Why Bitcoin Drop Was Good and Why Cryptocurrency Just Might Become a Fiduciary Asset

15 months ago we wrote a blog entry asking if Bitcoin will ever be an asset that fiduciaries can recommend i.e. if it can grow out of a speculative mania phase.

Paradoxically, we believe that we are closer to such a scenario after the tremendous declines experienced in 2018. Now, the Bitcoin community can all pick up the pieces and focus on building products that deliver value, rather than live by the headlines. So, let me close out 2018 by elaborating on the positive effects of the crypto bloodbath we’ve seen in the markets.

Technology is Here to Stay

Firstly and obviously, the insane ‘to the moon’ cryptocurrency price ramp was unsustainable, as anyone with even a bit of a knowledge of financial history would agree. Cryptocurrency is certainly a technological advance on the order of the internet, or railroads, but even those magnificent breakthroughs could not sustain the neck-breaking pace of the rallies that took off when general public became aware of the invention’s implications. As someone who was working in the financial markets during the 2000 dot-com bubble burst, I can see great many similarities. The pain was similar (80%+ drop in prices), the preceding run-up, hyperbole and party discussions about making a few hundred or thousand percent in this or that dot com stock (Bitcoin or Altcoin) were deja vu. As we all know, the internet changed the human experience significantly (if not always for the better), even though many of the startups from the time seem foolish in retrospect. And the spirit of the times is perfectly, just perfectly shown in this sketch:

Only a few years after 2000, as internet platforms drove blue chip businesses out of business, we could already appreciate the real power behind the supposedly delusionary bubble. Remember in 2001, any mention of dot com caused a smile or a cringe depending on the loss sustained; probably something similar that happens when crypto is brought up in family or friend conversations. The aftermath will be the same with crypto. It is just impossible that something that enables trustless exchange of value without central authority would not change the world. Anyone who knows monetary and economic history recognizes that search for seamless transfer of value without centralization is as old as societies. In addition, the political and geopolitical instability that we are witnessing makes it virtually certain that large swaths of humanity will not have a stable government issued currency to rely upon (see Venezuela). So, the technology is here to stay and it will change things.

Slowed Down Entrance of Large Investment Houses

The second and less obvious effect of the crypto bloodbath is that it slowed down entrance of large investment houses into the crypto space. If you think that Goldman Sachs’ ‘too slow to be noticeable’ progress on entering the crypto space is a bad thing, then you need to reconsider. Once investment banks and big trading houses enter the crypto space en masse, it will become a story of tail wagging the dog, as the price will disconnect from any reason and will only depend on synthetic derivatives that have no relation to crypto itself. It will become just another correlated speculative asset in a world of ‘tightly coupled’ markets, as famed trader Rick Brookstaber once said. And that would really be a bad thing. Do we need another risky leveraged investment that goes up and down with all of these mono trend-following stocks and leveraged loans?

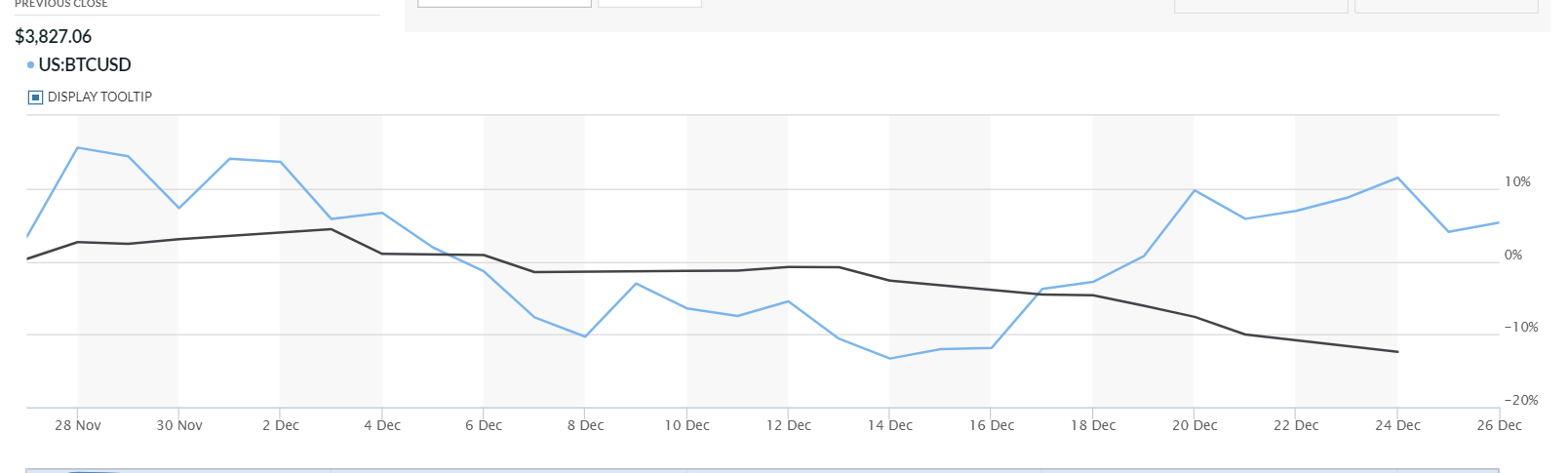

If you thought that crypto is already this kind of an asset, you would be wrong. The correlation between Bitcoin and S&P 500 was near zero for most of the last few years (admittedly, mostly due to extreme volatility in Bitcoin). It did start rising toward the end of 2017 when it got to .15, just as institutional investors started entering the crypto space. That is not a coincidence. It is also not a coincidence that correlation is dropping over the past month as stocks have entered a bloodbath of their own. Note the dramatic pre-Christmas decoupling of Bitcoin (light blue) from the S&P (black line) price. This decoupling is quite amazing, more so because it happened after near panic conditions in equity markets. Yet Bitcoin held.

Not to say that Bitcoin can continue to be insulated from equity declines or that it cannot continue its downward trajectory, but the signs are quite encouraging. And those positive signs occurred precisely because large investment houses stopped adding synthetic and various other crypto products. Hopefully, decentralized crypto startups can actually grow without being swamped by waves of temporary liquidity that leaves when you need it most.

Pingback : Cryptocurrency: Fiduciary Asset or Verrückt?