When reading the headlines of today’s financial press, which has more and more turned into infotainment, it is easy to forget why we as a society actually invest in the first place. Of course, it is to make money, but that is just the motivator for the mechanism of something that is much more important. Investing is supposed to facilitate efficient capital allocation. Analyzing various investments leads to capital inflows for those with better prospects. People who allocate capital better funnel it to the best companies. This ensures that the highest ROI investments thrive providing a growth engine for the economy and society at large. This all may seem trivial until you actually examine today’s marketplace.

John Maynard Keynes, whatever you think of him as an economist (separate article on that coming), did have one of the most important observations about potential dangers of subverting capital allocation. He wrote: “It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligence to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.” (Keynes, General Theory of Employment, Interest and Money, 1936).

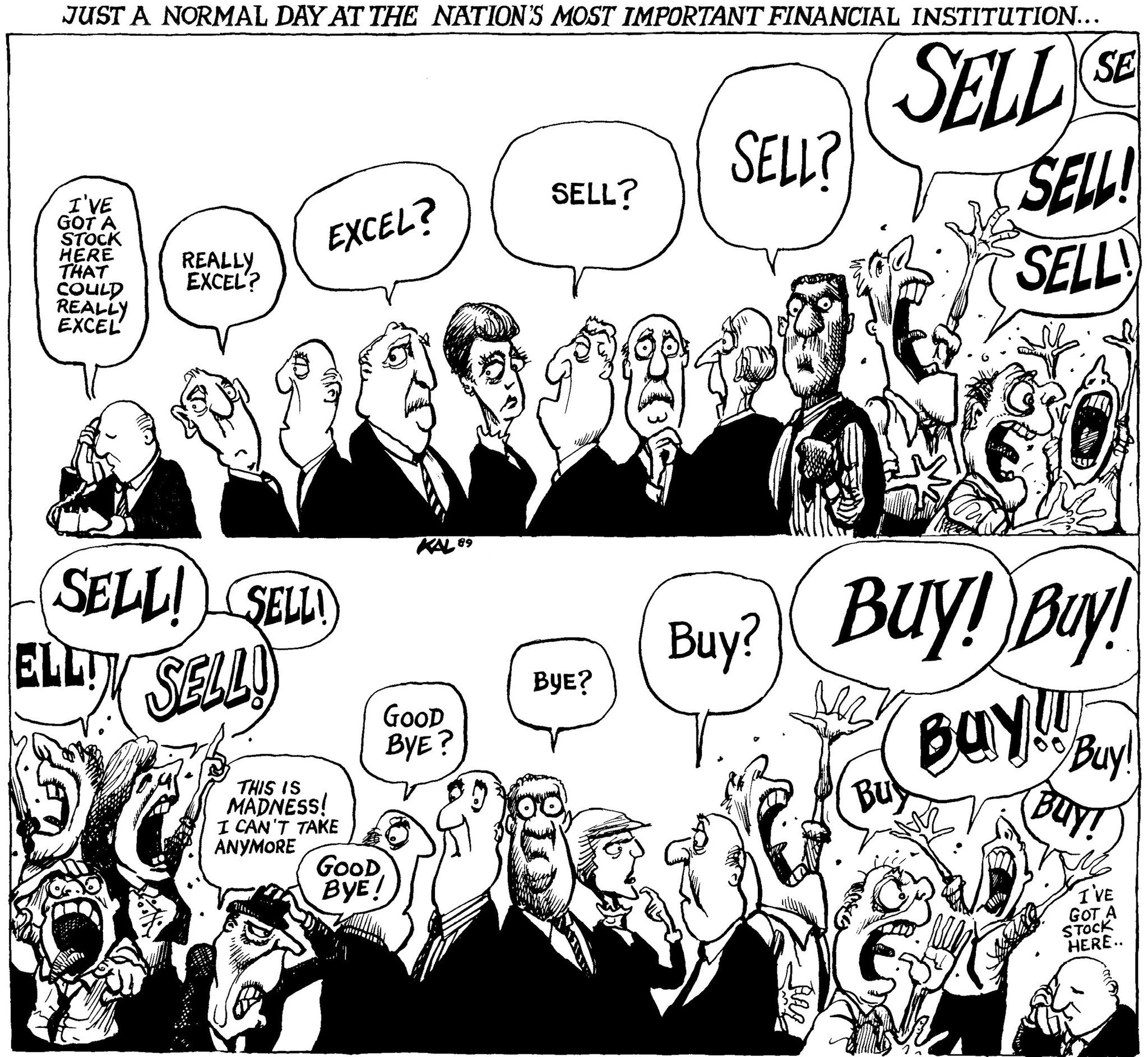

At first glance, there is nothing criminal in looking to opinions of others. In fact, despite all the hype about irrationality, crowd behavior is very rational in absence of solid information. Of course, we look at opinions of others and are informed by them. But the key word in a Keynesian beauty contest is ‘average opinion’. With human herding mentality average opinion in the financial markets is usually wrong. Best investors go against the average opinion, that is what successful investing should be about. However, when short-term trading takes over, those successful investors may not survive long enough. Look at the performance of last few days in the S&P 500 (on the graph below). In the short-term trading environment when information is scarce, investors grab on to anything and those moves are amplified by robots trading. Robots have no common sense. To them a small difference in sentiment is just a difference and they buy or sell based on that with abandon. Those who think that it ends well, should read about ‘portfolio insurance’ and its role in the 1987 market collapse.

Source: Yahoo Finance

There is another great quote by Keynes to that effect: “The market can remain irrational longer than you can remain solvent”

So, to allocate capital efficiently we need to let great investors go against the crowd and not punish them for it. But that is not possible if Federal Reserve constantly pumps liquidity into the markets, thus causing investment decisions to be made on the basis of what the Fed will do, rather than to allocate capital efficiently. It is also not possible when by the tick trading is where most of the money is made. John Bogle once upon a time had a great idea to tax ultra-short term gains at prohibitive rates, to let smart investors actually allocate capital.

