and professional advice can greatly benefit a client. This is a perfect opportunity for any advisor to forge a professional, trustful relationship with their younger clients. An advisor’s involvement in helping manage cash flow allocation properly can add value to the financial relationship and charge a fee for the service. Trust built upon the early years can go a long way in the financial planning relationship. One day the Next-Gen clients will have similar wealth to Baby Boomers. Then, you as their trusted adviser will stand to benefit from it because you were the one who helped them to get there.

Transitional events are the perfect opportunity for advisors to form professional, trustful relationships with Next-Gen clients.

Figure 2

You can read about market news and investment analysis alongside tutorials of our financial planning software platform at our blog. There you can also read about each product’s features, especially Larkspur Executive’s new marketing feature, Customized Trackable Marketing Letters, which can be deployed to streamline your marketing efforts. Feel free to contact our Client Success Team at clientsuccess@rixtrema.com to learn more about our products or articles.

Pingback : Financial Advisors Can Still Be Advisors In The Free-Trade Platform -

Pingback : How Similar Is Reg BI To DOL Fiduciary Rule? Find Out... -