Environmental and socially responsible investing (also known as ESG, where the ‘G’ stands for governance) has been a hot topic in recent years. Since Earth Day was just a couple of days ago, I thought I would honor the day with a blog posting about ESG. Some reading that inspired this post was Jeremy Grantham’s “The Race of Our Lives Revisited” and the release of the US Government’s Fourth National Climate Assessment.

As I drove around my town (Bend, Or) on Earth Day, I saw an interesting sign in a demonstration consisting of 1 person and 1 sign. That sign said “Capitalism = Ecocide” with some strange symbol beneath it. So I had that image in my mind as I started to examine the ESG landscape.

ESG strategies have gained significant assets in recent years (an article from Forbes in July 2018 estimates that investments in ESG strategies has exceeded $20 trillion globally). With much concern about the environment and the legacy we are leaving behind, some investors have expressed a desire to ‘invest their values’ or invest their assets in a manner that rewards corporations that behave in an environmentally and socially responsible way. Index providers have answered this demand by creating an ESG or socially conscious version of their indexes. For example, S&P has created the S&P 500® ESG Index which is a subset of S&P 500 companies that meet their criteria for inclusion. Top index providers like MSCI, FTSE Russell and Nasdaq also have versions of ESG indexes and all have still other versions that span geography, asset class and theme, where investors can choose various ‘flavors’ of ESG indexes to narrow the investment scope. For example, if one wanted to remove coal investments from a portfolio one could use MSCI’s ex coal benchmark where “any constituent identified as having proved & probable coal reserves, that are used for energy purposes is excluded”[1] from the index. In fact, MSCI produces over 1000 equity and fixed income indexes that fall under the ESG umbrella.

As with most investment themes, there are compelling reasons to invest client assets in said theme, and equally convincing counterpoints. The primary point/counterpoint discussion revolves around investment performance. After all, clients are investing to make a return on their assets and most would not choose to ‘invest their values’ if that meant significant underperformance and risking their retirement, though many would indeed accept slightly less return to ‘do good’. Investing in ESG themed investments means shrinking the number of investment options available. Some investors, including GMO’s Grantham, believe that ESG or environmentally conscious investing can beneficial to investors’ portfolios from a performance perspective. Others believe that permanently excluding certain types of investments is detrimental to long term results.

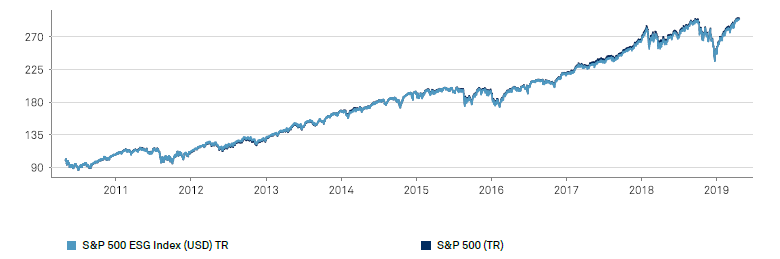

The index providers seem to have attempted to answer the performance issue by creating ESG indexes that track their benchmarks rather closely. This is achieved by making the sector and industry weights representative of the parent index while excluding certain constituents that don’t meet ESG inclusion criteria. The result is an ESG index that closely tracks the parent index. As shown in Exhibit 1, the S&P ESG Index performance is virtually indistinguishable from the performance of the S&P 500.

Exhibit 1 – Performance of the S&P ESG Index Against S&P 500 Index

Source: S&P 500 ESG Index Factsheet

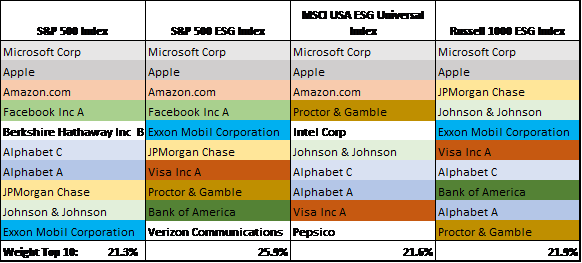

Another common point of contention regarding ESG investing is that there not a consistent methodology employed to determine which companies meet standards, or even what the standards should be. A simple review of the methodologies used by different vendors will validate that uniform standards do not exist. But an examination of top holdings and sector weightings show that the index creators have arrived at a relatively consistent set of holdings.

Exhibit 2 – Top Holdings of ESG Indexes from Various Providers

Source: Index provider factsheets from March 31, 2019 (S&P 500, S&P 500 ESG, MSCI USA ESG Universal, Russell 1000 ESG)

These ‘top level’ indexes are an attempt by providers to lean towards ESG investing rather than a claim to invest in the most environmentally and socially responsible companies available. The Russell 1000 ESG index was the most aggressive, in removing companies that don’t meet certain criteia investing in only 499 of the 978 (51%) companies of the parent, while the S&P 500 ESG Index invested in 329 companies of the 505 (65%) stock S&P 500. The MSCI USA ESG Universal index, on the other hand, invests in 607 of the 623 (97%) of the companies in the MSCI USA with the variation between ESG and non-ESG indexes residing in the weights of securities. The bottom line is that if an advisor is going to use one of these indexes as a benchmark, time must be spent examining the methodology used to determine ESG eligibility and index weighting.

It is not that there haven’t been attempts to create standards for ESG investing, but a single uniform set of rules remains elusive. Recently, as reported in Barron’s, the Sustainability Accounting Standards Board unveiled accounting standards that guide companies on reporting financially material ESG information for 77 industries. Time will tell if adoption is widespread and consistent as the burden is on companies to voluntarily comply and report financials according to these standards.

Of course, more than simply understanding index methodology, an advisor also must determine whether the indexes are investing in a way that meets the ESG requirements of their clients. Said differently, which set of rules align with the values that the advisor or client is trying to capture by adopting an ESG investment mandate. Does ExxonMobil belong in your ESG portfolio? If ExxonMobil doesn’t, does Amazon? Or Walmart? Both Walmart and Amazon’s business models require large scale consumption of the same oil and gas produced by ExxonMobil. And oil and gas will be drilled and produced no matter what. Should your ESG investments include those companies that produce this energy in the most responsible manner? Or should they be roundly excluded? All companies consume this energy in one way or another. If the determination is made to include energy companies, is ExxonMobil the best representation of a company upholding ESG values?

All indexes above hold Apple as the second largest holding, but the iPhone, which represents 62% of Apple’s revenues, is seen as a significant environmental issue in some quarters, There have been more than 7.5bn smartphones produced since 2009 and consumers treat them as nearly disposable, with a two-year average life cycle and very little recycled. Where is the line drawn? Is ESG Investing really a way of focusing assets to companies that are behaving in an environmentally and socially responsible manner? Or is it simply rewarding the act of putting lipstick on a pig?

These are conversations that an advisor and client need to have, and the debate of “To ESG or Not to ESG” certainly won’t be settled here. The good news is that no matter what is decided you will find an index to benchmark against. But it is arguments like these, when taken far enough, lead to the conclusion that the production and consumption of goods that is central to capitalism is not wholly compatible with an ESG investment strategy. This is essentially the message of the sign I saw on Earth Day.

[1] MSCI GLOBAL FOSSIL FUELS EXCLUSION INDEXES METHODOLOGY, December 2017.