To paraphrase Keynes we could say that we have reached a degree where people make investment decisions not on the quality of the investment, but on the sentiment and that sentiment is now based almost purely on what the Fed will do. You live by the sword and you die by the sword.

So where do Robots come into this? Well, robots cannot be great investors. Not yet and I believe not ever. There are far too many variables to consider and many decisions by humans are made heuristically based on experience that is not easily coded in programs, even uber-hyped quantum computers. Quantity is not translated into quality.

Of course, if we forget about capital allocation and start trend following or watching the sentiment, then robots are great. However, then we are in a stormy sea of sentiment and that does not lead to great allocation of capital. For the past few years robots drove the markets up due to expectations of QE4EVER. But they could just as easily cause a crash when crowd sentiment shifts rapidly. And if there is anything we know about the sentiment of crowds is that it is quite fickle. In my opinion, robot traders trading index investments will be behind the next major sell-off whenever that comes. But it is not the robots or their designers fault. Rather, we should look at the conditions that made the thrive in the first place. Robots and computer scientists should not be trading. The rules should be created to favor long term investors e.g. reduce short term trading, reduce the impact of monetary policy on the markets.

But the robots have already taken over to a large degree. And I believe normalization can only come when investing becomes a human art and science again. I know it is an unfashionable opinion in the age of ridiculous hype around AI in all its forms. But as someone who has some background in mathematics I can tell you that most of the AI hype is just that – hype.

In this race between Sarah Connor and Kyle Reese vs Skynet, I am rooting for return of the Kyle Reeses to investing. Otherwise, we will see many more insane days like the last two weeks on little or no real economic news.

As a financial advisor, you can use your common sense to win over the robots. Go back to traditional valuation metrics, consider Shiller PE and leverage, value investing. In short, be more like Reese and Connor and less like Skynet, if there is some intermediate pain.

Pingback : 5 Articles for the Financial Advisor Weekend Reading List: January 5-6, 2019

Pingback : John Bogle – The Missing Narrative